149

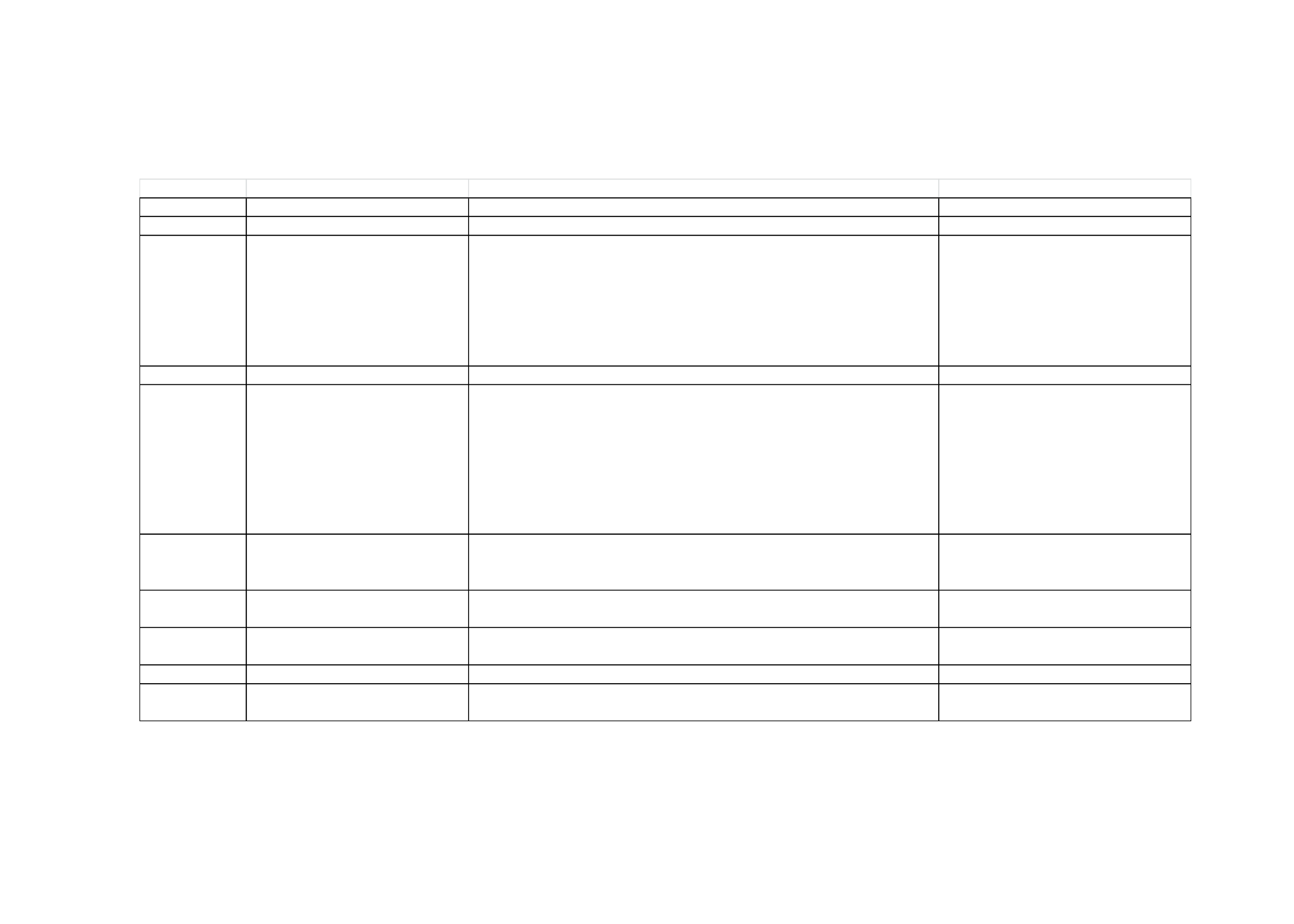

Table 28:

Overview of Rules of origin in Selected RTAs Involving OIC Countries

RTA

Basic Rules of Origin

Cumulation

De minimis rules

ASEAN

RVC (40) Plus CTC (4 digit)

Cumulation permitted across all RTA Parties provided

ASEAN-China

RVC (40)

Cumulation permitted across all RTA Parties pro- vided inputs satisfy RVC(40) rule Not applicable.

Jordan-EU

Complex product specific rules.

Bilateral cumulation

Excluding products in HS chapters 50- 63:

total value does not exceed 10 % of the ex-

works price of the product;

any of the percentages given in the list for

the maximum value of non- originating

materials are not exceeded

Agadir

Diagonal cumulation across Pan-Euro-Med region (42 countries)

Egypt-Turkey

Complex product-specific rules.

Cumulation permitted across Pan-Euro-Med region

Rules excluding products in HS chap- ters 50-

63:

total value does not exceed 10 % of the ex-

works price of the product;

any of the percentages given in the list for

the maximum value of non- originating

materials are not exceeded

GCC

Not specified (would not be needed

once customs union fully

implemented)

SAARC

RVC (40) and CTC (4-digit) Regional cumulation allowed provided inputs satisfy RVC (20) and CTC (4-digit) or

product-specific rules related to CTC (6 digit)

Not applicable

Mal-Pak

RVC (40) or CTC (4-digit) specific rules

for several products

Bilateral cumulation

Not applicable

WAEMU

RVC (30) or CTC (4digit)

Cumulation across parties allowed

n/a

Rus-Bel-Kaz CU

CTC (4digit) specific rules for several

products

Cumulation across parties allowed

5%

RVC (X) denotes a condition for eligibility to preferential treatment where Regional Value Content in a given RTA need to be not lower

than X percent of the Free on Board Value (FOB) of the product. CTC denotes change in tariff classification.