Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

144

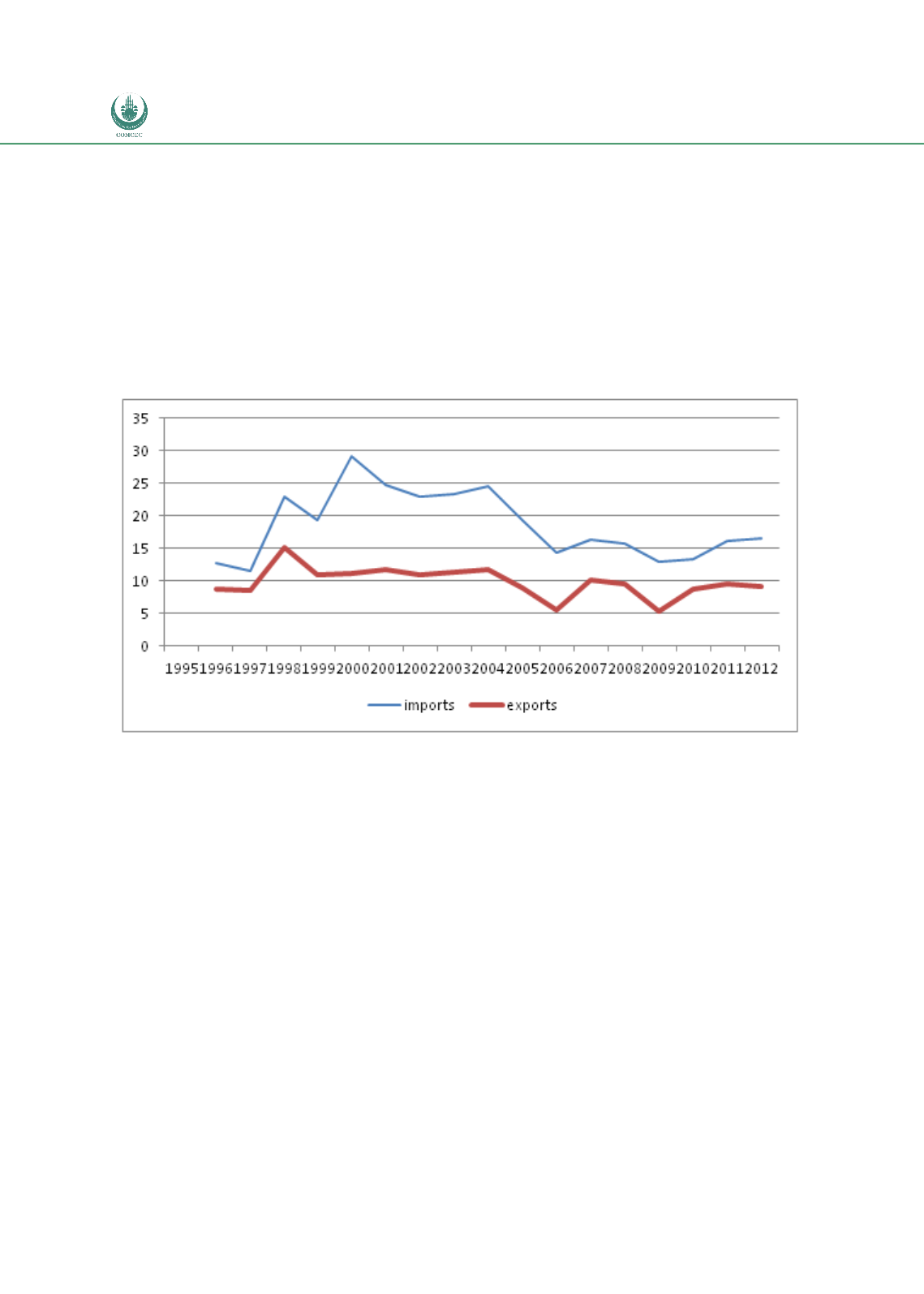

The share of intra-customs union exports has remained close to 10% for the last several years.

The share of imports oscillated around 15%, down from close to 25% in early 2000s. The

falling share of customs union partners in Kazakhstan’s exports is explained by rapidly rising

role of oil in total exports. The share of mineral fuels, oils, distillation products (HS 27) in total

exports of Kazakhstan

increased from 34% in 1997 to 52% in 2000 and 70-76% in 2010-

2013. Oil exports are predominantly destined to the EU market and more recently also China.

Figure 69:

Share of Intra-FTA Trade for KBR as Share of Total Trade

Calculations based Comtrade data

Trade values between Kazakhstan and Belarus are very low in 2013, Kazakhstan’s exports to

Belarus were below USD 60 million, compared to USD 5.8 billion worth of exports to Russia.

Trade between Kazakhstan and its customs union partners is very diversified and over time

Kazakhstan’s exports to both Russia and Belarus have further diversified (Figure 71.

Kazakhstan’s exports to the world are dominated by oil (HS chapter 26 accounted to 75% of

total exports in 2013), whereas in exports to Russia HS27 accounted for just 14% of the total in

2013. It is also worth observing that potential joining of the customs union by Kyrgyzstan

would imply significant increase of Kyrgyzstan’s external tariffs. On the other hand Kyrgyzstan

is strongly economically integrated with its larger neighbour Kazakhstan.