23

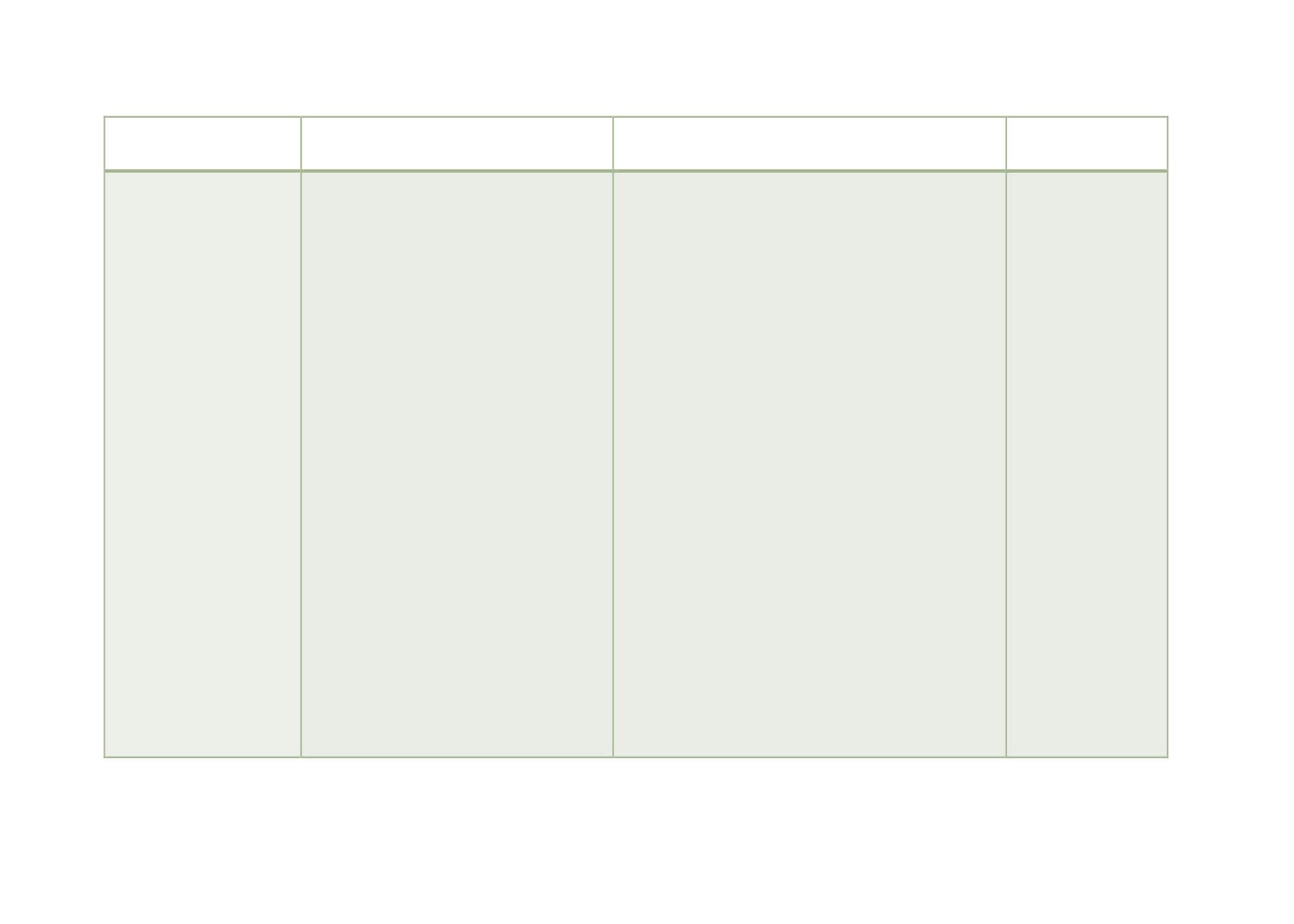

Elements of the

conceptual framework

Guiding questions identified by COMCEC

Topics of analysis under the elements of the conceptual

framework

Policy

recommendation

measures

strategies

PPP contractual

arrangements

Performance metrics

Remuneration

applicable further to their operation and

maintenance, including financial aspects

Describe the rationale behind the identification

ad choice of the procurement routes

Review risk sharing matrices for the PPP

transport projects, specifying which project

risks were assumed by whom (public, private,

shared)

Discuss their pros and cons from the risk

management point of view

Explore the financing schemes adopted for PPP

transport projects, including details on

debt/equity ratios

Discuss the pros and cons of the selected PPP

methods, with a focus on risk allocation and

management

Examine the typical concession/contract

periods of transport PPP projects and the

rationale behind its definition

Describe the type of risks identified and

allocated to the parties involved in PPPs for the

different options of PPP arrangements,

including the ones that may be external to the

project, i.e. environmental risks

With reference to case examples, and based on

data availability, compare the foreseen and

actual (real) values of the main performance

parameters (traffic, revenue, tariff ...)

Examine the rationale, structure and content of

output and performance measurement of PPPs

Analyze howperformance metrics is linkedwith

payment to the private party or compensation

to the public

Analyze the rationales underpinning risk

allocation (or risk transfer) strategies

PPP contractual arrangements

: According to the risk sharing

matrices for the PPP transport projects, which project risks are

allocated to public and private party? Which types of project

risks are shared? What are the pros and cons from the risk

management point of view? What type of financing schemes

are adopted for PPP transport projects? What are the main

features of each type of financing scheme? What are the pros

and cons of the selected PPP methods, from a risk allocation

and management point of view? What is the typical

concession/contract period of transport PPP projects? What is

the rationale behind? What are the types of risks (including the

ones that may be external to the project, i.e. environmental

risks) identified and allocated to the parties involved in PPPs

for the different options of PPP arrangements? What is the

rationale underpinning risk allocation (or risk transfer)

strategies?

Performance metrics

: How do the foreseen values of the main

performance parameters (traffic, revenue, tariff ...) compare

with the actual ones? What is the rationale, the structure and

content of output and performance measurement of PPPs?

Remuneration

: How is performance metrics linked with

payment to the private party or compensation to the public?

Statistics and

surveys

Capacity-building