Analysis of Agri-Food Trade Structures

To Promote Agri-Food Trade Networks

In the Islamic Countries

86

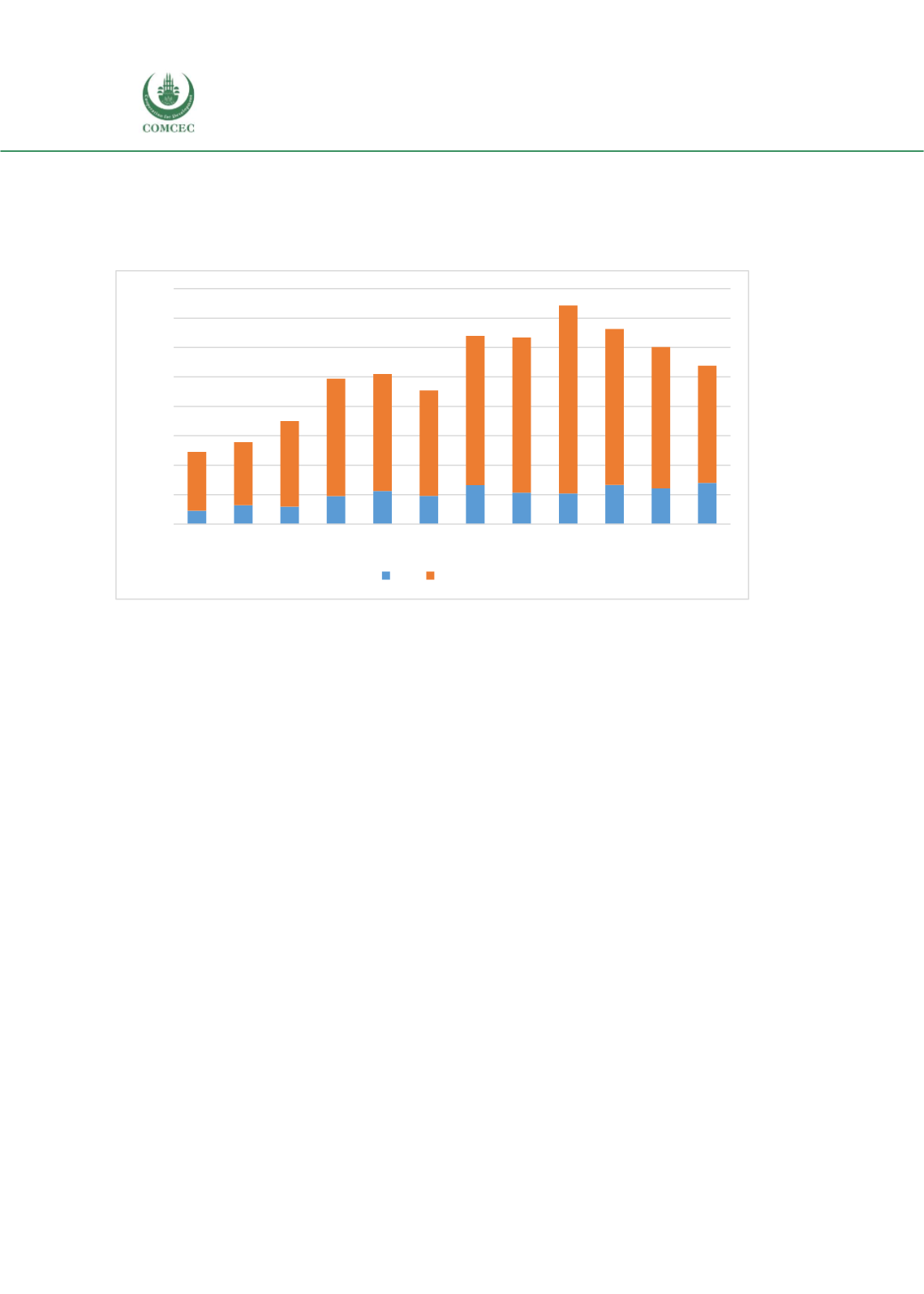

Figure 41 shows the evolution of Cameroon’s imports of agricultural products over the last

decade. As was the case for exports, most imports are sourced from outside the OIC. However,

OIC imports have generally been growing over time, despite a decline in total imports since their

2013 peak.

Figure 41: Cameroon's Imports of Agricultural Products, 2005-2016, Million USD

Source: UN Comtrade.

For OIC countries specifically, agri-food products dominate imports of agricultural products.

However, this dominance has a decreasing trend. In 2005, agri-food products represented

85.77% against 67.74% in 2016. These agri-food imports in comparison to exports are

nevertheless diversified. We observe a strong presence of cereals/cereal preparation products,

animal/vegetable oil/ fat/wax and miscellaneous food products. Besides, the share of beverages

and tobacco products in imports has been growing since 2012.

As for exports, it is possible to examine imports at the level of disaggregated products. Figure 42

presents results. The import bundle is again very concentrated, with the top ten products

accounting for 86% of the total, which is less than was the case for exports, but is still very

substantial. The three leading products—fish, wheat, and rice—made up 63% of the total in

2016. The figure shows that there is generally an upwards trend for imports, which is consistent

with increasing food consumption associated with economic growth. However, the overall trend

is dominated by the three leading products, as was the case for exports.

0

200

400

600

800

1.000

1.200

1.400

1.600

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

OIC Non-OIC