29

Customs simplifications (AEOC): AEOC members benefit from easier admittance to

simplifications under the Customs legislation. In 2018, there are 7,027 AEOC (44.5

percent of total AEO) in the EU.

A full authorization AEOF: full authorization a full scale of benefits from AEOC and

AEOS. In 2018, there are 8,111 AEOF members (51.5 percent of total AEO) in the EU.

3

Application, Verification and the Authorization Process

Application Criteria

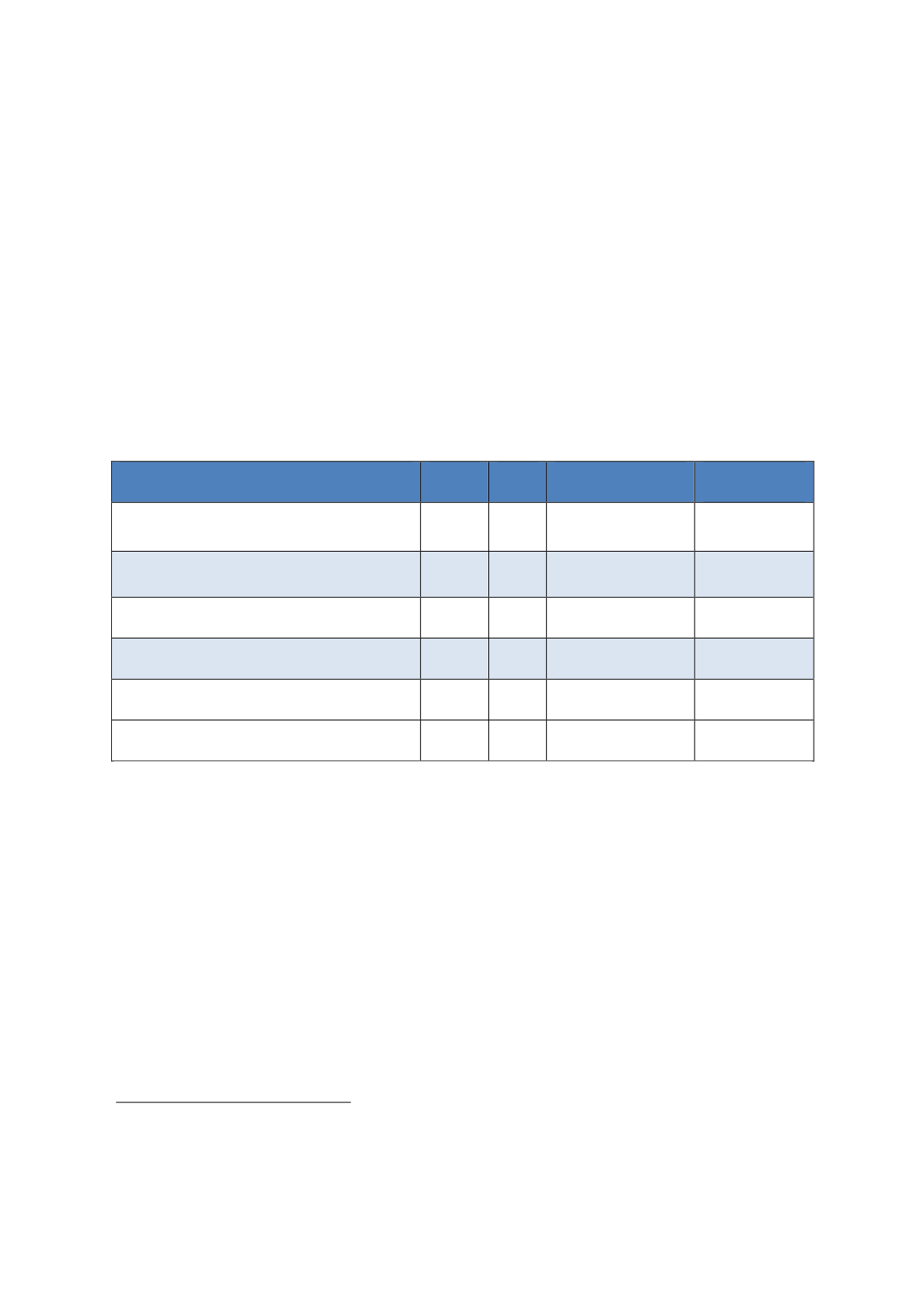

On the basis of Article 39 of the Union Customs Code, the AEO status can be granted to any

economic operator if a number of criteria are met. Table 2.1 illustrates these criteria while

pointing out the differences between conditions for AEOC and AEOS.

Table 2.1. Conditions and C

riteria for AEO in the EU

Criteria

AEOC AEOS Reference in UCC Guidelines

Part

Establishment in the Customs Territory

of the Union

X

X

Art. 5(31)UCC

1.II.2

Compliance

X

X

Art. 39 a)UCC

Art.24 UCCIA

2.I

Appropriate Record Keeping

X

X

Art. 39 b)UCC

Art. 25 UCCIA

2.IIFinancial Solvency

X

X

Art. 39c) UCC

Art. 26 UCCIA

2.III

Practical Standards of Competence and

Professional Qualification

X

Art. 39d)UCC

Art. 27 UCCIA

2.IVSecurity and Safety

X

Art. 39e)UCC

Art. 28 UCCIA

2.V

Source: European Commission (2016)

Application and Verification Procedure

Figure 2.10 summarizes the application process and it is composed of the following steps:

Economic operators who wish to apply for the AEO status are required to submit the

application to their AEO section/competent Customs Authority of an EU Member State.

The application is accompanied by a questionnaire for self-assessment providing the

authorities with as much information about the applicant as possible. By completing

the questionnaire, a trader can determine the risks and can try to remove or reduce

them.

The competent AEO Section carries out various checks before the application is

formally accepted.

3

Source: Taxation and Customs Union online database, last update: 12-06-2018. To our knowledge, data on the type of

operator (position in supply chain) are publicly unavailable. Statistics on the yearly evolution of the number or AEOs is also

publicly unavailable.