8

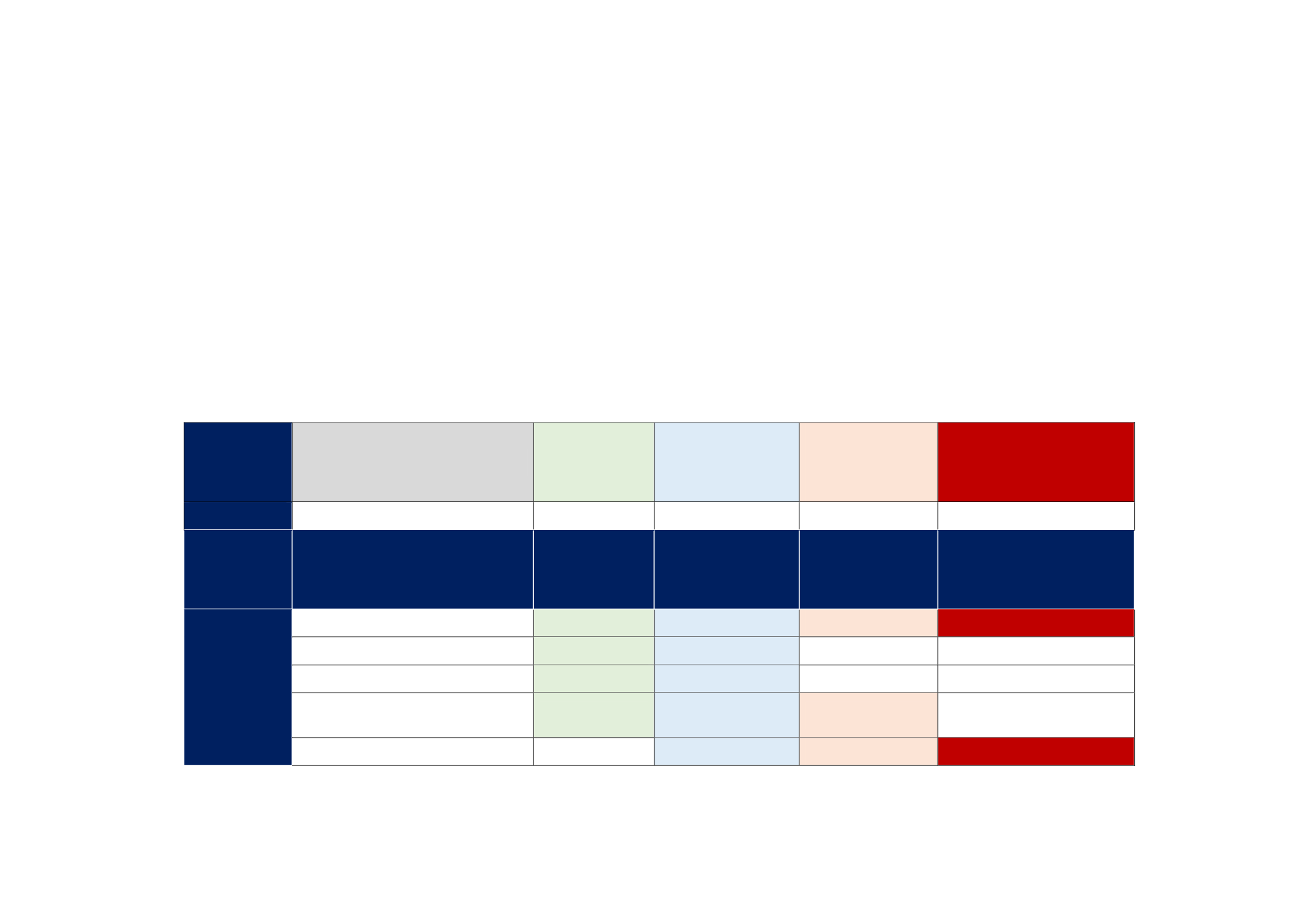

Table F.12: Top export products and tariffs implemented by the OIC members

Note: This table collects information on the global and OIC market shares of countries’ top export products at the product level and

weighted average tariff rates these products face at the OIC markets. Each column is colored according to the thresholds indicated at the

first row. To take just one example, Grapes (fresh) from Afghanistan has a large share within Afghanistan’s agricultural exports (larger

than 10%) as indicated in the colored third column. This product is important, and hence the fourth column is colored, also because 0.9%

of Afghan share in Grapes (fresh) is larger than the overall Afghan share in agricultural products. Furthermore, the share 98.7% of OIC

markets for Afghan Grapes (fresh) is larger than the overall OIC share of agricultural products from Afghanistan, and the fifth column is

also colored. Finally, the last column is colored for Grapes (fresh) because the weighted average applied tariff rates faced by this product

by Afghan exporters in OIC markets is larger than the corresponding rates applied to overall agricultural exports from Afghanistan in OIC

markets.

Thresholds for coloring

10.0

Country's share in

the world

agricultural

exports, %

Share of OIC as

destination for the

country's agr.

exports, %

Weighted avg. tariff rates

implemented by OIC

members to the country's

agr. exports, %

Exporter

Product

Share of the

product in the

exporter’s total

agr. exports, %

Share of the

country in the total

world export of the

product, %

Share of OIC as

destination for the

country's export

of the product, %

Weighted average tariff

rates implemented by OIC

members to the country's

export of the product, %

Afghanistan

Grapes, fresh

14.4

0.9

98.7

20.0

Grapes, dried

13.7

4.1

9.2

2.5

Figs, fresh/dried

12.3

11.9

1.1

2.5

Cotton (other than linters), not

carded/combed

11.5

0.5

99.6

3.0

Apples, fresh

5.6

0.4

91.3

20.0