DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

13

k.

Supply chain finance

Supply chain finance is the term used to refer to a set of “new” solutions, which can involve for

some banks, one or two very specific products, and for others, comprehensive programs

covering, say one large buyer and dozens of suppliers.

The development of supply chain finance as a proposition evolved from the near-global shift

away from traditional mechanisms to trade on open account terms. This trend which began

prior to the global financial crisis was seen as a serious threat by banks in particular, as their

role in open account transactions was typically limited only to the transmission of payment,

without any need for risk mitigation or financing. Supply chain finance was seen as one way for

banks to “re-intermediate” themselves back into a more significant (and profitable) role in

supporting international trade activity.

Supply chain finance is particularly promising in terms of assuring adequate levels of trade

finance to SMEs, including those located in developing and emerging markets, thus potentially

well suited to providing financing solutions in support of international development. It should

be noted that supply chain finance can involve the use of certain financing mechanisms long-

established in trade finance, such as factoring or invoice-based finance. It is the way in which

such mechanisms are applied to the financing of supply chains that makes the framework

around supply chain finance innovative and evolutionary.

1.2.2.2.

The Documentary Letter of Credit: Illustrating the Flexibility of

Trade Finance

Documentary letters of credit are among the most established instruments of trade finance,

favoured by markets across the MENA Region and parts of Asia in particular, as proven

mechanisms of trade payment and financing and as effective means for mitigating a wide range

of risks. Letters of credit are also appreciated for their linkage to international commercial

practice and to long-established guiding rules like the Uniform Customs and Practice for

Documentary Credits. The transaction flow and structure around a documentary letter of

credit can be used to illustrate the flexibility and features available through trade financing

practices and mechanisms.

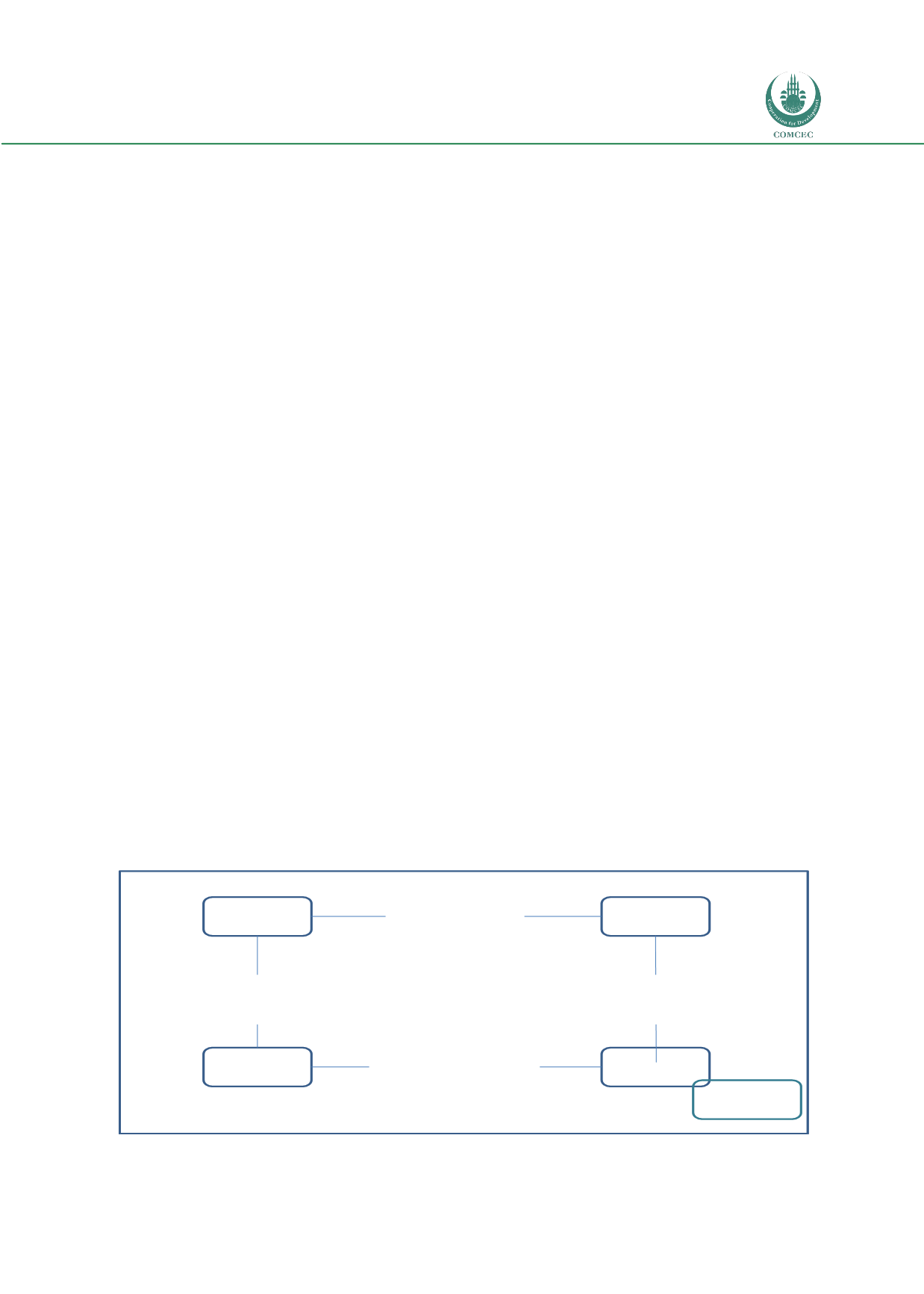

Figure 3: Documentary Letter of Credit Transaction Flow

Source: OPUS Advisory Services International Inc.

Importer

Issuing

Bank

Exporter

Advising

Bank

Sales Contract

&

Delivery of Goods

L/C Application

Payment Exchanged

For Documents

Exporter Documents

Document Verification

Exchange for Payment

L/C Issued/Advised

(With Confirmation)

Document Verification

Settlement/Payment

Confirming

Bank