DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

9

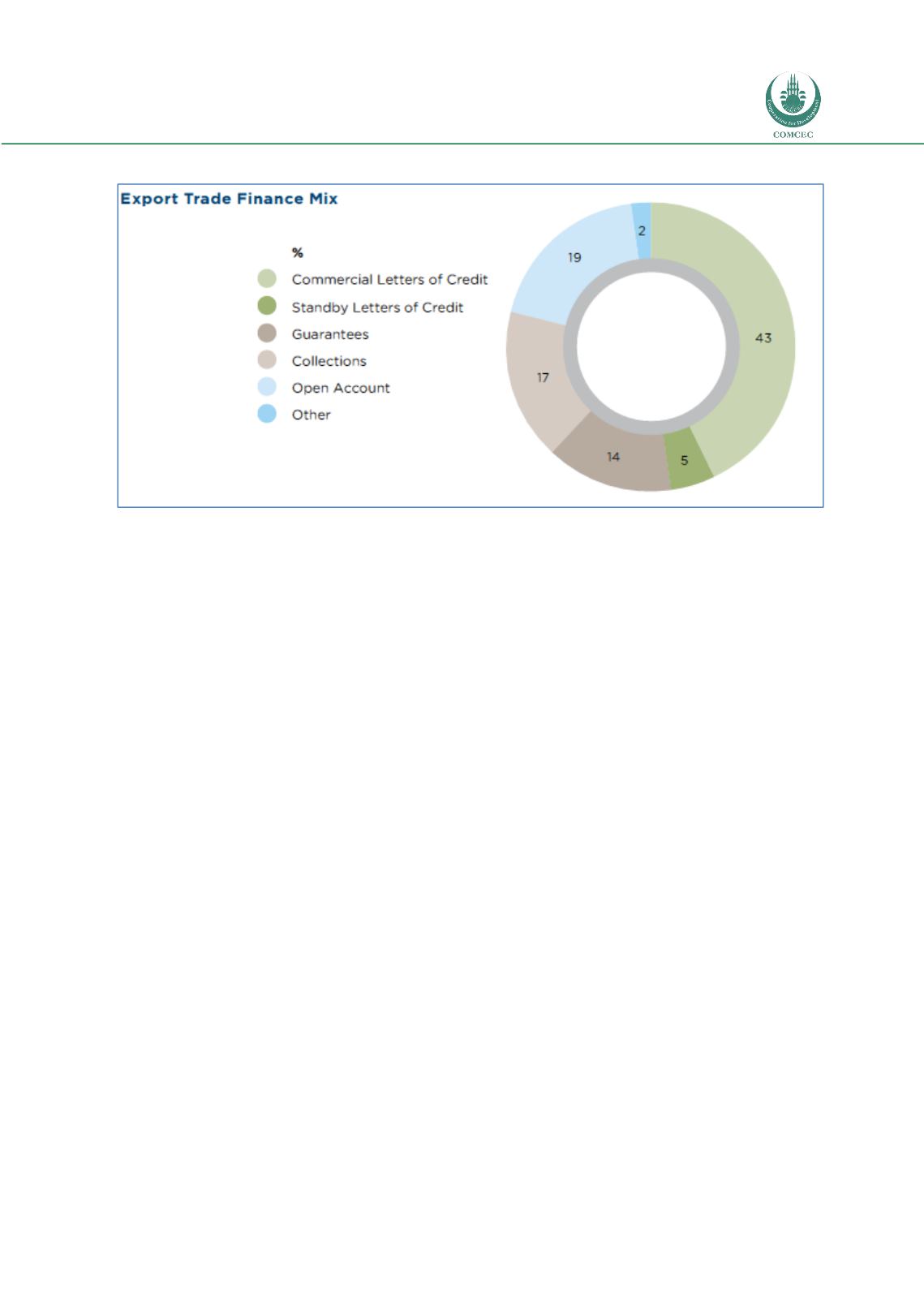

Figure 2: Export Trade Finance Mix in Bank Portfolios

Source: ICC Rethinking Trade & Trade Finance 2013

Although estimates from banks and IFI sources suggest that about 80% of trade is now

conducted on open account terms (ICC Banking Commission, 2013), only about 19% of export

trade finance activity in bank trade finance departments relates to this type of transaction –

partly because open account transactions typically will involve banks only in the payment step,

which can be handled in other areas of a financial institution and may not be tracked as trade

finance-related.

Nonetheless, there is an implication that trade finance could be more active in this area, and

this is one of the factors that has led banks to devise solutions for open account business under

the umbrella of supply chain finance.

1.2.2. Financing

Financing is another core component of trade finance. In effect, this refers to some form of

lending to the importer, the exporter or to both, and in the context of supply chain finance, to

additional members of the supply chain ecosystem, such as distributors and other service

providers.

Financing can involve numerous approaches, from traditional lending to allowing exporters to

collect money faster than it would otherwise be due through the financing provided by a bank,

or allowing an importer to pay later than would be expected, again through financing from a

bank.

Financing can be provided on the basis of lending against an asset, like the shipment that is

being sent from exporter to importer, or an invoice approved for payment, or a financial

instrument such as a bank draft, evidencing the legal existence of a financial debt, against

which lending can be effected.

Financing can be categorized in several ways, including in terms of pre-shipment or post-

shipment financing. Pre-shipment financing might be offered to the exporter to help them