Risk Management in Transport PPP Projects

In the Islamic Countries

186

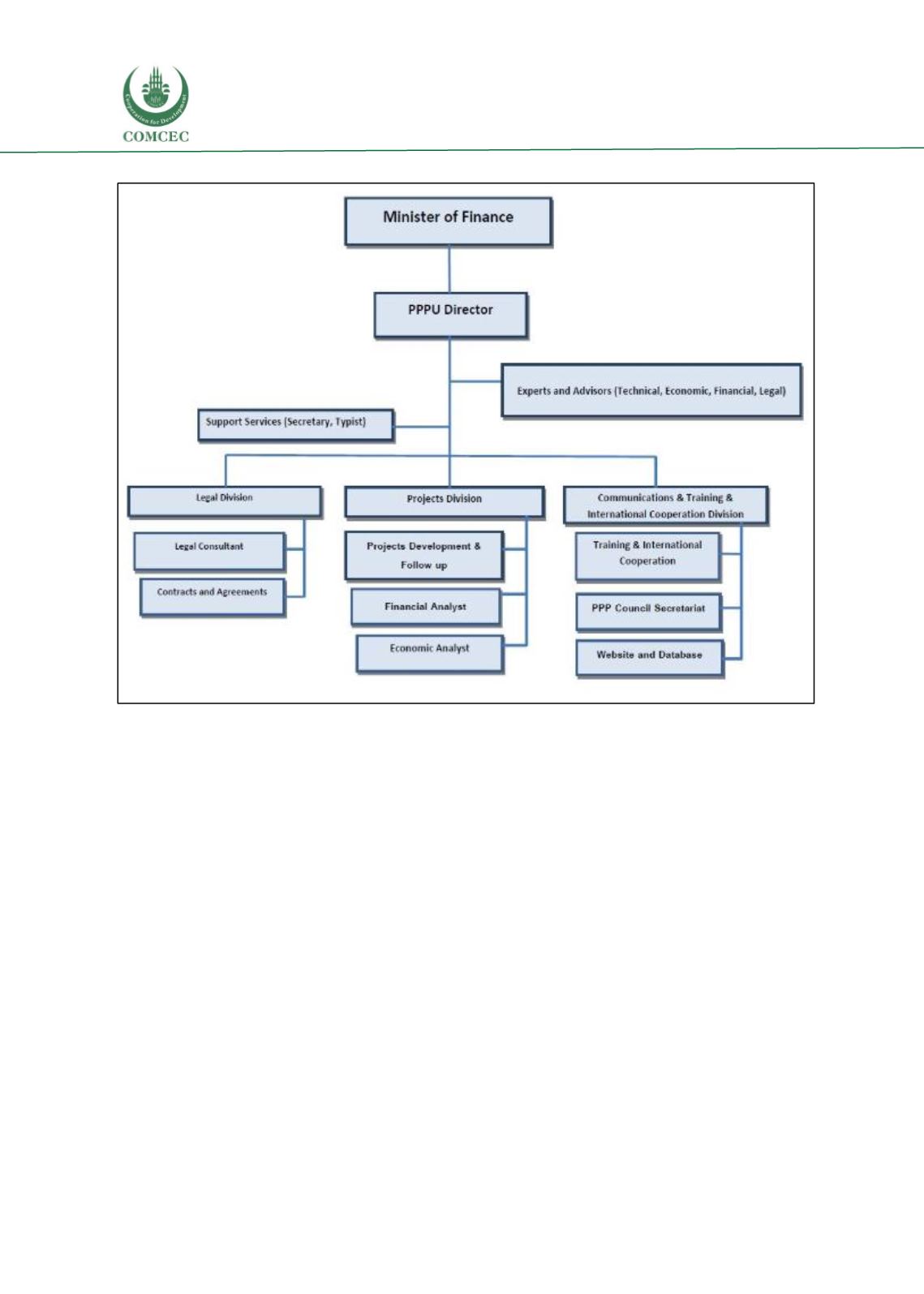

Figure 7: PPP unit – Organizational chart

Source: PPP unit.

Investment attraction

By ensuring a consistent approach to PPPs across different economic sectors as well as

streamlined procedures, the establishment of the PPP unit can represent an increase in the

country’s attractivity for private investors. However, as already mentioned, the PPP unit does

not directly engage in investment attraction activities.

The private partner has the responsibility to provide the necessary funds contributing to the

delivery of the project. Over the years and across sectors, the government of Jordan has proved

to be a reliable partner in PPPs, timely delivering its payments. This reliability is a major factor

contributing to Jordan’s attractiveness for private investments.

In addition, well-established cooperation between Jordan and

international organizations

and IFIs

on PPP issues as well as continued

donor support

have strengthened Jordan’s PPP

framework and finances, thus enhancing the country’s appeal for foreign investors, especially

crucial at times of slowing economic growth (in 2016 and 2017, GDP has grown by 2%, a rate

which had not been that low since the 1990s). In fact, Jordan has had collaborations in place

with a number of

development partners, multilateral banks and IFIs

: support is provided by

World Bank, IFC, Islamic Development Bank (IsDB), EBRD and EU, as well as through bilateral

agreements with development agencies from France (ADF), the United States (USAID), Germany