Improving Transnational Transport Corridors

In the OIC Member Countries: Concepts and Cases

89

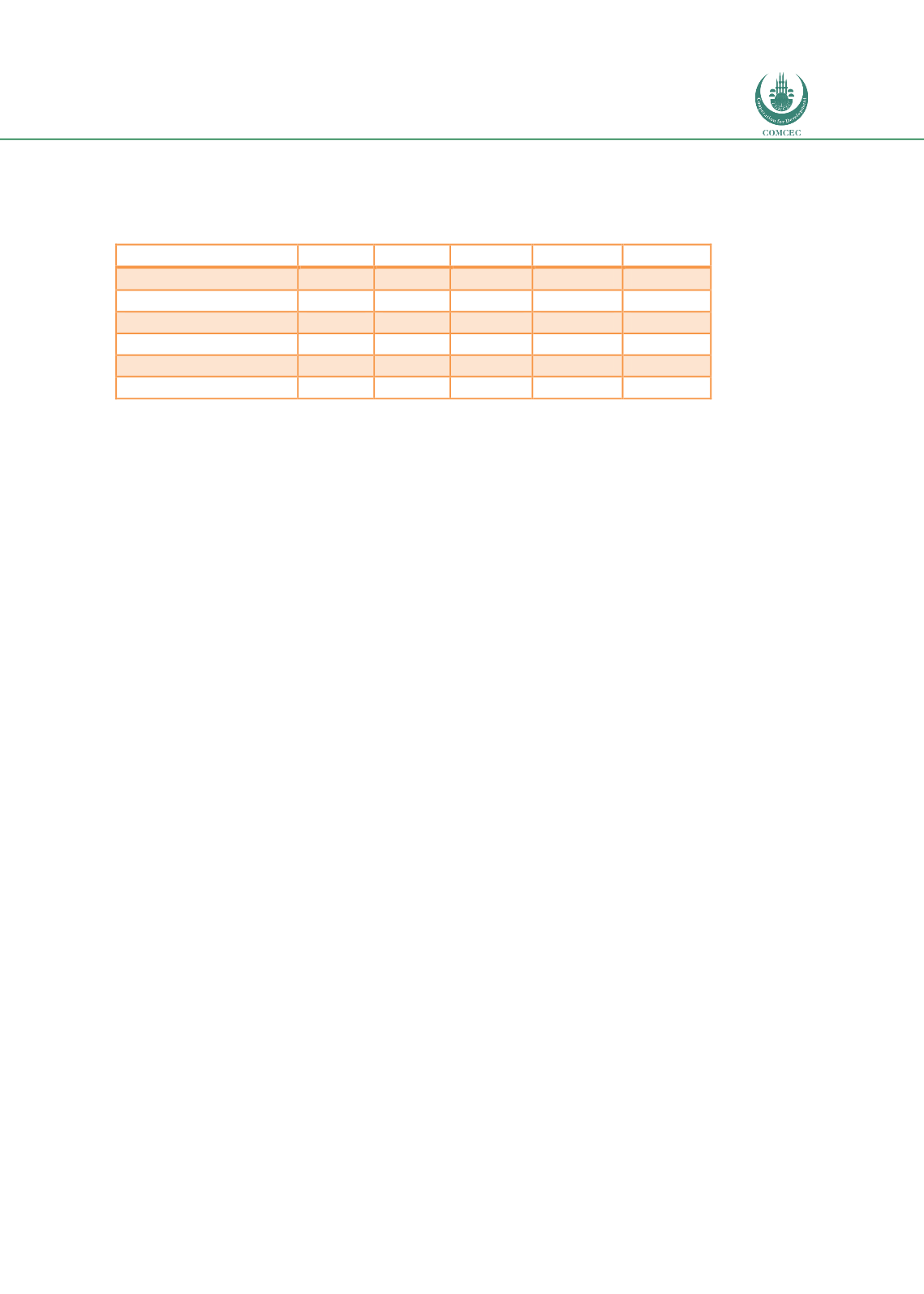

As all border posts as well as pipeline transport are not part of the TRACECA, it is interesting

also to see the subset traveling along the corridor, which is shown i

n Table 19.Table 19: Transport statistics - TRACECA routes in Azerbaijan in 2016 (ktons)

Total

Road

Aviation

Rail

Maritime

Import

11,417

906

158

6,025

4,328

Export

9,724

507

91

5,124

4,002

Transit

10,125

437

67

4,727

4,894

Total border-crossing

31,266

Domestic

18,884

Grand total

50,150

Source: TRACECA

Ismayil (2017) states that 17-18 mtons of rail cargo travels along TRACECA every year.

Comparing to other rail freight markets, there are currently few containers along TRACECA

since these are generally moved by road. Feeder ships move about 300 000 twenty foot

equivalent units (TEUs)/year to the Georgian ports Batumi and Poti, and about 2/3 are moved

by truck and 1/3 go by rail (Ismayil, 2017), of which 35 kTEU were moved along the TRACECA

routes T20-T22 in Georgia in 2016, down from 44 kTEU in 2015.

Oil shipping has a long history on the Caspian Sea and in fact, the Nobel brothers launched the

world’s first oil tanker, Zoroaster, between Baku and Astrakhan in 1878 (Azerbaijan Caspian

Shipping Company, 2017). Nowadays vessels carry oil from Kazakhstan and Turkmenistan

over the Caspian Sea to Azerbaijan for transit by pipeline or rail. There are no dry ports (Roso

et al.

, 2009) for containers by the combination of sea and rail and little containerized goods

overall along the Caspian Sea part of TRACECA but mostly bulk and oil (Mamedov, 2017).

Nevertheless, the new port in Alat, 75 km south of Baku, is prepared for containers. Much of

Baku’s maritime traffic has now moved to Alat to avoid congestion in Baku and release the city

from air pollution. The new port is positioned to grant more direct access to Georgia along

TRACECA route T22.

Competing for rail cargo between China and Europe with more northern routes through

Russia, TRACECA can offer superior transport safety and reliability. It is critical, though, that

the time spent at border crossings can be reduced as too many border crossings significantly

hamper competitiveness compared with a northern route through Russia. In the best case,

border control (inspection and paper work) is done in two hours, but due to many border

crossings it is still slowing down trains travelling over many countries.

To be competitive, however, not only time consumption but also costs need to be kept low. For

rail transport, shipping and port handling, pricing follows nationally decided tariffs depending

on commodities, type of wagon and container rather than attempting to apply market pricing.

Ministries set maximum tariffs, but not minimum. Road, on the other hand, is highly

competitive but restricted by road permits. Ismayil (2017) finds rail operators to be rather

inflexible compared to road hauliers, so if more road permits were issued, rail would lose

traffic.