Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

62

The reforms, combined with investments in technology and critical regulatory changes in

input markets (the deregulation of pump sets in the 1990s and the exceptions granted to

import hybrid rice varieties are two examples) brought about a major transformation in

Bangladesh. No longer a chronically food-deficit, food-aid-dependent country, it had

become nearly self-sufficient in rice, the main staple.

Self-sufficiency in food grains remains the central objective of national agricultural

strategies. Government policies and interventions have maintained incentives—for

example, output price supports and fertilizer subsidies—for domestic rice and wheat

production to expand. At the same time, policies have been put into place to protect poor

consumers. Sales of rice were subsidized until the early 1990s, and important, extensive

safety nets have been devised, involving food for work and food transfers (in the form of

wheat, for example).

124

National trade policy has undergone major reforms. Bangladesh reduced tariffs for

industrial products in the 1980s and especially the early 1990s; in the latter period, it also

liberalized private trade in rice and wheat. As a result, domestic output prices for rice (the

main agricultural product in terms of value) and wheat have been near border prices in

most years since the early 1990s. These reforms substantially reduced pervasive price

distortions in Bangladeshi agriculture, with some exceptions, such as sugarcane and

chemical fertilizers.

125

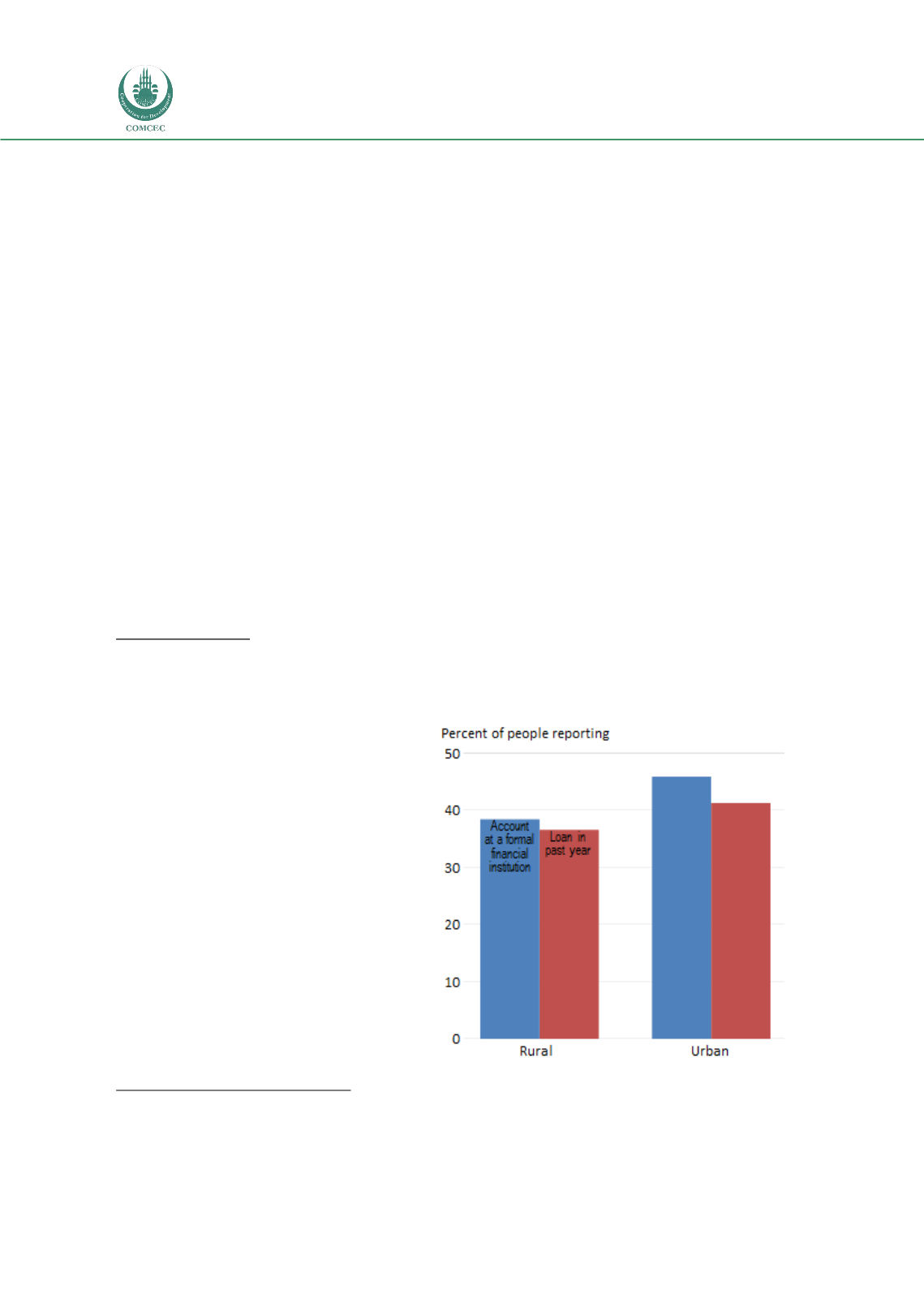

A

CCESS TO FINANCE

Based on the World Bank’s Global

Financial Inclusion database,

126

Figure 33depicts the share of

surveyed individuals who had an

account at a financial institution

and the share of surveyed

individuals (age 15+) who had

taken out a loan. In rural and

urban areas, a relatively large

share of individuals had recently

borrowed money; 37 percent of

rural respondents had obtained a

loan in the past year, compared to

just over 41 percent of urban

respondents. In rural areas, 38

percent of households had an

account at a formal financial

institution, compared to 46

percent of urban households.

124

World Bank (2013e).

125

World Bank (2013e).

126

Global Findex (World Bank 2014c).

FIGURE 33: FINANCIAL SERVICES IN RURAL AND URBAN

BANGLADESH

Source:

Global Findex (World Bank 2014c).