Risk Management in Transport PPP Projects

In the Islamic Countries

153

Reference to specific projects

Reference to the

Bejaia Mediterranean Terminal PPP

project concerning the rehabilitation,

operation and maintenance of the Port of Bejaia is made in this case study to substantiate the

description of risk management practices in PPP transport projects in Algeria and provision of

recommendations. This initiative has been selected based on availability of information,

however it does not constitute a representative sample of the performance of PPPs in the

country.

5.4.2.

Strategy and policy

Political support and strategies

In general terms PPP experience in the People's Democratic Republic of Algeria has so far been

characterized by the adoption of the

institutional PPP model

both in the transport sector as

well as in other sectors. Joint ventures have been established between state owned enterprises

and international private companies for the rehabilitation and/or new construction of projects

and/or for the operation and maintenance of existing infrastructure and equipment. Concession

agreements have been granted to the corresponding SPVs by the Ministry of Public Works and

Transport. The Table below summarizes the composition of the five PPP projects implemented

so far in the transport sector in Algeria.

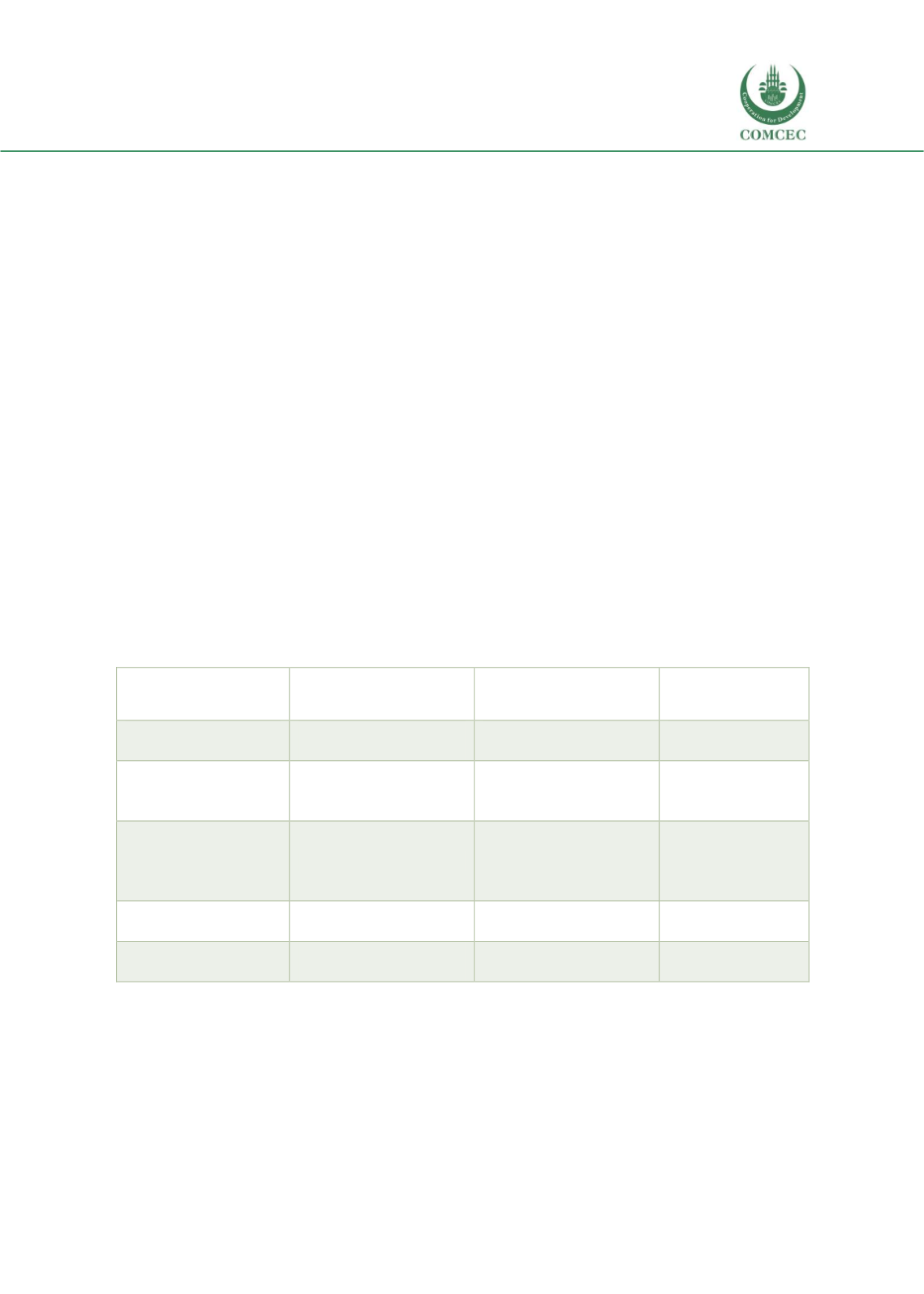

Table 32: Institutional PPPs in the transport sector in Algeria – JV Composition

Project Name

Type of PPP

Algerian Public Entity

Private Entity

Bejaia Mediterranean

Terminal

Rehabilitate, operate, and

transfer

Entreprise Portuaire de

Bejaia – EPB

Portek International

Pte Ltd (PIPL)

Houari Boumediene

Airport

Management contract

Société de Gestion des

Services et Infrastructures

Aéroportuaires – SGSIA

Aéroports De Paris –

ADP

Metro of Algiers

Management contract

Entreprise du Métro

d’Alger – EMA

Régie Autonome des

Transports Parisiens

Développement

(RATP Dev.)

Port of Djen

Build, rehabilitate,

operate, and transfer

Entreprise Portuaire de

Djen - Djen – EPJ

DP World

Ports of Algiers

Build, rehabilitate,

operate, and transfer

Entreprise Portuaire

d’Alger – EPAL

DP World

Source: Authors based on World Bank’s database on Private Participation in Infrastructure (WB, 2019).

The fact that the institutional PPP model has been adopted in Algeria does not seem to be

unintended. According to the existing legislation on finance,

foreign investments

in the

production of goods and services in Algeria are possible only in the framework of a partnership

with a local company in which the national resident shareholding represents at least 51% of the

equity. Further to the 49/51 rule, which is mandatory since 2009, some additional regulatory