Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

6

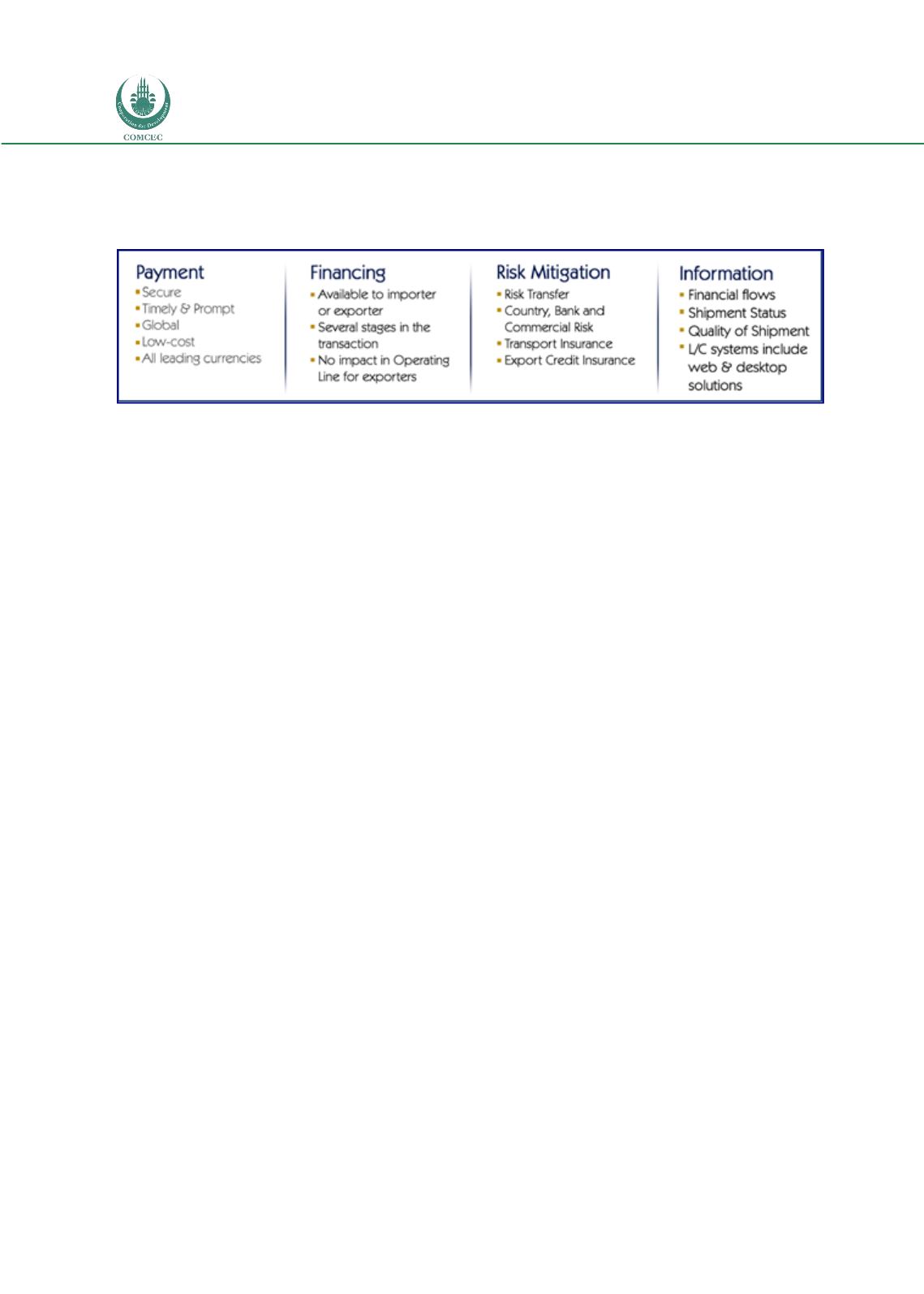

These elements are provided in varying degrees by banks, boutique trade finance firms, export

credit agencies and international financial institutions.

Table 1: Four Elements of Trade Finance

Source: OPUS Advisory Services International Inc.

It should be noted for the sake of clarity that these four elements are not necessarily separate

and distinct. That is to say, certain payment mechanisms also allow for the option to provide

financing as well as risk mitigation. Techniques or products that are perhaps aimed primarily

at the provision of financing will naturally in the end also enable settlement or payment to the

exporter, and finally, solutions aimed at risk mitigation may be associated in some way with a

payment mechanism or a financing structure.

Despite the imperfect boundaries between these four elements, the construct remains helpful

and serves as a useful framework in understanding trade and supply chain finance, since both

traditional mechanisms and emerging solutions incorporate the four core elements.

1.2.1 Payment Facilitation

Trade finance mechanisms and techniques include a component related to the settlement of a

transaction – payment to the exporter, or to a supplier for goods provided and shipped

according to the commercial terms agreed between buyer and seller.

While payment can take place in numerous ways, from check to credit card to escrow account

or through the use of certain payment mechanisms, there are several characteristics to

payment solutions in trade finance that exporters will look for:

Secure payment from a trusted source

Timely payment in line with the terms agreed with the buyer

Affordable payment solutions on a global basis

Available in multiple currencies

Importers and exporters can agree to be paid in several ways, including the following: