Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

110

duty free access. The same applied to practically all agricultural exports (99.5%). Given the low

level of the EU’s MFN tariffs, duty free access for Jordan provided a rather limited preference

margin of 1.9% (weighted averages)

23

.

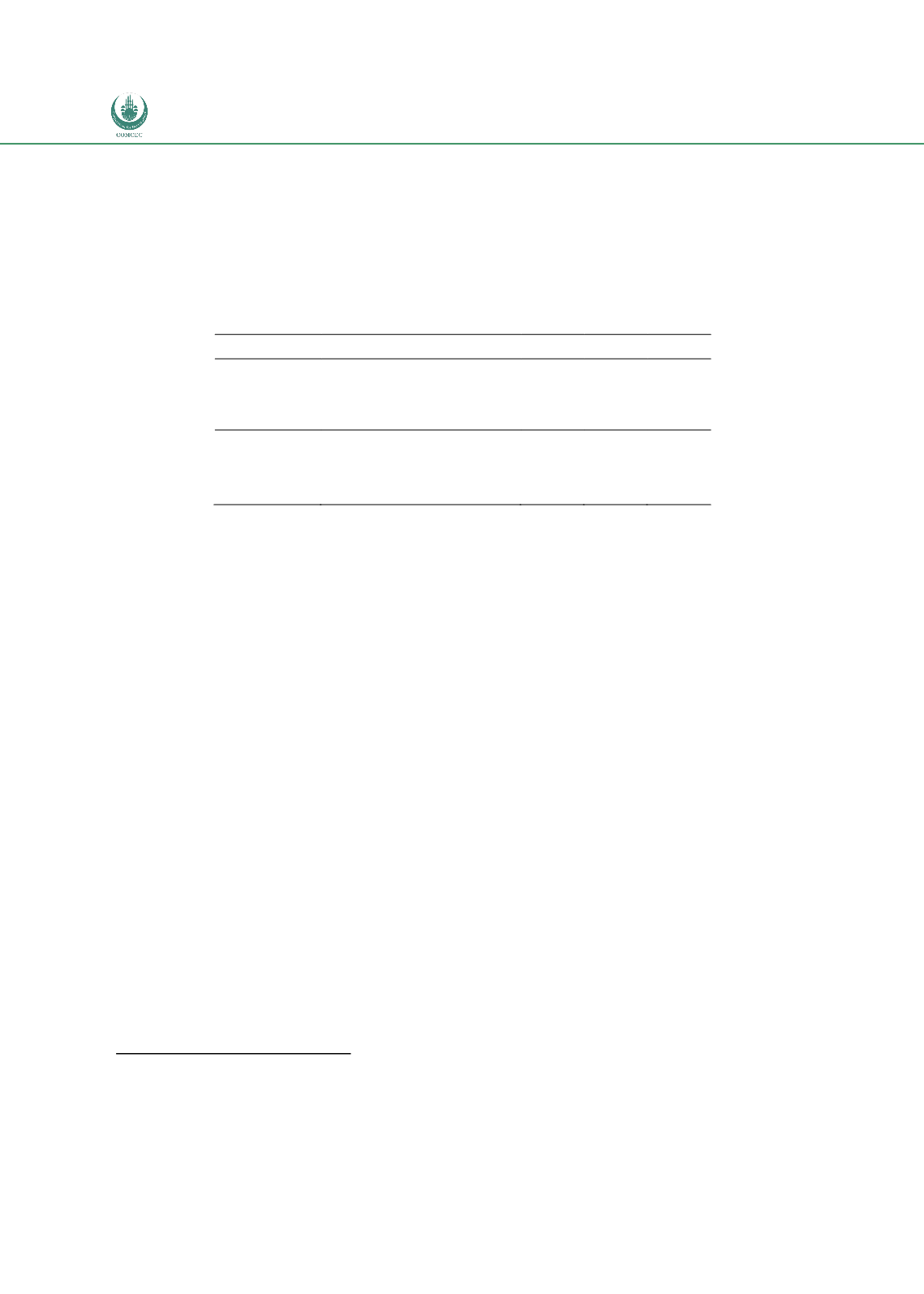

Table 18:

Simple Average MFN and Preferential Tariffs Applied by Jordan and the EU

Reporter

Partner

2000

2005

2010

Jordan

EU

24.8

15

World (MFN)

22.09 13.57

World (applied tariff) 22.09 11.29

EU

Jordan

0.25

0.36

0

World (MFN)

4.4

4.19

4.21

World (applied tariff) 1.92

1.71

1.93

Source: WITS (TRAINS database - aggregated from 6digit data).

In contrast, Jordanian tariffs were reduced gradually. The original agreement divided products

into four groups, with Jordanian tariff eliminations envisaged at the moment of the

agreement’s entry into force, over 4, 8 and 12 years, respectively. There were also some prod-

ucts excluded from tariff cuts. These original schedules were subsequently amended (e.g. in

2006 and 2008.)

24

It is difficult to provide an overall picture of the characteristics of the prod-

ucts in each group. As an illustration, in 2009 tariffs on several types of vehicles were removed,

mid-2014 was planned as a deadline when tariffs for several textile materials and clothing

were to be removed, whereas beer, vermouth and similar wines, cigarettes were excluded

from tariff reductions.

25

The difference in speed of tariff reductions between EU and Jordan reflects different levels of

economic development, different tariff levels before the agreement as well as relative

importance of bilateral trade for the partners. Jordanian imports that were heavily

concentrated on the EU in early 1990s with a share of above 1/3 have gradually re-oriented

towards other partner since then so that the EU import share declined to around 20%. The

other partners with a rising share in Jordanian imports during the analysed period were GCC

countries (mainly on the back of rising trade in oil prices -oil accounted for above 60% of total

Jordan’s imports from GCC in 2011), China and members of the Agadir agreement. It is worth

noting that MFN tariff reductions implemented by Jordan eased market access for these other

23

Data published by the WTO, in Tariff Profile 2012,

http://stat.wto.org/TariffProfile/WSDBTariffPFView.aspx?Langua[accessed 28.04.2014].

24 Published in Official Journal of the European Union, L41.3, 13.2.2006; and L9/33, 14.1.2009.

25 Official Journal of the European Union L9/33, 14.1.2009