Risk Management in Transport PPP Projects

In the Islamic Countries

38

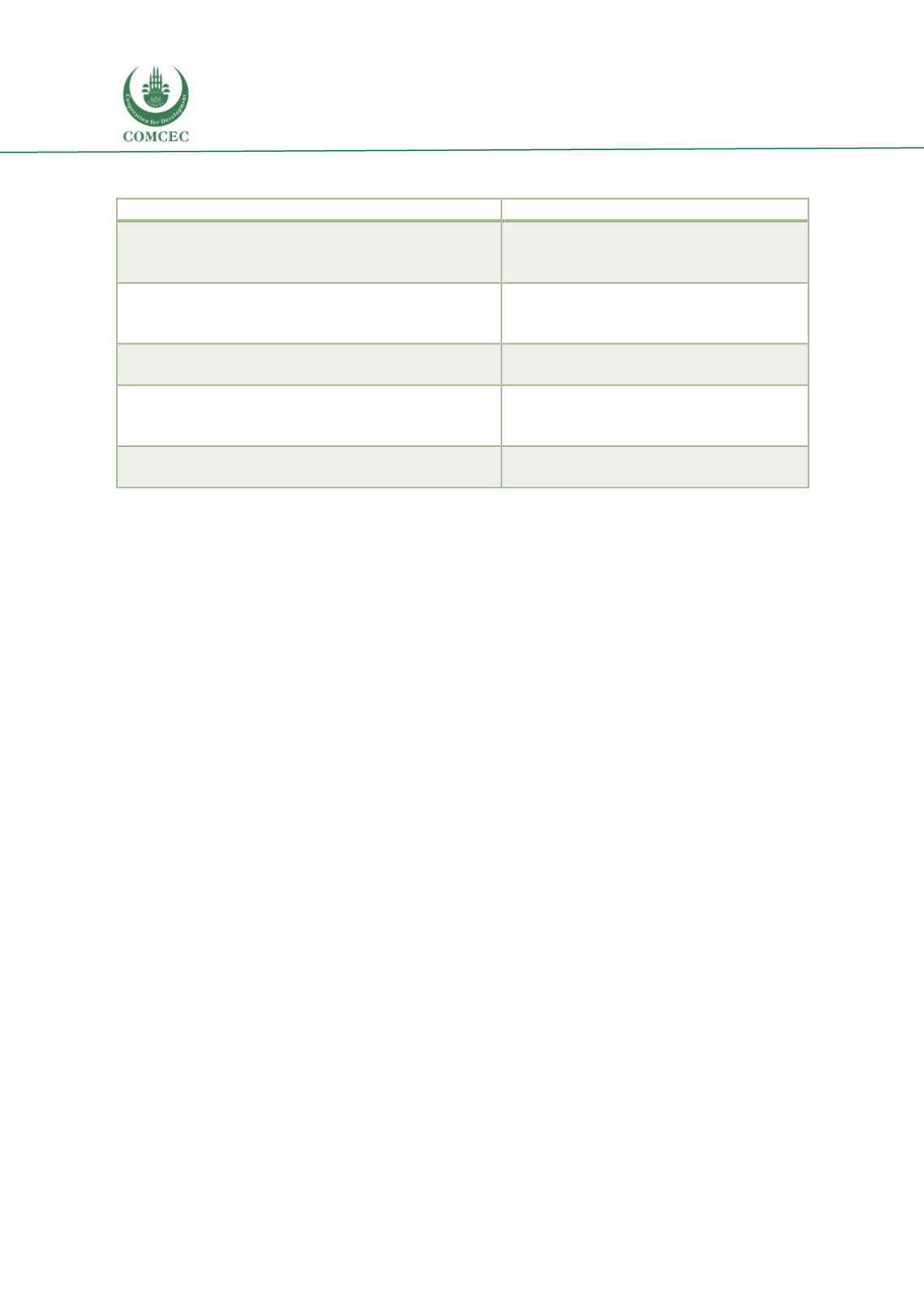

Table 8: Fit of Islamic finance and infrastructure PPP projects

Principles of Islamic finance

Infrastructure PPP project

Returns to Islamic financiers are linked to the

profit/earnings of an enterprise and derived from

commercial risk taken by the financier.

Infrastructure PPPs allow risk sharing among

the parties involved in the project, including

financiers.

Islamic financiers become partners in the project.

PPP projects allow Islamic financiers to

become parties to the project, not just mere

lenders.

Transactions are free from speculation or gambling

(“maysir”).

Infrastructure PPPs are by nature free from

speculation or gambling.

Excessive uncertainty in contracts (e.g. undetermined

price, time of delivery or subject matter) may be not

Shariah-compliant.

PPP contracts of infrastructure projects

generally include detailed clauses to minimize

uncertainty.

Investments relating to alcohol, drugs, gambling, weapons

and other prohibited activities are not permitted.

Infrastructures PPPs exclude these areas.

Source: Authors based on The World Bank, PPIAF and Islamic Development Bank, 2017.

The prohibition of excessive uncertainty or risk (“gharar”) in particular leads to a special

attention to

risk identification and risk assessment

, as an in-depth analysis of the risks is

especially necessary before stepping into the PPP process, for the latter to be Shariah-compliant.

Further, under Islamic principles whoever finances the operation needs to take the ownership

of the asset: this reduces the systemic risk and moral hazards associated with the conventional

risk transfer structures (The World Bank and IDB, 2018) and mitigates the risk of contract

violations arising from the agency conflict (Bowles, 2013). As profit is always connected with

assets onwhich it is generated and the transaction is not merely financial, speculation is avoided.

3.2.2.

Pre-tendering decision process

The second phase identified in the conceptual framework, i.e. Pre-tendering decision process,

has been divided into two elements: Screening for PPP suitability and Special arrangements for

PPPs. For each of the two elements, the following Table sets out relevant questions that guided

the analysis.