Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

8

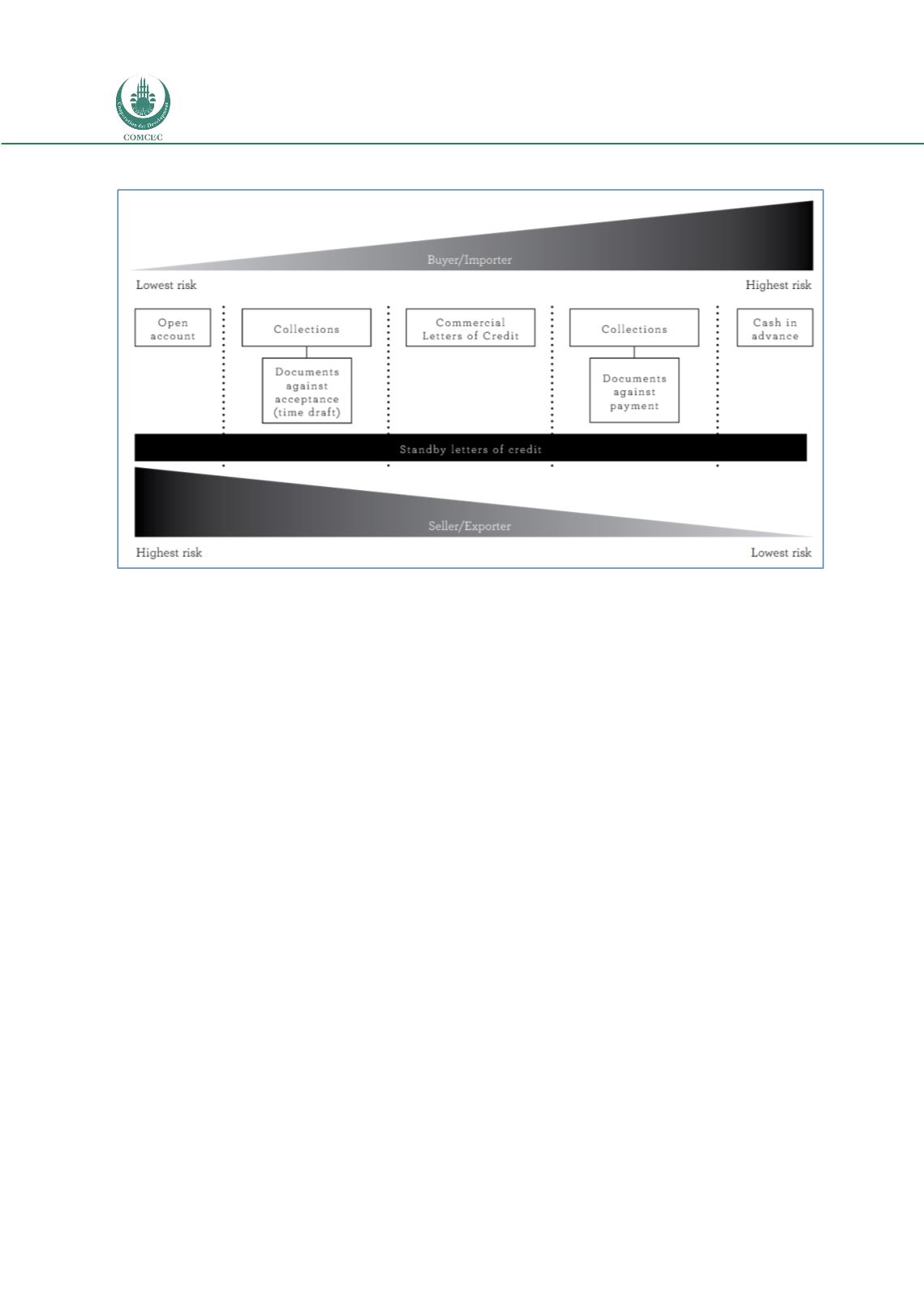

Figure 1: Risk in Payment/Settlement Options

Source: International Trade Procedures, Wells Fargo Bank

Commercial or documentary letters of credit provide the most balanced protection covering

the interests of importers and exporters. Confirmed documentary letters of credit provide

equally strong protection to the buyer, while enhancing the protection provided to the

exporter.

Standby letters of credit are sometimes used to facilitate trade between buyer and seller, but

are more commonly intended to serve as a protective instrument, to ensure that the

beneficiary of that credit is protected in the event of non-payment or non-performance of

agreed obligations by the party providing the standby credit.

Collections or Documentary Collections involve an exchange of shipping documents (including

documents of title to the goods shipped) for payment or for an undertaking to pay at an agreed

future date. Such instruments involve banks acting to facilitate an exchange, with no

responsibility to engage in any meaningful verification of documents submitted by the

exporter.

Documentary letters of credit provide an excellent illustration of the flexibility and efficacy of

established trade finance mechanisms, in facilitating and enabling global trade, in that they can

show all four elements and a variety of features and mechanisms available for importers,

exporters and their financiers.