Improving Institutional Capacity:

Strengthening Farmer Organizations in the OIC Member Countries

26

situation which was more common in the past, especially in cash crops in post-colonial Africa,

for example), and thus can exert a significant amount of power over the agricultural sector.

Even more so than with apex farmer organization bodies, understanding the control of

marketing boards is important. Boards which are controlled by the government – especially

when their mandate makes them the sole buyer of produce – can create significant power

imbalances and weaken the ability of farmer organizations to improve the livelihoods of their

members. This situation can arise not only when governments use marketing boards as easy

sources of revenue for central budgets (for example, in boards focused on export cash crops)

but even in the case of staple crops, when government boards may purposefully push down

the price paid to farmers in order to provide lower-cost produce to politically-important urban

consumers. An example of the impact of central control of marketing boards can be found in

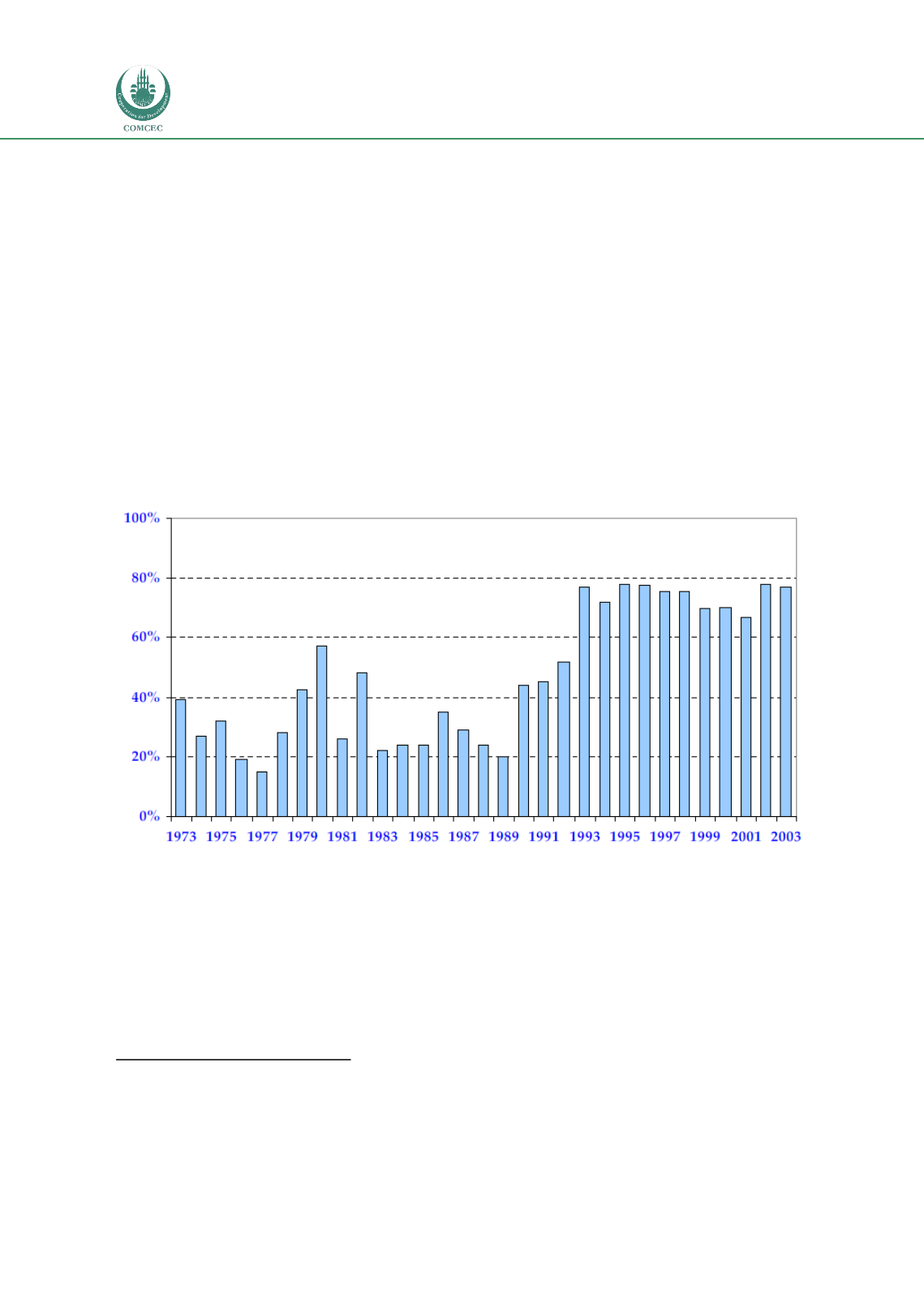

Uganda in the coffee sector (the most important cash crop). As shown in

Figure 7 ,in the era

when coffee marketing was controlled by a government body, farmers received only 20-40%

of the final export price. As soon as government control was abolished, farmers immediately

received upwards of 70% of the export price.

Figure 7: Share of coffee export price received by Ugandan farmers

33

Thus, understanding whether a marketing board exists and who controls it is an important

component of analysing the challenges that farmer organizations may face and formulating a

plan to engage with FOs. This study examines marketing arrangements for the highest-value

crop in each of the OIC member countries. In total, data was available for 39 countries in the

set, and of those,

17 countries (44%) had independent marketing boards,

nearly all of

whose mandate is primarily in sector promotion, rather than the control of buying and

selling

34

. Meanwhile

14 countries (36%) had government-run marketing boards.

A further

2 had semi-autonomous boards or a combination of a private and a government marketing

33

Adapted from Baffes, John, “Restructuring Uganda’s Coffee Industry: Why Going Back to the Basics Matters”, World Bank

Policy Research Working Paper 4020, October 2006

34

There are some exceptions, for example in Oman and Saudi Arabia private marketing boards with more control over

buying from primary producers were observed.

Post

Liberalization