110

URA monitors AEO performance through monthly and quarterly reports as well. In these

reports time clearance, revenue performance and AEO compliance are assessed for clearing

agents, importers and exporters as well as self-managed bonded warehouses.

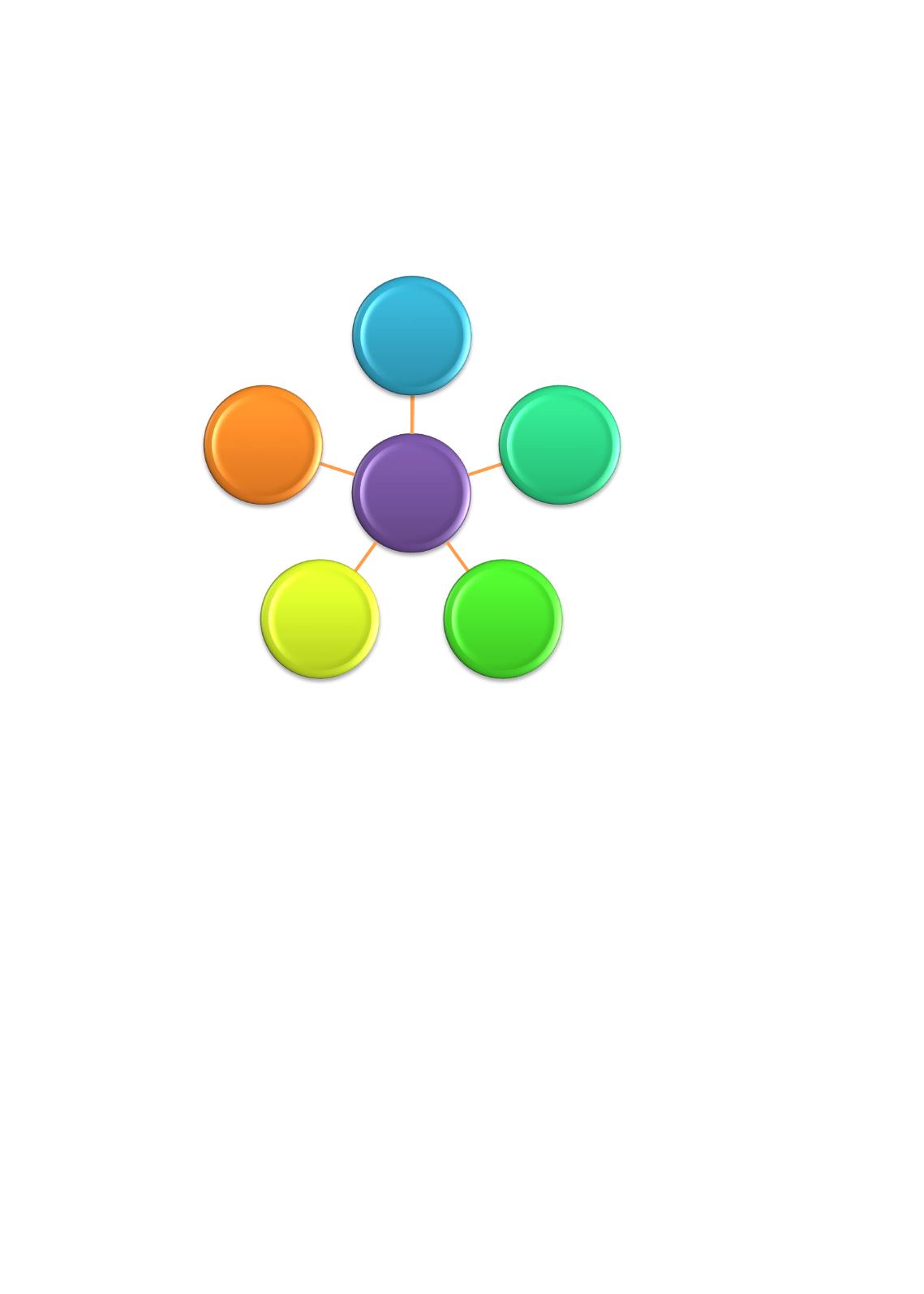

Figure 4.11. Client Relationship Management

Source: Uganda Revenue Authority

The AEOs are subject to regular scheduled post authorization audits (PAA) before the expiry of

the certification period. These audits are conducted to confirm that the operations of the AEOs

are still in conformity with the eligibility requirements.

The audit of the transactions of the AEO is done under the Post Clearance Audit (PCA)

arrangement which has a separate scheduling.

However, the outputs from the two types of audits (PAA and PCA) complement each other. In

the event that the two types of audits are scheduled to take place in the same year, then they

have to be conducted at the same time in order to minimize audit fatigue.

There are two types of post-authorization audits:

Scheduled audits:

These are routine audits which are scheduled at the time of

authorization or at a later date as have been agreed between the AEO and Customs.

These audits are carried out to confirm that the conditions at the time of authorization

are still maintained by the AEO.

Ad hoc audits:

These are unscheduled audits which are conducted to address urgent

issues that have arisen. The PAA process is conducted through the same procedures as

the pre-audit.

AEO

CRM

1.

Data

collection on

AEO

operations

2. Ensure the

AEO receives

authorized

benefits

3.

Identify

new relevant

risks and

benefits

4.

Report on

the AEO

operations

5.

Update the

AEO records

in the data

base