Analysis of Agri-Food Trade Structures

To Promote Agri-Food Trade Networks

In the Islamic Countries

85

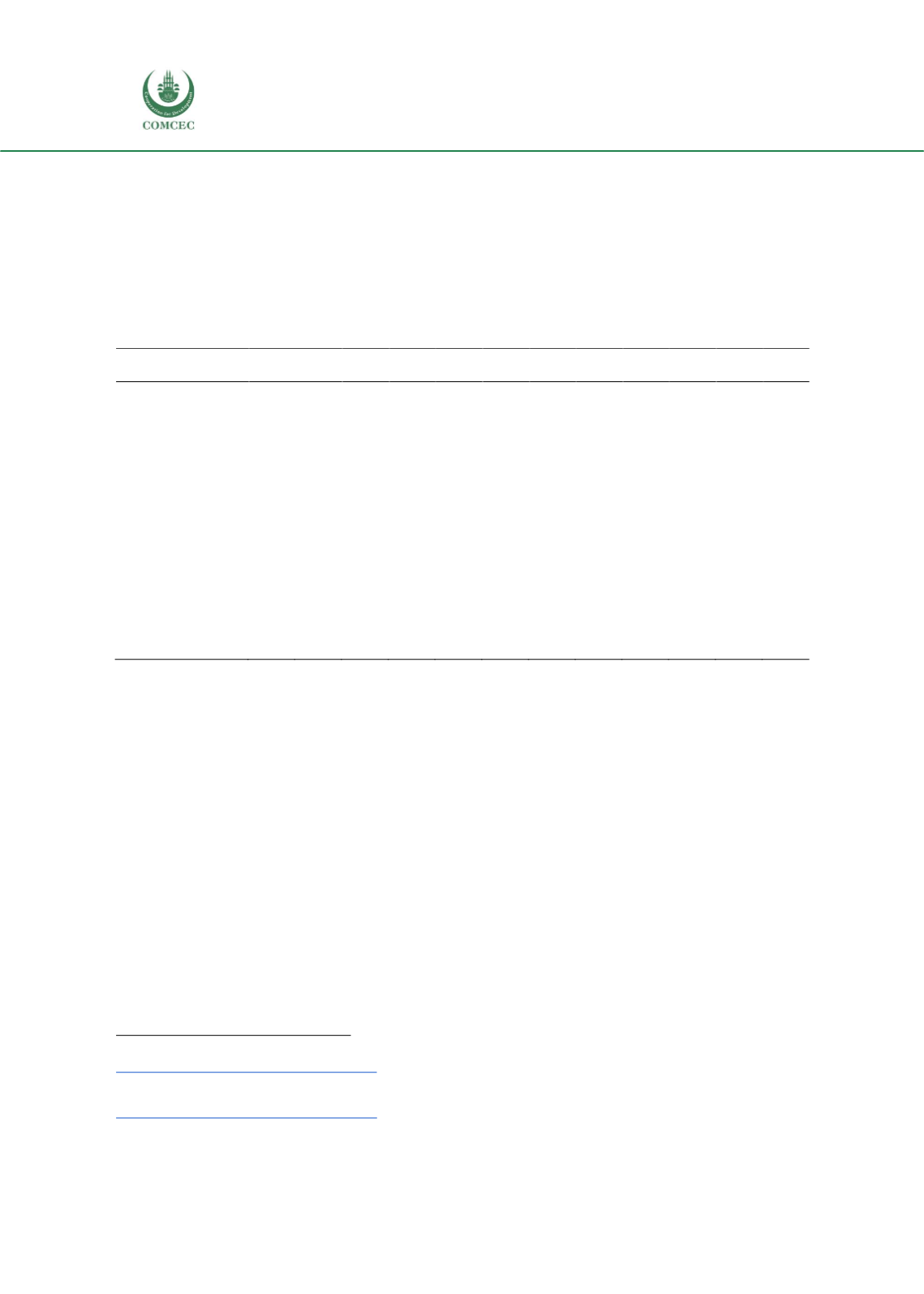

To formalize this analysis, Table 22 presents out degree centrality scores for Cameroon over the

last decade, disaggregated by leading product. The analysis shows a limited degree of export

diversification over time in most, but not all, products. Cocoa and chocolate stands out as having

a relatively high number of destination markets, whereas rice exports are strongly concentrated

on relatively nearby African partners. Combining the two tables suggests that network dynamics

vary substantially at a product level: in some cases geography is dominant, in others it is a

combination of geography and trade policy, and particularly for raw materials, foreign derived

demand for inputs plays an important role in shaping trade relations.

Table 22: Out Degree Centrality, Cameroon Main Export Products, 2005-2016.

200

5

200

6

200

7

200

8

200

9

201

0

201

1

201

2

201

3

201

4

201

5

201

6

Rice

2

1

2

2

3

4

6

2

2

5

Vegetables

prepared

12

11

12

12

16

14

18

16

13

15

13

16

Fruit and nuts

15

11

13

18

18

16

17

19

18

21

24

20

Sugar

confectionary

7

3

6

6

9

6

7

8

7

8

8

6

Coffee

21

22

27

32

25

34

28

30

27

26

38

31

Cocoa and

chocolate

21

18

23

24

24

25

23

28

29

27

30

25

Other edible

products

18

16

17

17

23

21

23

20

16

18

17

21

Crude rubber

17

16

22

18

26

27

29

31

28

26

27

23

Cork and wood

60

64

71

68

66

72

73

70

78

64

68

71

Cotton

26

23

27

20

18

22

22

15

16

21

24

17

Source: UN Comtrade.

Composition and Patterns of Agricultural Imports

Cameroon's primary points of import are the European Union which accounts for an estimated

27.7 %, China at 19.4 % and Nigeria at 12.1 %. While Europe remains a primary partner in terms

of imports, its share of Cameroonian trade has been on a steady decline since 2006. This steady

decrease in imports is also evident in Cameroon’s trade with its fellow African nations.

40

The

most significant import growths are observed with Cameroon's Asian trade partners. Between

2006 to 2010 Chinese imports increased by 4 % (from 6.3 % of all imports to 10.6 %) and Thai

imports by 1.3 % (from 1.3 % of all imports to 3%).

41

In 2005, agriculture was 19.8% of Cameroon's total imports. Agri-food products were 10.7% of

agriculture imports followed by milled or semi-milled rice at 5 %, frozen fish at 2.3 % and

agricultural raw materials at 1.8%. These patterns continued in 2010 as agri-food products

remained the top import, representing 10.2% of all agriculture imports. Frozen fish increased

slightly to 3.2%, as did imports of milled/semi-milled rice to 3.8%. Cameroon’s main raw

agriculture material imports as of 2015 were rice, wheat/meslin, milk and cream.

42

40

World Trade Organization. (2018). Member Profiles-Cameroon. Available at:

http://stat.wto.org/CountryProfiles/CM_e.htm41

Ibid.

42

World Trade Organization. (2018). Member Information: Trade Profiles. Available at:

http://stat.wto.org/CountryProfiles/CM_e.htm