Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

64

Even for wheat, security is a growing concern. Climate change and rising consumption in some

large countries such as China, Indonesia, and Nigeria, raises concerns about long-term security

of the wheat supply as well.

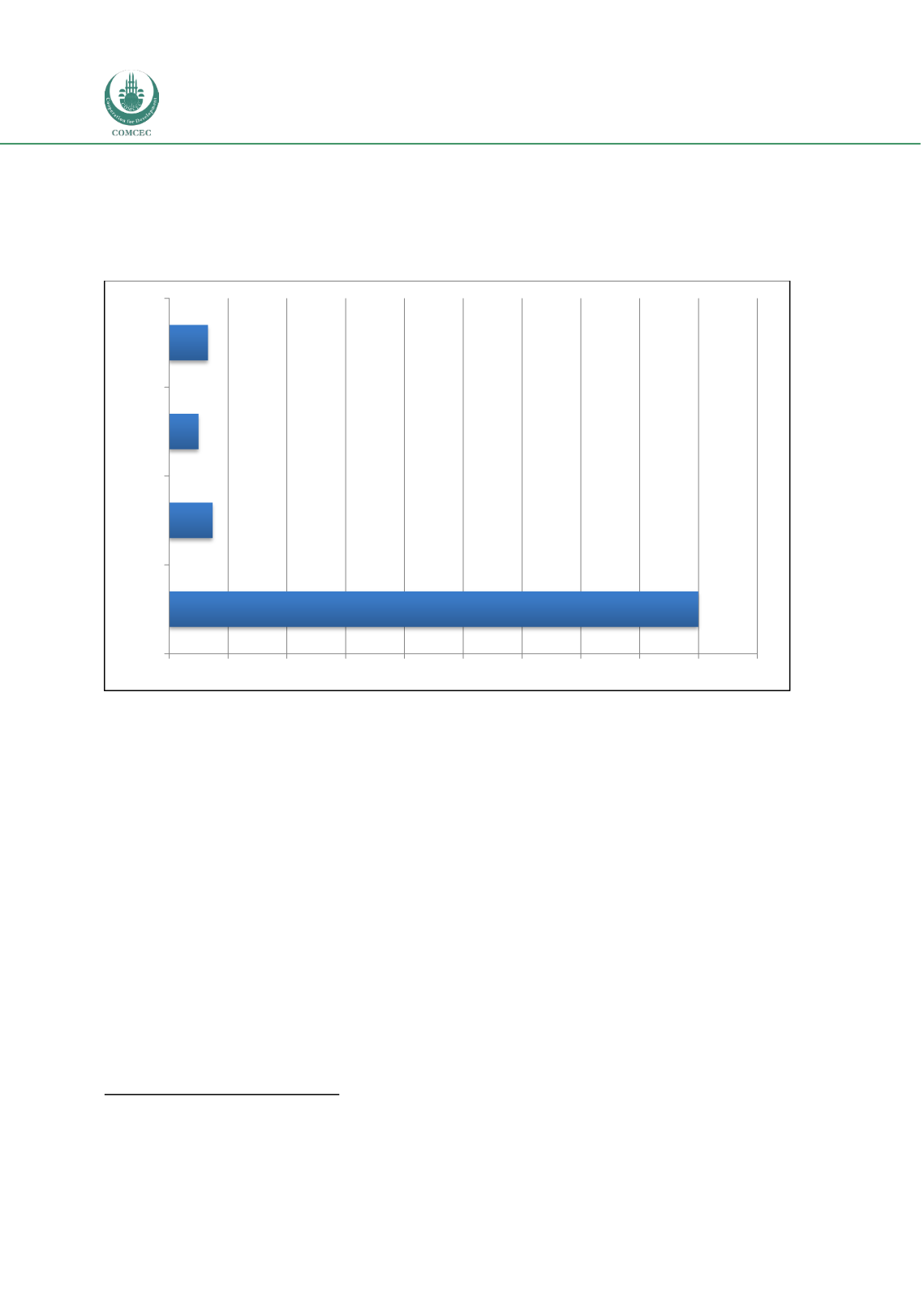

Figure 28: Saudi Arabia’s Imports of Selected Commodities as a Percentage of World Imports

2008

Source:

Kingdom of Saudi Arabia Ministry of Agriculture

As reported by the U.S. State Department,

85

in early February 2009 a consortium of Saudi

investors indicated plans to invest $267 million in agricultural projects in Ethiopia and Sudan

after completing feasibility studies. Also, Hail Agricultural Development Co (HADCO), one of the

six large private agricultural companies in Saudi Arabia, announced its intention to invest $45.3

million in Sudan to produce wheat and corn. The government-owned Saudi Industrial

Development Fund announced that it would provide soft loans to cover 60 percent of the total

investment cost. HADCC, which was established in northern Saudi Arabia in the early 1980s,

produces wheat, corn, dates, grapes, olives, animal feed, broiler meat, and table eggs. In 2008,

SAVOLA Group, the largest retail chain and foodstuff processor in Saudi Arabia, announced its

plans to invest millions of U.S. dollars in purchasing and developing thousands of hectares of

agricultural lands in several countries including Egypt, Sudan, Ukraine, Brazil and Ethiopia. The

firm aims at guaranteeing an uninterrupted supply of sugar and edible oils for its production

facilities, with plans to purchase land and develop agriculture infrastructure to grow beet sugar,

rice, edible oils (sunflower, corn, and canola) and other commodities.

85

U.S. State Department (2010), “Saudi Foreign Agriculture Investment Plans : Opportunities for Increased Trade,

Assistance, and U.S . Jobs,” cable dated January 24, 2010, U.S. Embassy Riyadh.

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

Barley

Rice

Wheat

Sugar