Risk Management in Transport PPP Projects

In the Islamic Countries

29

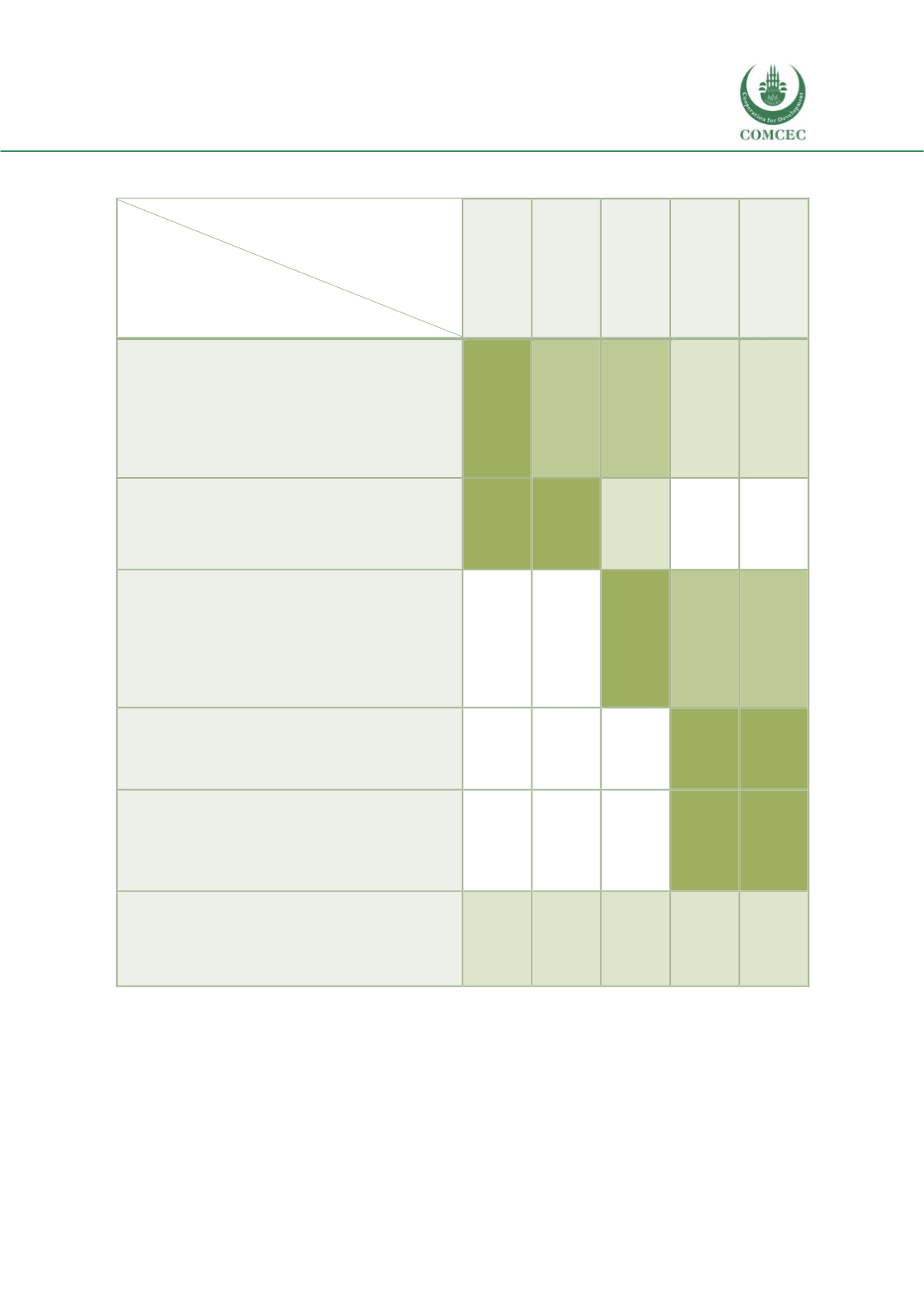

Table 5: Conceptual framework

Risk governance

dimensions

Investment

phases

Risk

Identification

Risk Assessment

Risk Allocation/

Sharing

Risk Monitoring

Risk

Treatment/Reme

dies

1.

Strategy and policy

Political support and strategies

Legal provisions

Institutional arrangements

Investment attraction

+++

++

++

+

+

2.

Pre-tendering decision process

Screening for PPP suitability

Special arrangements for PPPs

+++

+++

+

3.

Procurement and contracting

Procurement strategies

PPP contractual arrangements

Performance metrics

Remuneration

+++

++

++

4.

Construction and asset delivery

Management of risks during design phase

Management of risks during construction

+++

+++

5.

Operation

Management of risks during operation

Bonus/malus schemes

Contract renegotiation

+++

+++

6.

End of contract

Contract return

Follow up

+

+

+

+

+

Source: Authors.

The detailed presentation of the conceptual framework in the next paragraphs follows the six

investment phases which are summarized below:

1.

As a first phase,

Strategy and policy

refers to the political and institutional context and

the legal framework in relation to transport PPPs;