Risk Management in Transport PPP Projects

In the Islamic Countries

60

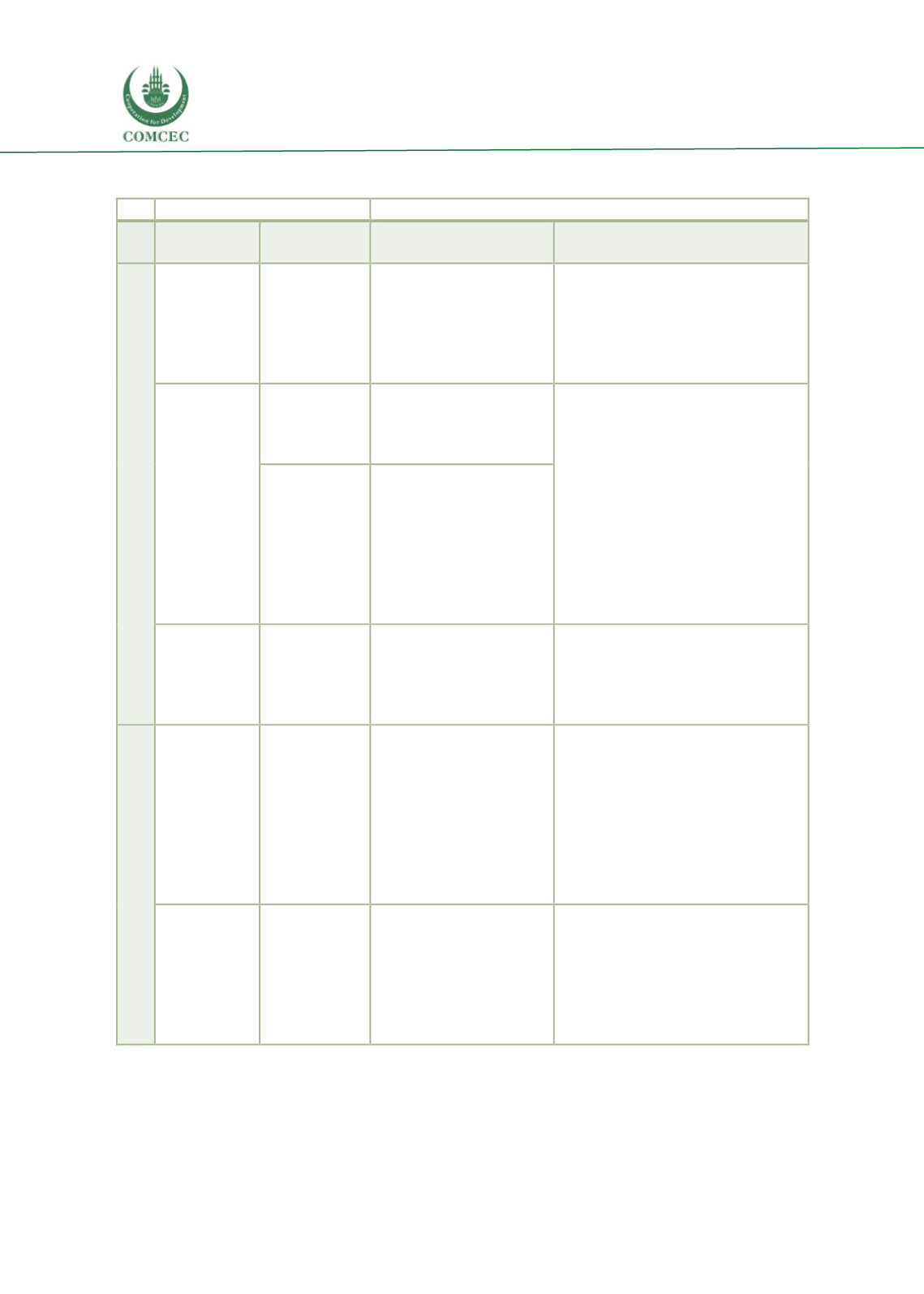

Table 16: Channels of transmission of the financial crisis

Risk threat and vulnerability

Risk Realization

Threat

Vulnerability

Effect on private

partners

Effect on the government

Financial

Interest rates

hike

Large

borrowing or

refinancing

need; variable

interest rates

Higher debt

service=increasing costs;

liquidity problems;

questionable feasibility of

some projects given lower

returns

Timing of investments (postponing);

trade-off between PPPs and

traditional concessions altered.

Possible cash flow support to

corporates

Unavailability

of credit

Underfinanced

project or new

project

Lowered capacity to

refinance; shorter loans;

shift to bonds and equity

vs. bank loans

Termination of existing projects,

failure to achieve financial close of

new projects; capital injections

Revenues

from the

project and/or

assets

securitized;

securities

indexed and

insured

Losses from downgrade of

bonds; lowered capacity

to refinance given lack of

insurers; shorter loans

and shift to bonds and

equity vs. bank loans

Decline in

stock market

prices

Companies do

not hold

sufficient

levels of their

capital in cash

Reduced capital of banks.

Reduced lending;

solvency problems and

recapitalization

Reduced investment for new and

existing PPPs and recapitalization

costs

Real

Exchange

rate

depreciation

Sizable

external debt,

currency

mismatches,

dollarization

Corporate balance sheets

if borrowing externally.

Counterbalancing:

increase in demand if

service is export oriented

(including highway).

Higher input costs if

inputs are imported.

Increased external debt service

(financing constraints) and lower

attractiveness for new investments

relying on external borrowing;

private sector defaults if widespread

dollarization; call of guarantees.

Counterbalancing force: switch from

foreign consumption to domestic

investment.

Slump in

domestic

demand

Commercial

projects

depending on

user fees and

explicit

contractual

guarantees

Corporate balance sheets

and pricing of credit by

financial partners;

liquidity problem;

contractor failure and

pressure to renegotiate.

Lower domestic revenue (financing

constraints) leading to lower

investment affecting new and old

PPPs; commercial projects risk; call

of guarantees due to decline in

fees/tolls; pressure to bail out failing

contractors and renegotiate.

Source: IMF (2009).