Risk Management in Transport PPP Projects

In the Islamic Countries

66

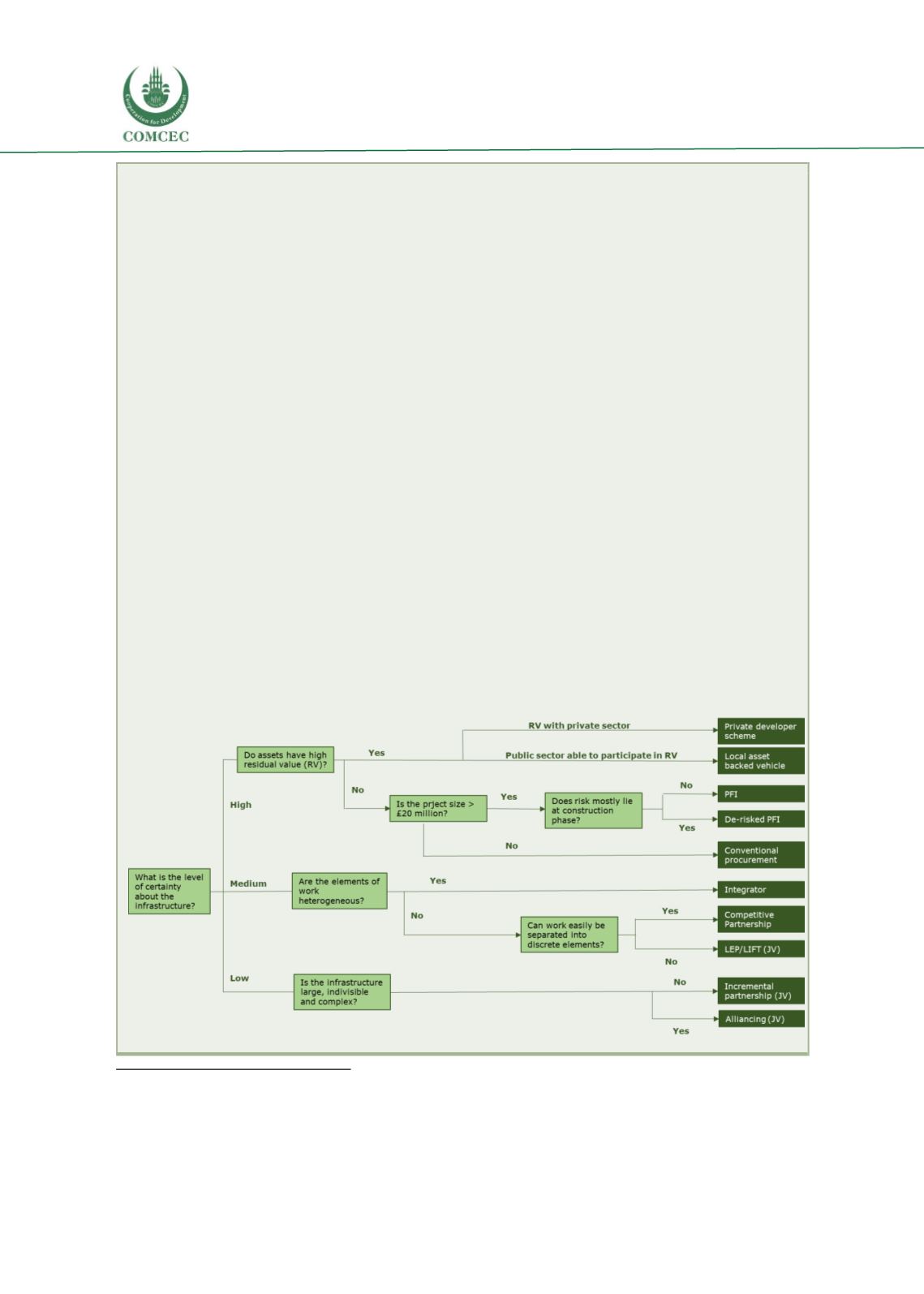

Box 2 The United Kingdom Treasury decision process (2014)

19

The decision tree below illustrates how

the decision process on adopting a PPP model should

be supported by an upstream strategic analysis of the portfolio of candidate investment

schemes

, which will then determine the type of PPP approach best suited to assist project

delivery and more likely to mitigate risks. The procedure outlined below is not specific to the

transport sector and reflects a mature and sophisticated PPP market like the one in the United

Kingdom. The diagram below shows how the features of the investments under consideration

affect the decision about the way to involve the private sector in the delivery of public assets and

services. The right-hand side of the diagram shows how the traditional procurement route is in

fact one of the various options, while the overall uncertainty related to the investment being

considered is a key step in the decision process and affects the preferred model for private

involvement. The conventional PPP model in the United Kingdom is driven through the approach

inaugurated by the Private Finance Initiative (PFI) of the early 90’s. More specifically, the

revenue-generating potential of the investment – this is presented as “net residual value” in the

diagram – is an important determinant of the route to follow, as it can give the public sector scope

to share revenues with the private party, including the option of full privatization. Another

relevant dimension in decision-making relates to whether the infrastructure is made by

heterogeneous components. If this is the case this may lead to structure the cooperation with the

private sector involving an “integrator” intermediary entity (in case the components cannot be

implemented separately) or – where the planned investment can be decomposed in discrete

components - with multiple partnerships or local Joint Ventures.

20

Finally, for large and complex

infrastructure a less structured, multi-phased joint venture approach can be considered a more

convenient than the more traditional PFI route.

19

This Box relies on the presentation in Crawford J. (2014) “Infrastructure & Risk: Identification, Management

& Transfer of Risk by HM Treasury”, Cambridge Judge Business School. The figure is drawn from Prior, N.

(2008) “Building Flexibility. New delivery models for Public Infrastructure projects”, Deloitte Research United

Kingdom.