Facilitating Trade:

Improving Customs Risk Management Systems

In the OIC Member States

21

To rate the risk entity regarding one or more certification programs (such as an AEO

program, the partnership program, the key customer program);

To identify which of the risk entities need to be subjected to some form of control action,

as is the case in post-clearance audits and various types of quality assurance audits.

In the Customs context, both risk analyses have an important role to play. The strength comes

when transactional and behavioral risk analysis are connected into a unique, holistic risk

approach whereby the output of the one form of risk analysis (and the results of performing the

identified control measures) serves as input to the other form of risk analysis and vice versa. For

example, the transactional risk analysis of an import declaration is enhanced by being able to

draw on the behavioral risk rating of the trader which would be cumbersome, if not impossible,

to calculate on the fly if reasonable processing times for the real-time risk analysis are met. Due

to the fact that such trader risk ratings typically represent both a historical perspective (by

virtue of the historical data that is drawn upon) and a third party perspective (by virtue of the

third party data that is drawn upon), incorporating the behavioral risk rating into the real-time

risk assessment enhances another dimension to the analysis of the current event – and as such

import declarations that might have been scored in one way in isolation may reach a completely

different result. Likewise, the cumulative output of the risk analyses of all the import

declarations constitutes a behavioral pattern that can subsequently affect the risk rating of the

related traders. In the Customs context, one of the main purposes of using the transactional risk

analysis is for risk screening related with the goods in clearance process (including pre-

clearance): pre-arrival information (e.g., manifest) and customs declarations. The transactional

risk analysis determines the risk associated with the shipment (either at the level of the whole

shipment or on the individual consignment level) and the need for physical intervention.

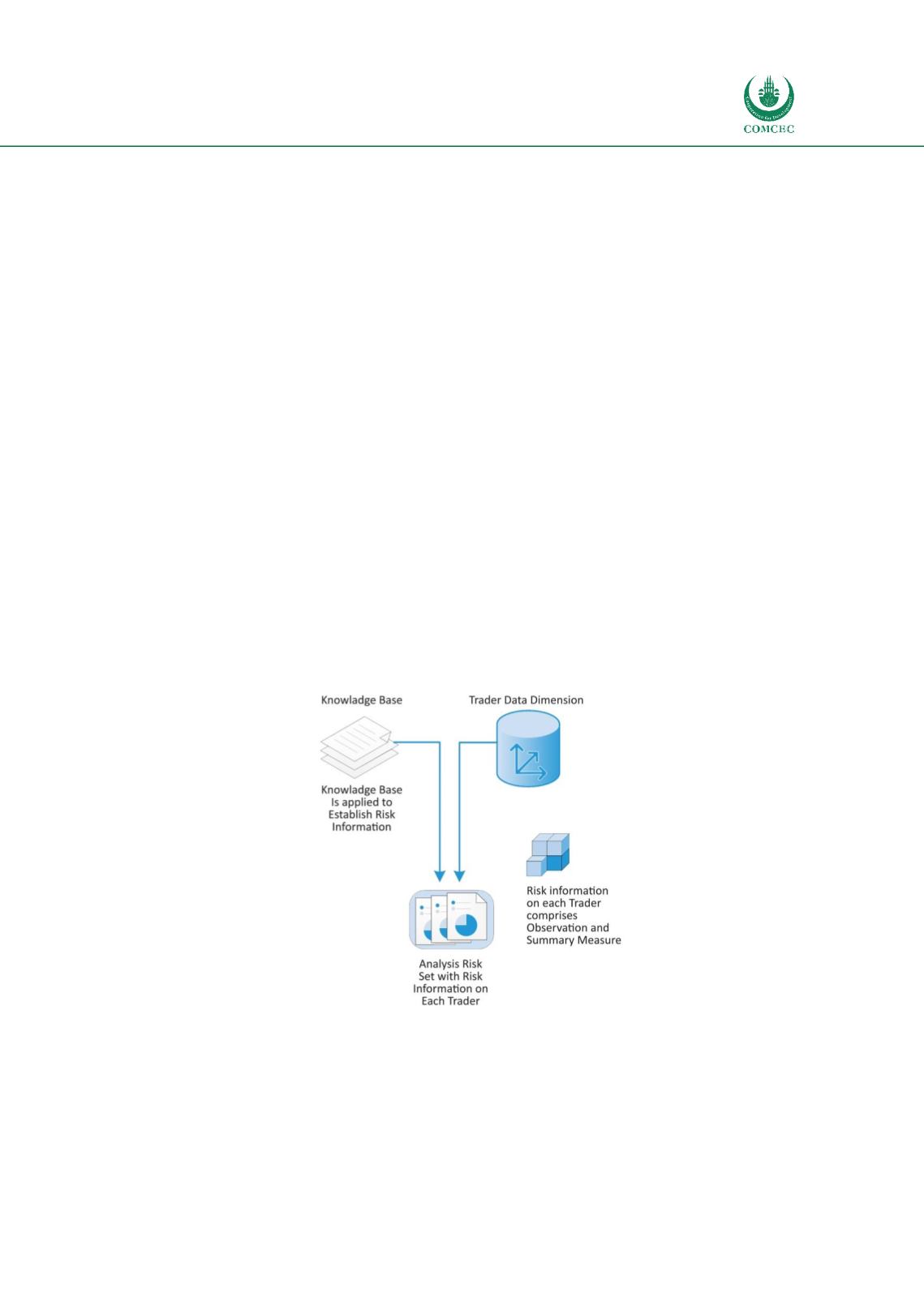

Figure 7: Behavioral Risk Analysis

Source: Author’s compilation

2.3

Benefits of Setting up CRMs

Risk management creates many benefits for the Government Authorities and the trading

community.