Risk & Crisis Management in Tourism Sector:

Recovery from Crisis

in the OIC Member Countries

100

In terms of its market, South Africa has the largest share of international arrivals in sub-Saharan

Africa, with almost 9.5 million visitors staying at least one night in 2016 (UNWTO, 2017). Of

these, just over 2.5 million originated from non-African countries, principally Western Europe

(60%), North America (16%) and Australasia, China and India (14%). The length of stay of these

categories is commonly between 7-14 days and their average spend (in-country plus pre-

departure expenditure) is around R.65,000 (US$ 4,930) per person. Regional arrivals by air (i.e.

tourists from other Sub-Sahara African countries) totalled 635,950 in 2016, with a typical stay

of around 6 days and expenditure per person per trip of R. 33,400 (US$ 2,500). Meanwhile, land-

arrivals typically stay for 1-3 nights and spend just R. 6,200 per trip (US$ 470) (Saunders, 2017).

Land-arrivals are generally from countries within the Southern African Development

Community (SADC), especially Botswana, Lesotho, Mozambique, Namibia, Swaziland and

Zimbabwe. This category includes many people on VFR trips or who are working or studying in

South Africa.

These figures make it clear that tourists from outside Africa are overall more valuable to the

economy than others, and according to the 2015-20 Strategic Plan, these are the core target

markets along with the higher-spending African markets such as Nigeria and Tanzania (South

African Tourism, 2014).

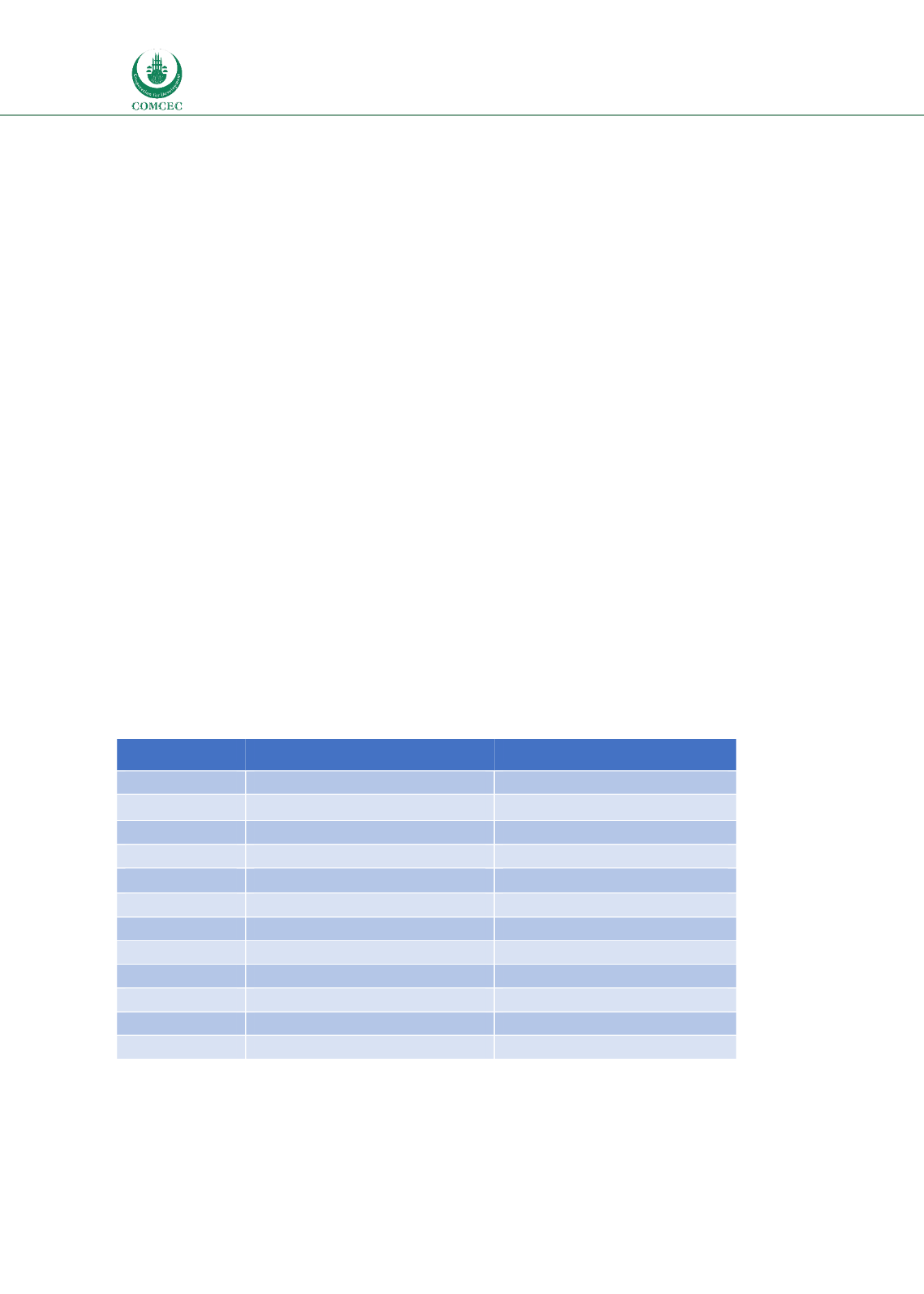

Table 5.1 shows international visitor arrivals over the period 2005-16. Although the total

number has risen by 26% over this period the growth has almost all come from SADC countries,

while the more lucrative markets of Europe, the Americas, Australasia and Asia have remained

somewhat static.

Table 5.1: International Visitor Arrivals and Foreign Exchange Earnings - South Africa

Year

Arrivals (‘000s)

Receipts (US$ million)

2005

7,518

7,327

2006

8,396

7,875

2007

9,091

8,418

2008

9,592

7,925

2009

7,012

7,543

2010

8,074

9,070

2011

8,339

9,547

2012

9,188

9,994

2013

9,510

9,238

2014

9,549

9,348

2015

8,904

8,235

2016

9,490

9,500

Sources: WTTC, 2016; UNWTO (various); South African Tourism (various)

Figure 5.1 illustrates the disappointing non-growth of arrivals from these countries, with the

reasons for this discussed below.