Improving Transport Project Appraisals

In the Islamic Countries

111

1.

Project application and registration phase

a.

Identification

: Cabinet approved the project as PPP On 24 July 2016;

b.

Identification of resources

: Funding for technical assistance (AFD, see above) was secured

in September 2018;

2.

Project preparation

: a technical assistance contract has been finalised and the team of

consultants is to be mobilised;

3.

Tendering and procurement

: to be done, to be supported by the consultants;

4.

Implementation

: following contract award. It should be noted that the design and

construction of the BRT infrastructure and superstructure is about to commence, with

contracts being awarded, as indicated above.

MCA applied in the transport strategy

For the LTNTS,

MCA

was applied in order to determine an optimal scenario for development of

the transport sector. To this end, six main criteria (regional and macro-economic; technical;

social; policy; economic and financial; and environmental) have been defined in terms of specific

indicators, both quantitative and qualitative. Quantitative transport indicators have been

computed by the outcome of the dedicated transport model (see section below). Financial and

economic indicators are derived from the CBA. The following economic and financial indicators

have been used, as

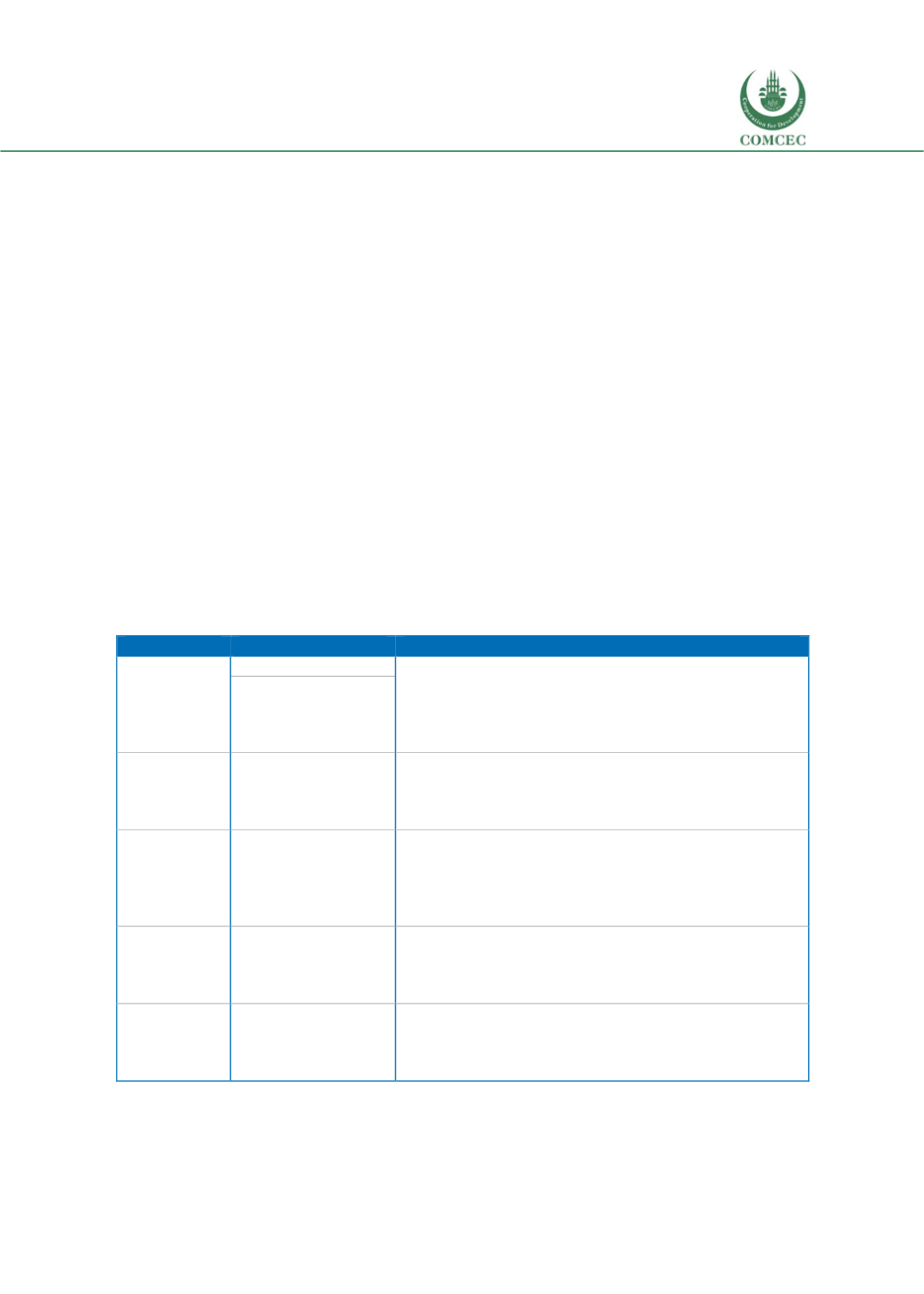

Table 6.5: MCA economic and financial sub-criteria and indicators

Sub-criteria

Indicators

Description

Costs and

benefits

NPV (economic)

Costs and benefits computed through the CBA of

alternative scenarios and evaluated in terms of

economic performance indicator NPV and of financial

performance indicator NPV expressed in Million JOD at

2012.

NPV (financial)

Timing

Distribution of

investments over

time

Timing of the alternative scenarios evaluated in terms of

distribution of investments over time. The indicator here

considered is the ratio between total discounted

investments and total not-discounted investments.

Readiness

Institutional

readiness

The institutional readiness considers whether the option

has already established responsibility for actions

development, administrative/institutional steps for

measures’ implementation already defined, pre and/ or

feasibility studies already available etc.

Financial readiness

The financial readiness is evaluated in terms of financial

plans already developed, allocation of budget, estimated

investment volumes for mature projects included in the

option etc.

Private

sector

participation

Attractiveness for

private sector

participation

Attractiveness for private-sector participation which

measures the overall attractiveness of the option for

private sector participation (e.g. on the basis of expected

revenues or other potential profits).

Source: Jordan Long Term National Transport Strategy and Action Plan