Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

115

In the Pan-Euro-Med zone, in principle, in diagonal trade a prohibition of duty drawback must

be respected, i.e. it will not be possible to repay duties paid on inputs imported from non-

participating countries. This is meant to reduce the incentives for the use of imported inputs

from non-participating countries and to encourage the use of inputs from parties of Regional

Convention on pan-Euro-Mediterranean preferential rules of origin. However, at present all

four Agadir members are allowed to apply partial drawback as a temporary provision

(currently running until end-2015).

27

The Agreement also provides for enhanced cooperation

on customs procedures and technical standards. The services provisions re-iterate GATS

commitments.

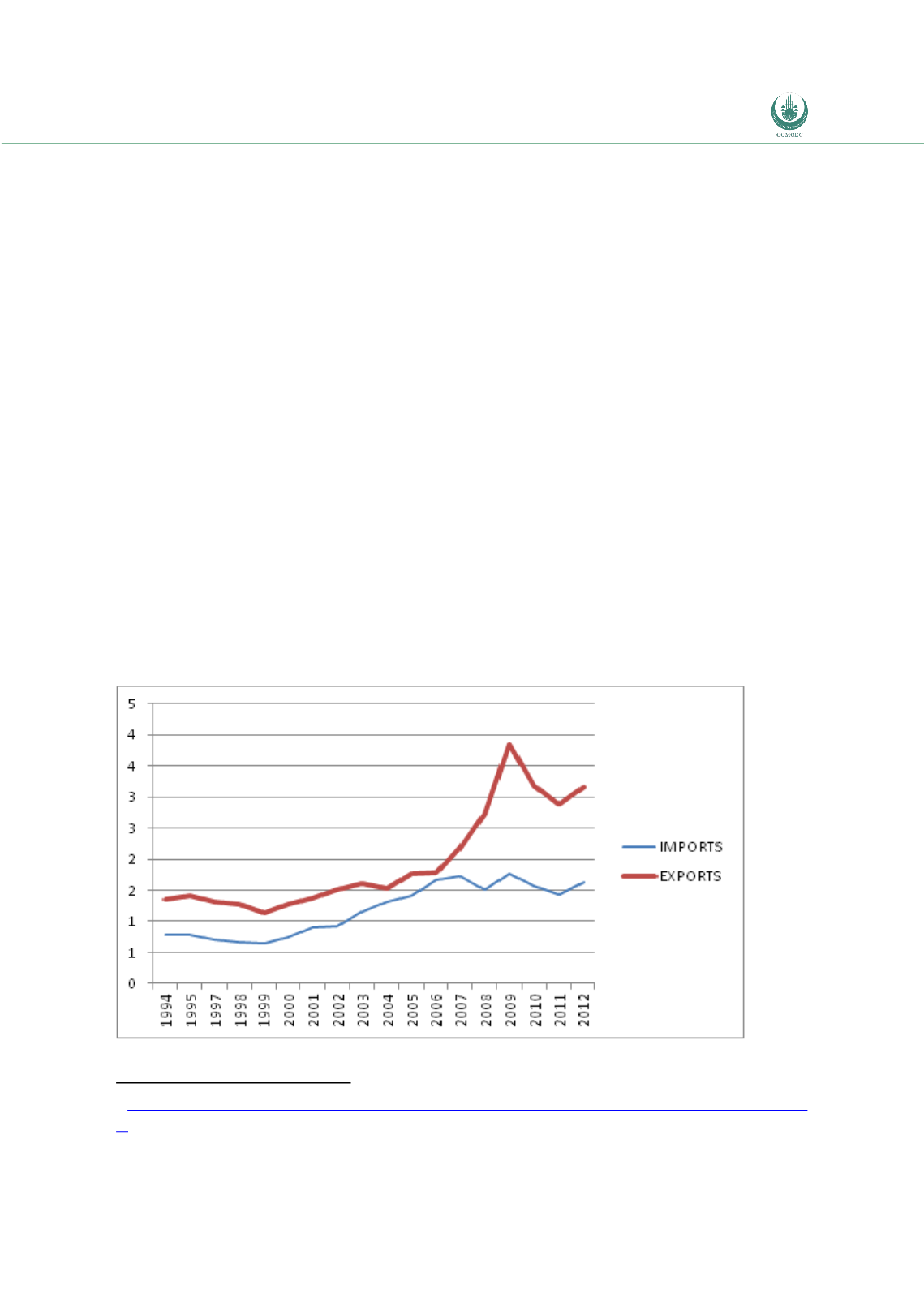

Intra-Agadir trade increased significantly from the early 2000s in relative terms. The share of

intra-Agadir exports and imports in total exports and imports doubled from early 2000s to

2009-2012 (Figure 32). This increase largely coincides with the period of entry into force of

the agreement. The analysis of individual members’ shares of trade with Agadir partners

reveals that the main driving force of the rise of intra-Agadir trade was a boost of Egypt

exports, especially to Jordan. This can be partly explained by rising natural gas exports

following the opening of the natural gas pipeline in mid-2000s and to a lesser extent rising

electricity ex ports. However, the levels and dynamics of intra-Agadir non-oil and gas exports

and imports are actually very similar to the ones for total trade confirming increasing trade

integration in the region (or at least between Egypt and Jordan).

Figure 32: % Share of Intra-bloc Trade out of Total Agadir Trade)

Calculations based on Comtrade data

27 http://ec.europa.eu/taxation_customs/customs/customs_duties/rules_origin/preferential/article_783_en.ht m[accessed 2 May 2014].