Increasing Broadband Internet Penetration

In the OIC Member Countries

119

principal technology for accessing Internet. The countries in this group include Kuwait, Libya,

Tunisia, Lebanon, Egypt, Cote d’Ivoire, Indonesia, Morocco, Nigeria, Gabon, Kirgizstan, Senegal,

Sudan, Mauritania and Uzbekistan. The countries in groups C are at lower levels of economic

development and, consequently, at an embryonic stage of adoption of either broadband

technology. Nations in this group include Afghanistan, Bangladesh, Benin, Burkina Faso,

Cameroon, Chad, Comoros, Djibouti, Guinea, Guinea-Bissau, Gambia, Iraq, Mali, Mozambique,

Niger, Pakistan, Sierra Leone, Somalia, Syria, Tajikistan, Togo, Turkmenistan, Uganda, and

Yemen. Finally, the three countries in group D (Guyana, Palestine, and Brunei) are at an initial

stage of mobile broadband adoption and expected to move to either group A or B in the future.

While Saudi Arabia represents a country with high adoption of fixed and mobile broadband

technologies, the comparative analysis of adoption trends between both access technologies

indicates a clear substitution pattern, whereby mobile is capturing share from fixed broadband

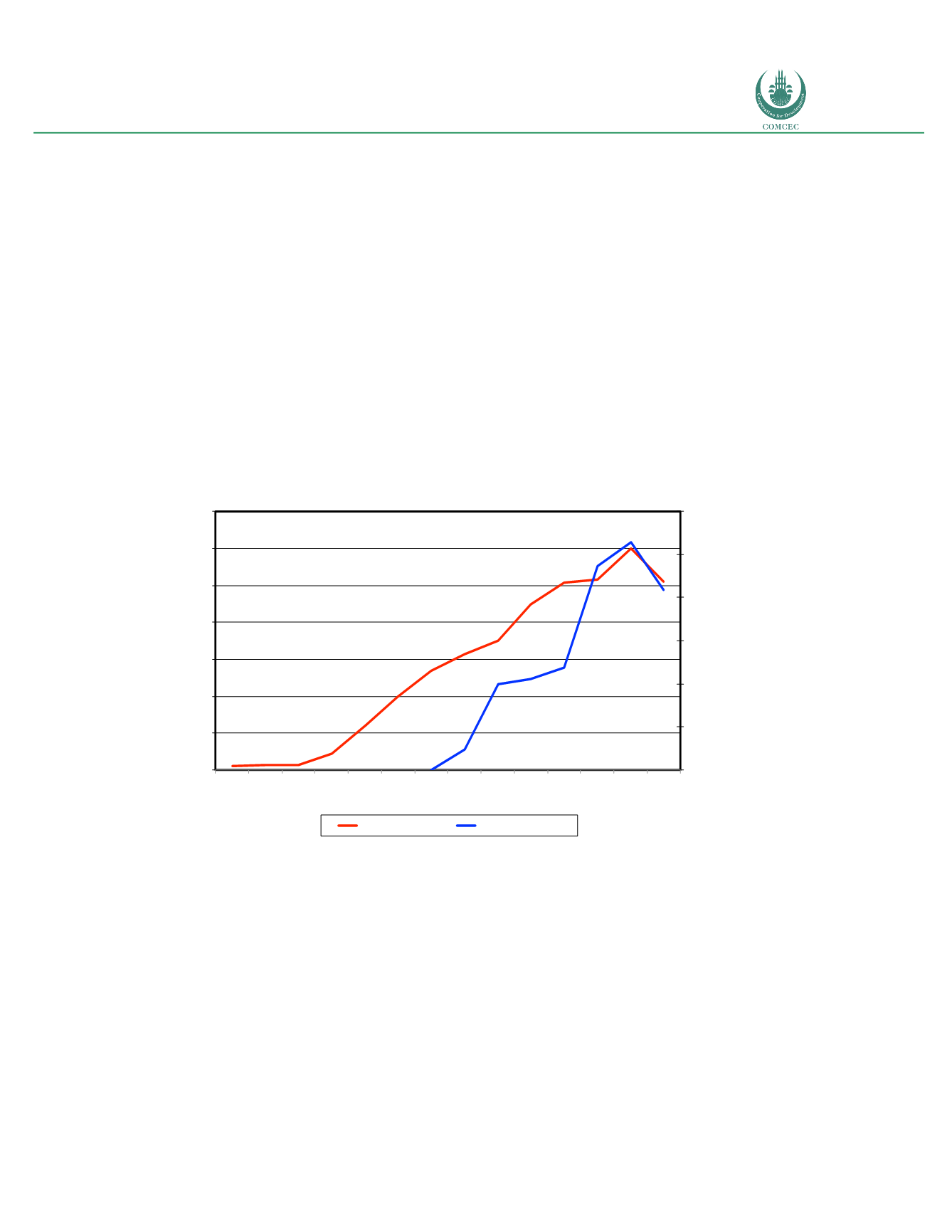

(see figure 34).

Figure 34: Saudi Arabia: Comparative adoption of fixed and mobile broadband (2003-2016)

Source: Telecom Advisory Services analysis.

Figure 34 depicts several trends affecting the diffusion of fixed and mobile broadband in the

country. The first trend is a ramp-up in fixed broadband adoption between 2011 and 2013.

This acceleration occurs at the same time that mobile broadband penetration is not increasing

at a fast pace. This would indicate that fixed broadband is capturing a large portion of the

latent demand. The second trend depicts a slow down in fixed broadband penetration between

2012 and 2014. This occurred because fixed broadband subscriber growth was inhibited by

the substitution effect of mobile broadband driven by more competitive plans, such as

unlimited packages, coupled with easier setup and the mobility advantage. In fact, while fixed

broadband prices remained comparable to global and local benchmarks, mobile plans were

relatively cheaper (see pricing analysis below).

0.20% 0.29% 0.27%

0.86%

2.40%

3.98%

5.37%

6.28%

7.03%

8.98%

10.13% 10.32%12.01% 10.23%

9.70%

39.60% 42.10%

47.60%

94.50%

105.90%

83.50%

0%

20%

40%

60%

80%

100%

120%

0%

2%

4%

6%

8%

10%

12%

14%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2Q2016

Fixed Broadband

Mobile Broadband

Fixed&Broadband&

(Percent&of&popula5on)&

Mobile&Broadband&

(Percent&of&popula5on)&