Risk Management in Transport PPP Projects

In the Islamic Countries

72

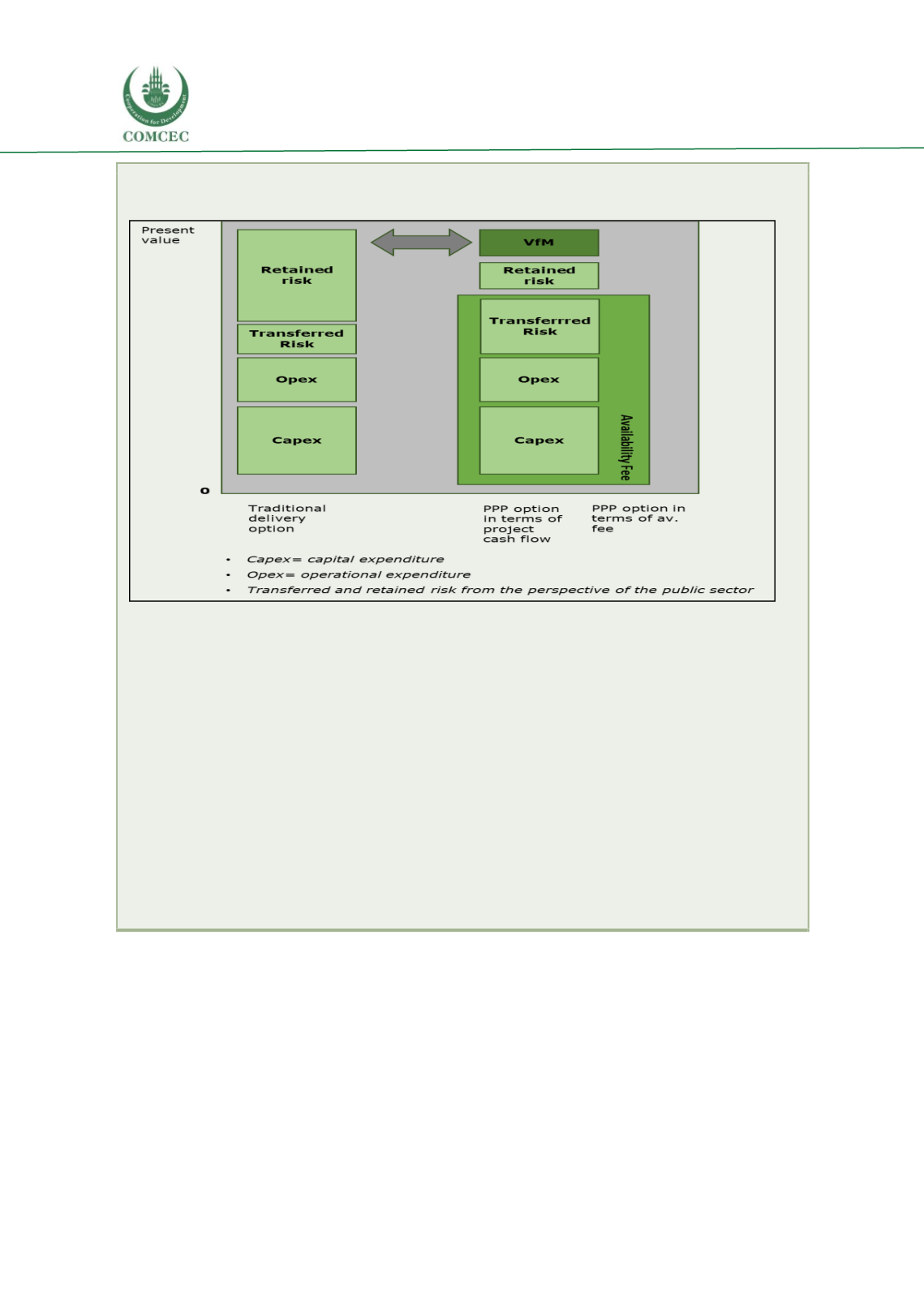

The following picture shows how conceptually the PPP option could be assessed vis-à-vis the

conventional delivery option.

Source: Authors based on EPEC (2015).

In practice

the evaluation is driven by a mix of quantitative and qualitative considerations

,

however the NPV approach leads to a disciplined vision of the likely differences between the

various components of the cost for the public sector and gives a strong incentive to assign a

monetary value to the risk retained or transferred. It is conceptually important that the PPP

option produces a positive difference in PV (the blue Value-for-Money section in the picture) and

that the PV of public sector fees paid to the private sector – the illustration above refers to an

availability fee-driven PPP – remains under the PV of the expected cash-flow.

In order to conduct

this type of analysis it is important to have a credible public sector comparator

, which

allows a systematic comparison between the likely cost of each PV component under the

traditional vs the selected PPP option. In principle these quantitative evaluations should be

supported by risk analysis modelling that produce statistical distributions of exposure under the

compared options.

Soft market testing

with potential private partners (investors, construction companies,

transport operators…) could be launched at this stage to refine the PPP project definition and

improve the assessment of barriers and opportunities to private sector involvement. It should

not be ruled out that, in countries with no/limited PPP experience and/or a maturing strategic

framework, pilot-based PPP investments could be worth considering and soft market testing

could be part of the pilot investment preparation. In sum, takeaways, barriers and parallel

strategy options related to the pre-tender phase can be summarized as presented in the

following Table.