Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

108

1995 when two product groups: animal and vegetable fats and oils and wood and articles of

wood (HS44) accounted for two thirds of exports to China. Increasing diversification of exports

to China is clearly visible in Figure 28 below. In the case of Indonesia main 2012 ex- ports

included mineral fuels (HS27) 37.5%, animal and vegetable fats and oils (HS15) 19.3% and

ores, slag and ash (HS26) 11.2%. Again, compared to the situation in 1990s Indonesian exports

to China have become much more diversified. Brunei Darussalam mainly exports oil to China.

All three countries mainly import electrical and electronic equipment (HS85), nuclear reactors,

boilers machinery (HS84), iron and steel (HS72) and articles of iron and steel (HS73).

Diversification of products imported from China is yet higher than in the case of exports to

China.

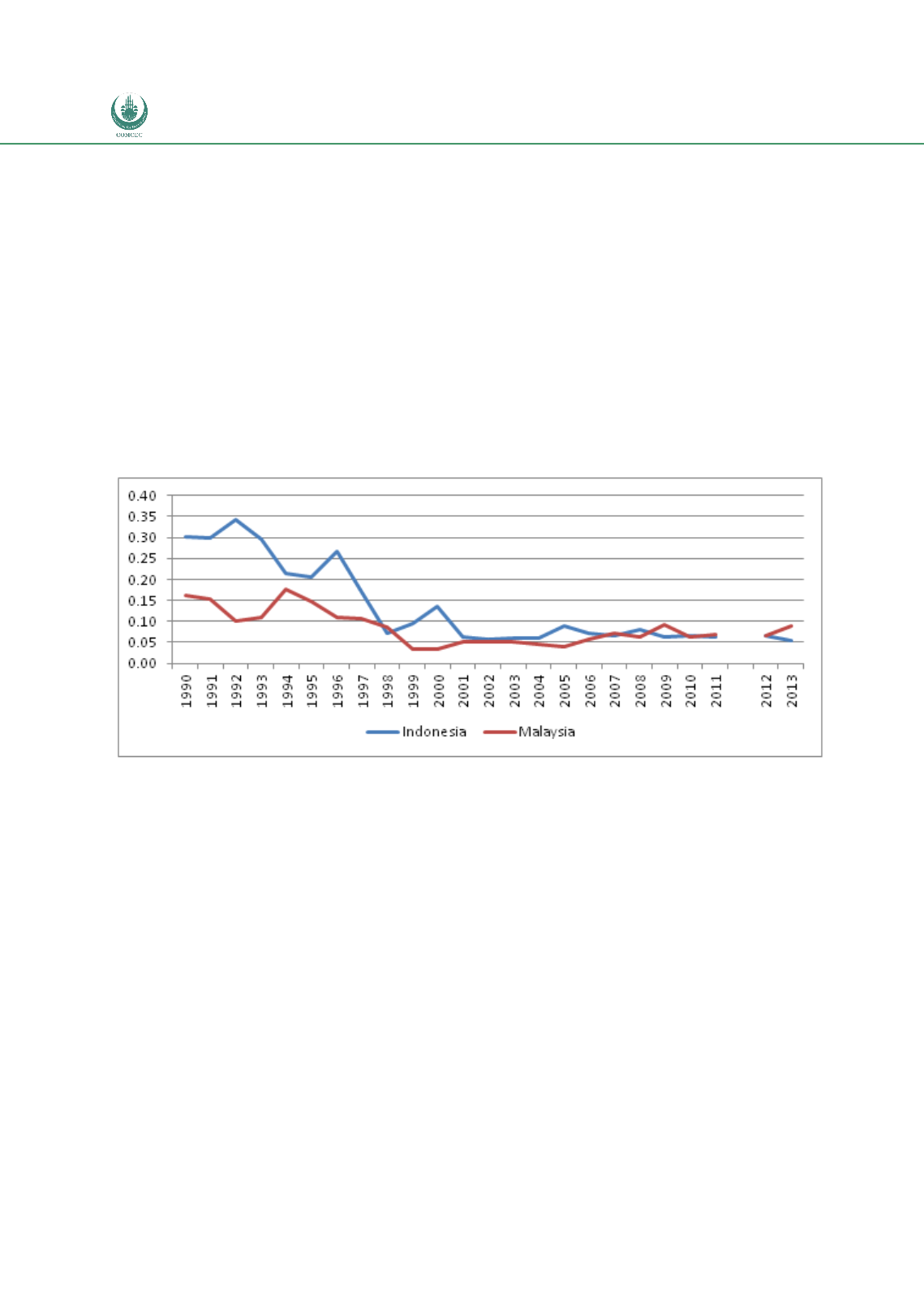

Figure 28: Index of Concentration of Indonesian and Malaysian Exports to China (higher values

indicate more concentrated exports / imports), 1990-2013

Source: calculations based on Comtrade data

Yang and Martinez-Zarzoso (2013) estimate that the ASEAN-China agreement created trade

both within the bloc and with external partners. At the sectoral level significant export effects

are found for manufactured goods and chemical products, while the results for agricultural

raw materials, as well as machinery and transport equipment, are not significant. A range of

other studies using different empirical specifications find mixed results. For instance Supriana

(2013) finds positive and significant impact on export creation for Malaysia, but no significant

impact on Indonesia (Brunei Darussalam is not analysed). Okabe and Urata (2013) analyse

trade patterns between ASEAN and China. They note that ASEAN exports of parts and

components and capital goods have partly re-oriented from ASEAN towards China. This

indicates emergence of regional production networks in the ASEAN-China region.

The Trade in Services Agreement entered into force in mid-2007, but its commitments do not

go much beyond re-iterating GATS commitments (Table 17). China’s original WTO

commitments are to open to ASEAN 26 branches in 5 service areas: construction,