Increasing Broadband Internet Penetration

In the OIC Member Countries

110

fixed broadband investment by the private sector is expected to be partially offset as the

Orange Group is planning to deploy fiber optics in the Abidjan area, with further expansion if

possible.

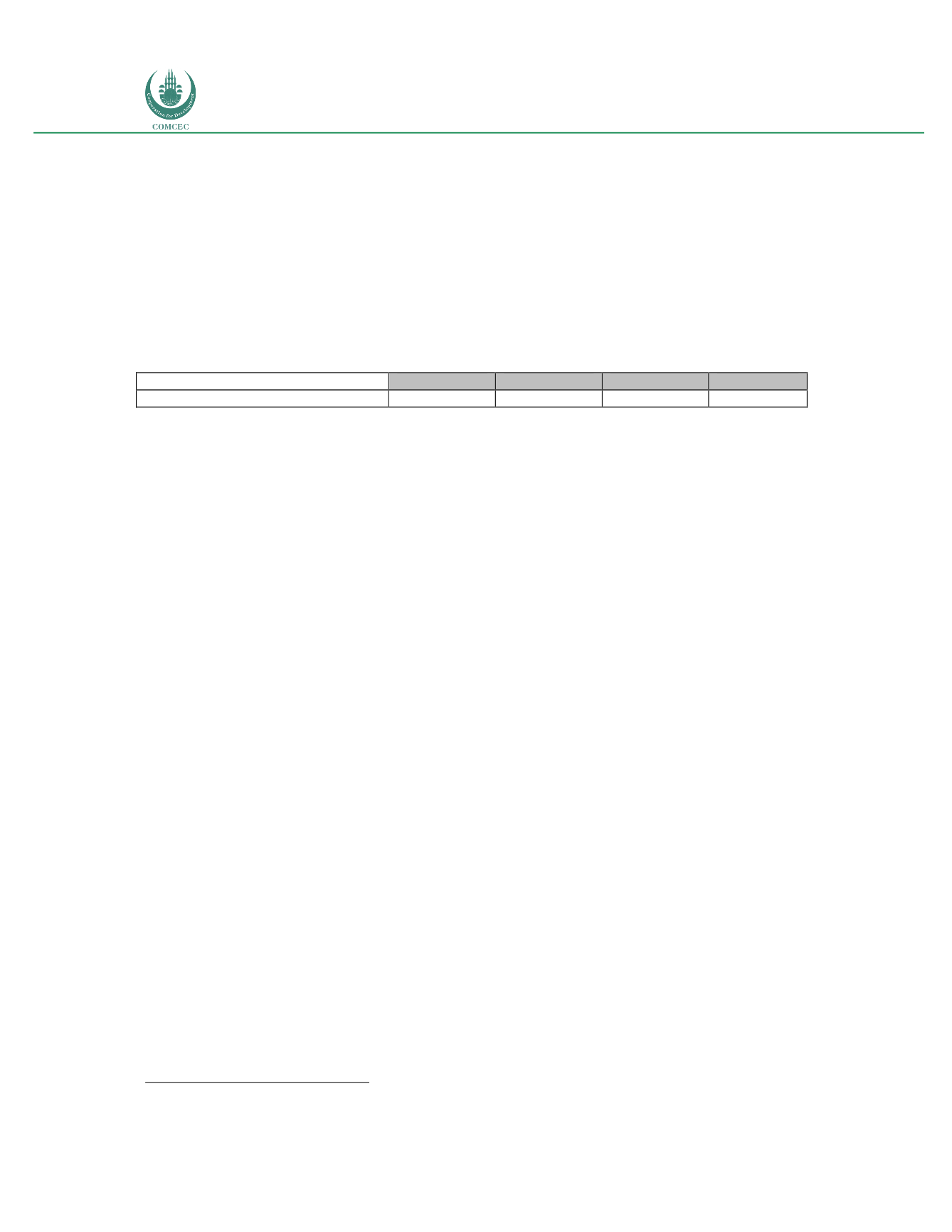

The Ivoirian regulator does not publish statistics for mobile broadband because, given the

nature of mobile infrastructure, it is difficult to discriminate between voice and data

investments. Assuming that most mobile investment is dedicated to mobile broadband

services, the amounts are limited but increasing significantly in 2016 (see table 53).

Table 53: Cote d’Ivoire: Private sector mobile investment (US$)

2013

2014

2015

June 2016

Mobile (including voice and data)

244,194,256 162,689,686 146,860,420 294,201,228

Source: Autorité de régulation des télécommunications/TIC de Cote d’Ivoire; Telecom Advisory Services analysis

As table 53 indicates, the shift in investment from fixed to mobile broadband is exemplified by

the 2016 statistic, which indicates that only in the first six months of 2016 the private sector

investment in mobile voice and data has exceeded the entire amount spent in 2015.

In addition to the investment from the private sector, the government has been actively

involved in the deployment of a national intercity network. The deployment is being managed

by the French firm Bouygues, working alongside SagemCom and Polyconseil. Investment is

expected to conclude in 2017, when the network is planned to span around 7,000km. The

project started in 2012 when Chinese equipment manufacturer Huawei rolled out a 1,400km

cable linking the south-western port city of San Pedro to Ferkessedougou in the central north.

Phase two of the project got underway in July 2013, focusing on a 650km link connecting

Grand-Bassam and Abidjan in the southeast with the northeastern town of Bouna. This phase

was carried out by Chinese state owned manufacturer China International Telecommunication

Construction Corporation (CITCC)

56

.

Major factors that influence broadband investments

The government has been putting in place a number of demand and supply-side initiatives to

promote broadband usage, thereby stimulating capital spending by operators. On the demand

promotion side, as described above, the tax exemption on terminal equipment is aimed at

reducing the cost of purchasing broadband service, which, in and of itself, acts as a stimulus for

market development. As noted earlier, an additional demand promotion policy consists of the

promotion of “one citizen, one computer” policy, which entails the subsidization of PC

purchasing and also acts as a promotion of demand. However, there are other policies that may

act as a disincentive to stimulate demand. For example, wireless carriers cannot sign up a

customer if they do not produce a valid ID. A large portion of citizens in the Cote d’Ivoire lack a

proper ID, which means that either the carrier cannot sign up these customers or, if they do,

they may incur a penalty fee.

56

Telegeography.

Cote d’Ivoire launches third phase of NBN

. April 22, 2016.