Increasing Broadband Internet Penetration

In the OIC Member Countries

106

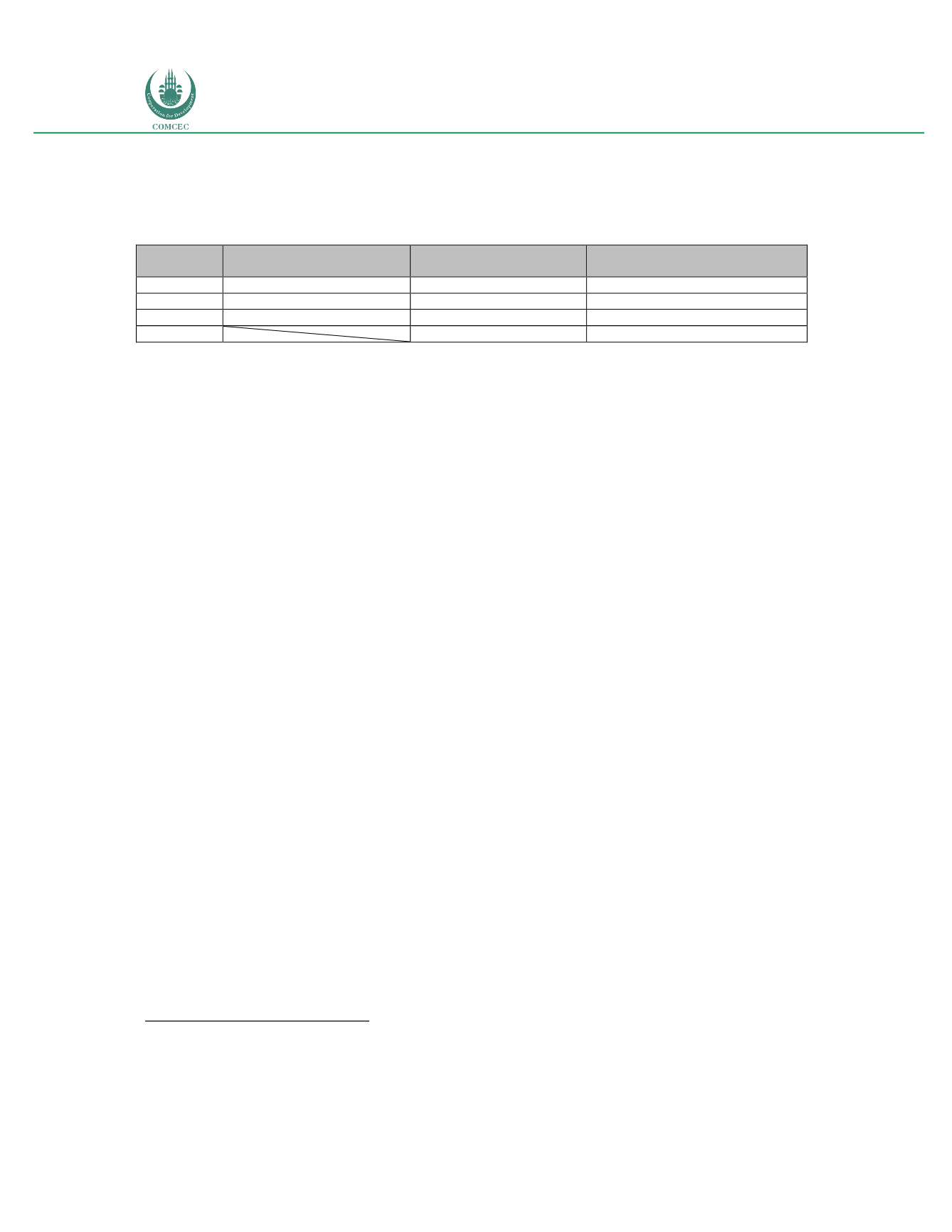

As a result, the market structure as of 2Q2016 consists of three subsidiaries of global players

(see table 49).

Table 49: Cote d’Ivoire: Mobile broadband market structure (2Q2016)

MNC

Number of Subscribers

Market Share

(by Subscribers) (%)

Orange

Orange Group

2,707,779

36.11

MTN

MTN Group

3,505,557

46.75

MOOV

Maroc Telecom

1,285,251

17.14

Total

7,498,587

100

Source: Autorité de régulation des télécommunications/TIC de Cote d’Ivoire; GSMA Intelligence; Telecom Advisory

Services analysis

In this context, the government has sought to reconfigure the mobile sector as a four-player

market, by means of introducing a new convergent player capable of supporting mobile and

fixed telephony, data transmission and Internet access. In September of 2016, the fourth

convergent license was given to the Libyan Post, Telecommunications and Information

Technology Company

46

. This move intended to foster competition is not yet reflected in the

market’s competitive intensity, since the entry of the new operator is planned for 2017

47

.

In addition, to further stimulate competition the government has been promoting the entry of

Mobile Virtual Network Operators. Youmee, the fixed broadband player, is in negotiations with

Orange to launch service

48

.

State of competition in broadband market

As a result of exits and entries that took place in the last year, the Ivorian market is composed

of two convergent players (Orange and MTN) and one pure mobile play (Moov). As of May

2016, Orange signed an agreement with the Ivorian government to merge the assets of CI-

Telecom (a jointly owned company between Orange and the government of Cote d’Ivoire) and

Orange mobile. After the merger, the government’s position in the new entity will be of 31%,

the remainder being in the hands of Orange

49

.

Similarly, MTN is present in the wireline, fixed and mobile broadband segments. The

convergent license assigned to Libyan Post, Telecommunications and Information Technology

Company is currently under implementation. While the forced exit of the minor wireless

players has increased the HHI index, reducing the level of competitive intensity, the entry of

the fourth player is expected to reestablish an adequate level of competition.

46

The new entrant is leveraging the assets of GreenN, the closed operator. This company was fully owned owned by the

Libyan Post, Telecommunications and Information Technology Company (source: field trip interviews).

47

Source: field trip interviews.

48

Source: field trip interviews.

49

Telegeography.

Govt, Orange strike agreement to merge fixed, mobile assets in Cote d’Ivoire

. May 3, 2016.