24

Figure 2.7, there are 9 Regional Customs Headquarters (Hakodate, Kobe, Moji, Nagasaki,

Nagoya, Yokohama, Osaka, Okinawa and Tokyo) that have the ability to process and examine

applications and provide authorizations to applicants. Furthermore, Tokyo Customs are in

charge of overseeing the operation of the aforementioned regional offices to guarantee that the

AEO program is implemented in a consistent and harmonized way.

This scheme has three main advantages: first, it guarantees a wide coverage and an efficient

way to handle different applications since there are several offices across the country. Indeed,

Japan is one of the rarest countries where applications can be handled by regional offices not

by a centralized office. Second, Tokyo Customs ensures that the multitude of offices does not

alter the consistency of the whole program. Third, in order to make the whole process easier

and simpler in implementation, the Japanese Customs implemented a training program for

newly assigned AEO officers. These courses cover AEO policy, legal frameworks, and other

necessary procedures (authorization, validation, and audit). Moreover, at the regional level,

Japan’s Customs Authorities provide on-the-job training to make sure the AEO program is

uniformly implemented.

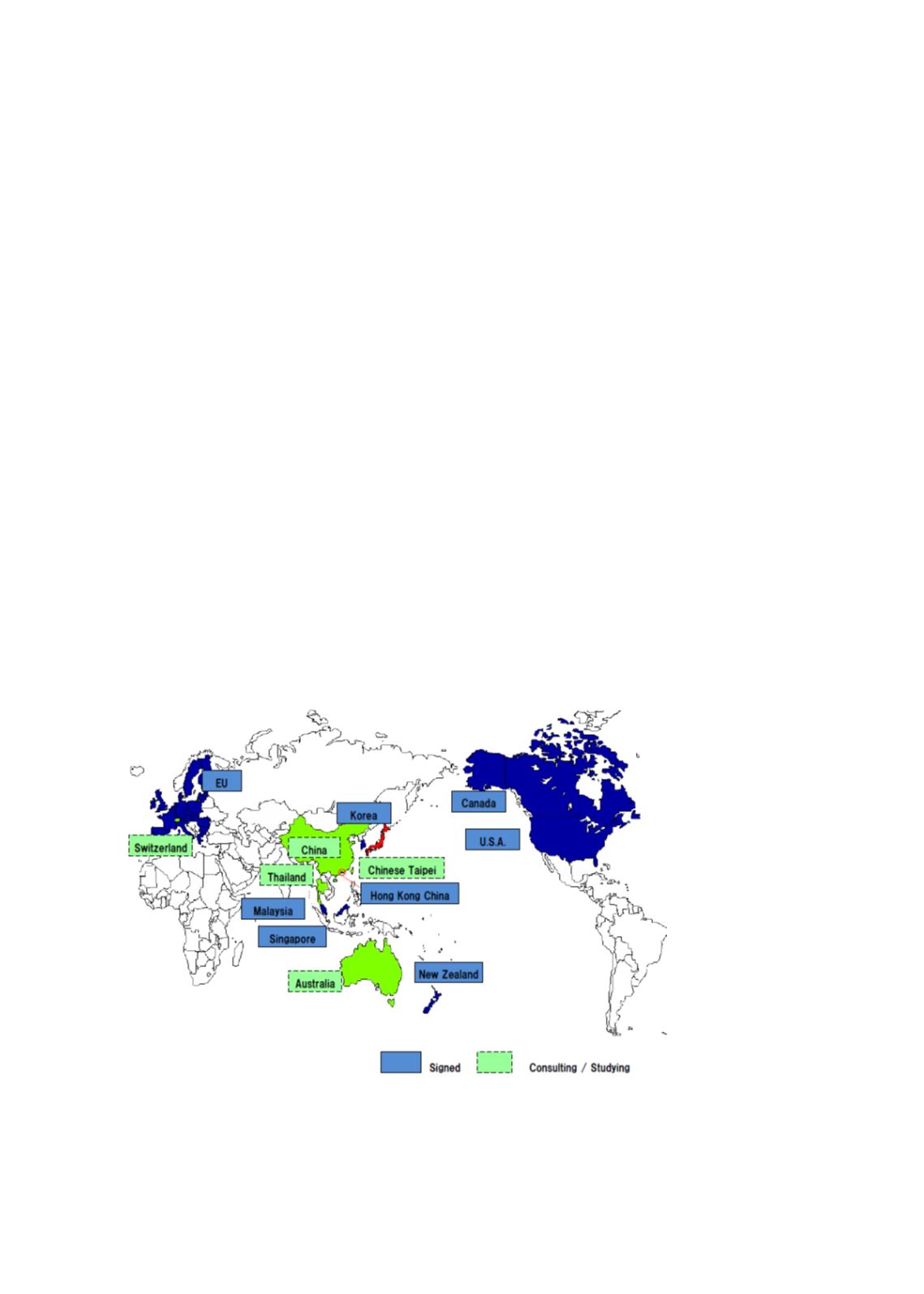

Mutual Recognition Agreements

The government of Japan deployed several efforts to develop partnerships with different AEO

programs across the world to have mutual preferential treatment, simplified Customs

procedures and quicker time to trade for economic operators complying with the supply chain

security standards. This is of particular importance as the perception of the Japanese

government is that the mutual recognition of AEO programs could maximize the benefits of

compliant stakeholders by exchanging relevant information.

Figure 2.8. Partners Having a Mutual Recognition Agreement

Source: Customs and Tariff Bureau and Ministry of Finance (2018).