Improving Transnational Transport Corridors

In the OIC Member Countries: Concepts and Cases

88

Many of the TRACECA member states are on the bottom part of Transparency International’s

Corruption Perceptions Index (CPI)

34

. This is obviously troublesome for an organization like

TRACECA building on infrastructure investments that are prone to corruption. This implies

that all spending might not come to use jeopardizing the success of TRACECA and making IFIs

cautious. According to Ismayil (2017) the problems are worse in the eastern part, an

observation that coincides with the countries’ CPI rankings. In Romania and Bulgaria, for

instance, officials do not dare to take bribes since there are signs where to call if you have been

encouraged to bribe and there are strict actions due to EU rules. In the east there seem to be

more of a liberal attitude towards corruption and officials are not so afraid of getting caught.

4.3.7.

Technical and Operational Factors

Trade in value is reported above, but another measure of the economic value of a transport

corridor is the amount of freight forwarded. According to Ismayil (2017), TRACECA had an

annual flow along the corridor of some 200 ktons at the start, it is now in the range of 70

mtons, some years ago even 80 mtons. Now are mostly dry bulk and oil products transported,

but also some general cargo.

In the case of Georgia at the heart of the selected routes, the 11,8 mtons transported along

TRACECA in 2016 were divided between 2,8 mtons domestically, 1,1 mtons export, 2,6 mtons

import and 6,2 mtons transit (Ismayil, 2017). Crude oil and oil products dominate with 5,5

mtons, while the other reported commodities sugar, grain, iron and manganese ores, non-

ferrous ores and chemicals and fertilizers are surprisingly equal each accounting for 430-500

ktons. The high amount of transit traffic reflects the importance of TRACECA for landlocked

countries’ access to deep sea ports in the Black Sea.

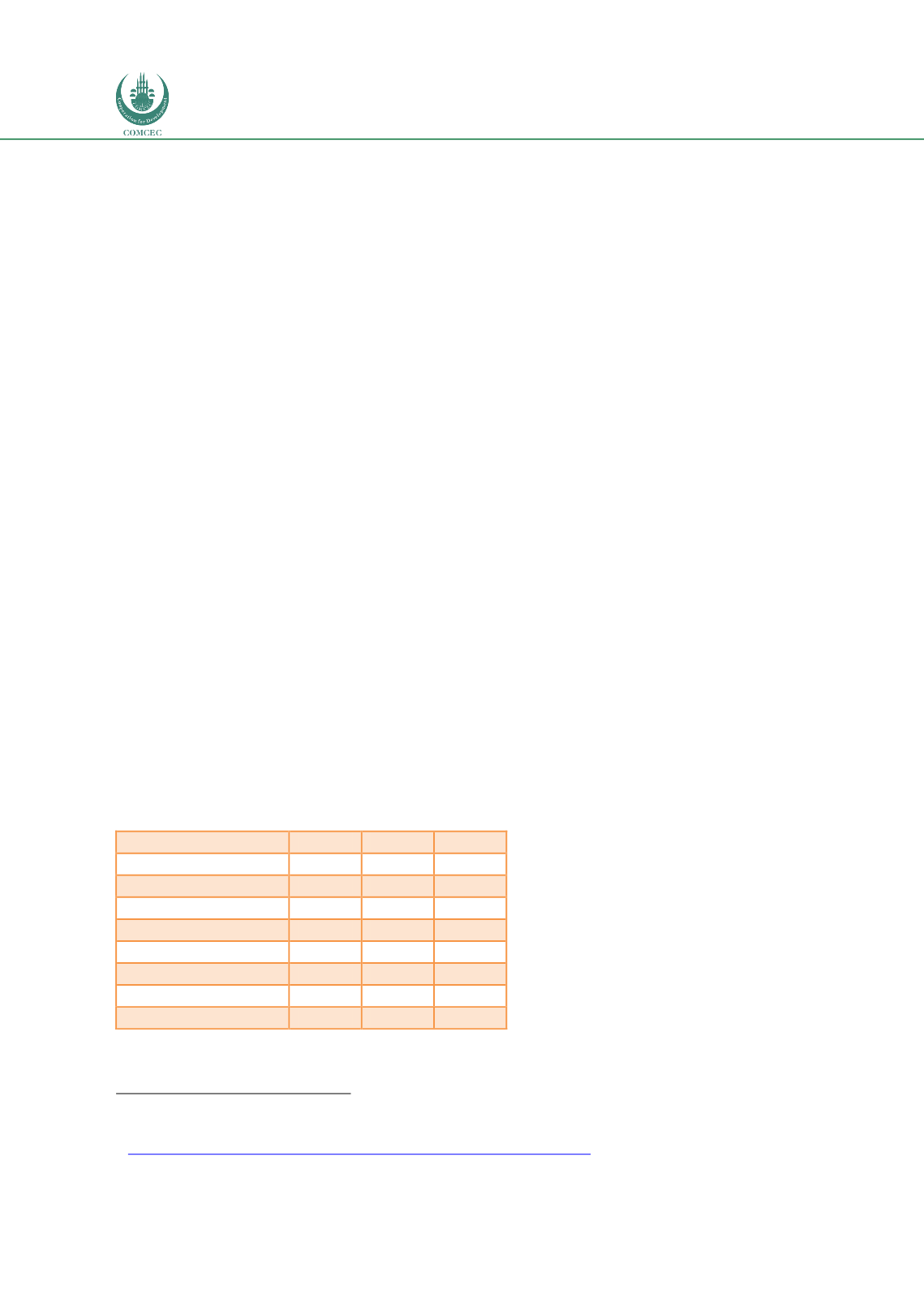

The other country in the middle of the studied routes, Azerbaijan, has very strong focus on the

oil trade. This is obvious from the figures in

Table 18showing the dominance of pipeline

export of crude oil.

Table 18: Border crossing trade of Azerbaijan in 2016 (ktons)

Import Export

Total

Maritime

704

395

1,099

Rail

4,936

2,456

7,392

Road

1,775

644

2,419

Aviation

18

52

70

Post

0

With motor

53

5

58

Non-motor (pipeline)

163

25719

25,882

7,649

2,9271

36,920

Source: TRACECA

3

4 https://www.transparency.org/news/feature/corruption_perceptions_index_2016