Risk & Crisis Management in Tourism Sector:

Recovery from Crisis

in the OIC Member Countries

101

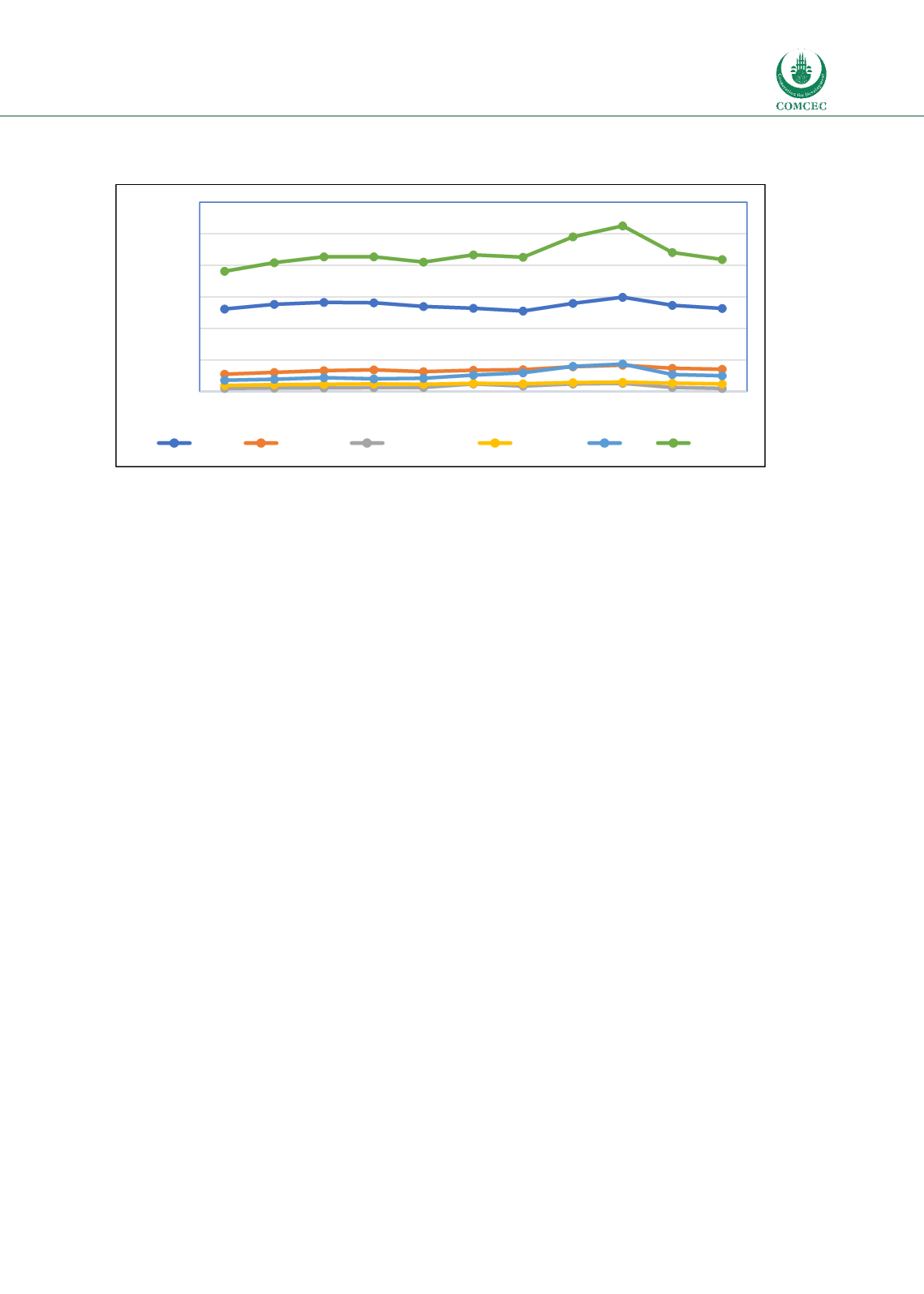

Figure 5.1: Arrivals to South Africa fromOutside Africa, 2005-15

Sources: WTTC, 2016; UNWTO (various); South African Tourism (various)

To compensate for the sluggish growth in international markets, many tourism businesses have

turned to domestic and regional markets. While this at least has allowed for businesses to

survive and for some transfer of wealth between urban and rural areas, domestic tourists have

a lower spend than international ones while regional visitors have a shorter length of stay in

addition to a lower spend, meaning that these two groups cannot compensate for the foregone

foreign exchange earnings.

In economic terms, tourism continues to make a significant contribution to national revenue

despite its slow growth. Data from the WTTC (2017) suggests that direct expenditure from

tourism contributes around 3% to GDP, rising to 9% when direct and induced expenditure is

taken into account, with around 5% of employment in the tourism and hospitality sector –

although this does not include jobs in the informal sector. The WTTC forecasts that the

contribution to GDP will rise to 3.8% by 2027 (direct share) and 11.5% (indirect share) and 6%

of employment (WTTC, 2017). These figures are particularly significant given that growth in the

South African economy overall is slowing, with GDP growth rate of just 0.3%and unemployment

at 26.5%, and the downgrading of sovereign debt to sub-investment grade in April 2017 (World

Bank, 2017).

Organisationally, the arm of South Africa’s Department of Tourism responsible for promotion is

South African Tourism (SAT). The principal private sector forum is the Tourism Business

Council of South Africa (TBCSA), which groups companies right across the sector, and through

which the Department of Tourism and SAT channel their messages and policies. In addition,

there are other trade association such as the Southern Africa Tourism Services Association

(SATSA), the South African National Convention Bureau (SANCB) and the Association of South

African Travel Agents (ASATA). Additional influence comes from the office of Brand South Africa

(BSA), established in 2002 and responsible for managing the overall image of South Africa

overseas, with the aimof encouraging inward investment as well as tourism. BSA sets the overall

brand for South Africa, which is picked up by South African Tourism, tourism associations and

private companies. The current branding strapline is ‘South Africa – Inspiring new ways’.

0

500.000

1.000.000

1.500.000

2.000.000

2.500.000

3.000.000

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Europe

N America

C & S America

Australasia

Asia

Totals