38

Table 3.1 Real GDP Growth in Sub-Saharan Africa (percentage change)

2004-08

2009

2010

2011

2012

2013

Sub-Saharan Africa (Total)

6.5

2.8

5.3

5.2

5.3

5.3

Oil exporting countries

8.6

5.1

6.6

6.3

6.7

6.0

Middle Income Countries

5.0

-0.6

3.8

4.5

3.4

3.8

Low Income Countries

7.3

5.4

6.4

5.5

5.9

6.1

Fragile Countries

2.5

3.1

4.2

2.3

6.6

6.5

World

4.6

-0.6

5.1

3.8

3.3

3.6

Source: (IMF 2012)

All four countries in our sample represent the lowest possible level or a 0% of share of world exports.

However, these figures have to be examined in their proper context, namely the generally low share of all

African exports as a proportion of world exports and the only marginally better performances of countries

such as South Africa and Nigeria. There are no outlier countries which buck the trend. While the larger of

the sub-Saharan African countries have a low ranking in the overall exports market, countries at the

lowest possible end of the spectrum may achieve a higher ranking due to the exclusive nature of the

products or services that they export. Cameroon, Senegal, Uganda, and Burkina Faso (in ascending order)

all have a higher ranking than for example Nigeria and South Africa.

In examining the direction of exports from African countries to other parts of the world we find that

although exports have been growing, 2012 marked a slowing down of this trend. Exports to advanced

economies increased for the period between 2010 and 2011 but decreased in 2012 to 187.5 bn US $ from

204.83 US$. This decrease was, however, was compensated by an increase in exports from 128.42 US$ in

2010 to 173.57 US$ in 2012 (or 35%) to emerging and developing economies, predominantly to Asia

(41%) and to a lesser extent to the MENA countries (39%) and Europe (17%). This shows that African

countries are presently exporting more within Africa as indicated in the data showing steady increase in

exports within Africa.

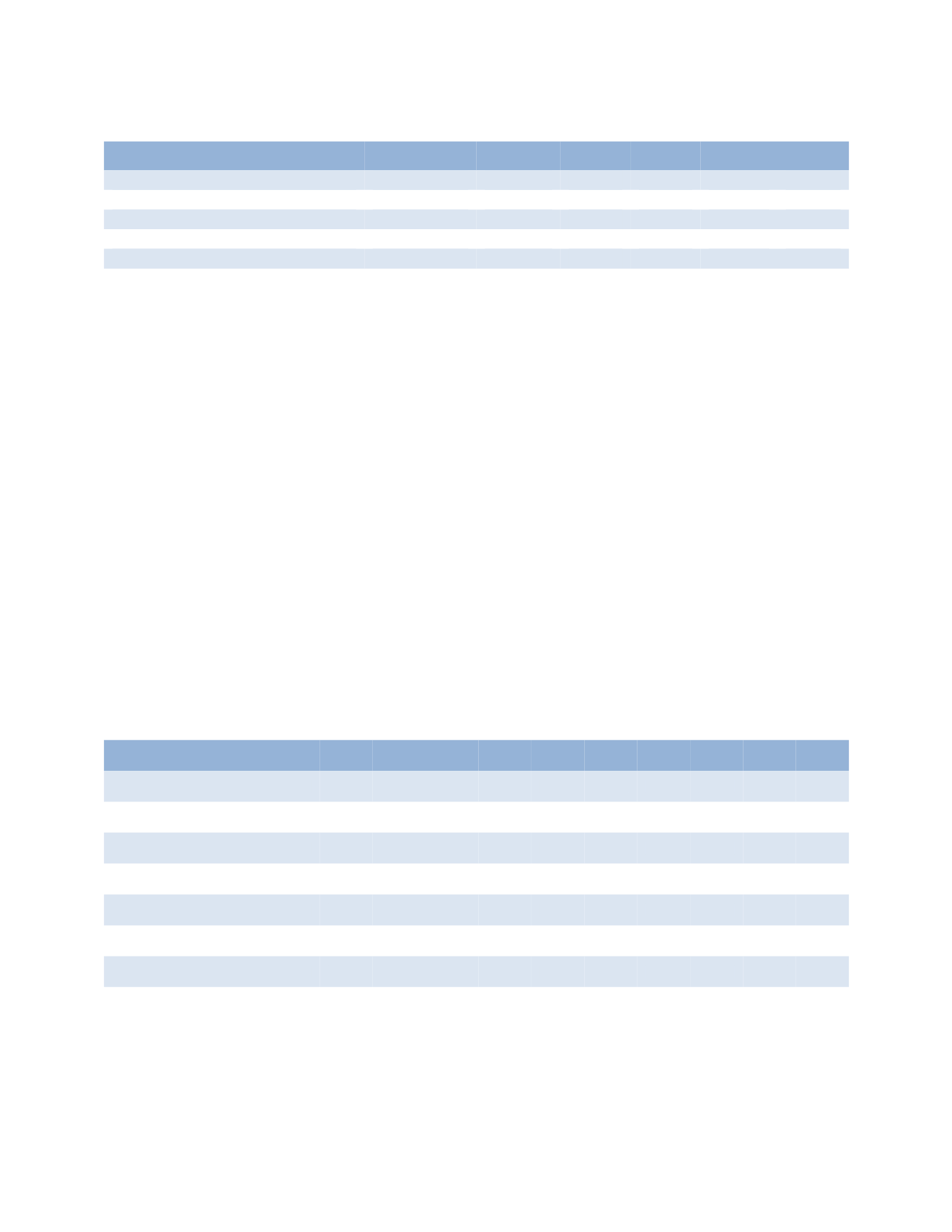

Table 3.2 Value of African Exports to Other Regions

2010

2011

2012

2012

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Sep

2012

Oct

2012

Nov

2012

Dec

World

294.47

372.31

375.21

93.30

94.57

91.71

95.63

31.41

31.66

31.33

32.64

Advanced Economies

162.12

204.83

187.45

48.51

45.81

47.04

46.09

16.34

16.82

15.50

13.77

Emerging and Developing

Countries

128.42

151.86

173.57

41.01

45.18

41.05

46.33

13.91

14.36

14.54

17.43

Developing Asia

72.22

85.23

102.40

24.83

27.26

22.73

27.58

7.68

8.24

8.03

11.31

Europe

4.61

5.13

5.42

1.27

1.34

1.33

1.48

0.49

0.56

0.46

0.46

Middle East and north

Africa

4.82

5.53

6.71

1.29

1.65

1.51

2.25

0.53

1.25

0.49

0.51

Western Hemisphere

11.36

15.58

14.22

3.28

4.22

2.81

3.91

1.02

0.84

1.70

1.38

Source: Direction of Trade Statistics (DOTS); Data extracted from IMF Data Warehouse on: 5/28/2013

Variations in the exporting fortunes of African countries are not necessarily uniform and this is because of

their dependence on commodities. The exports of the selected countries (Cameroon, Senegal, Uganda,

and Burkina Faso) are composed of primary commodities that are homogeneous products and with low

value. Rauch’s classification (1999) indicates that about 60% of African exports were goods traded on