94

5.

In the case of deficit, it will solely be borne by the shareholders of the insurance

company based on

qard hasan

(which cannot be claimed back according to the

regulations).

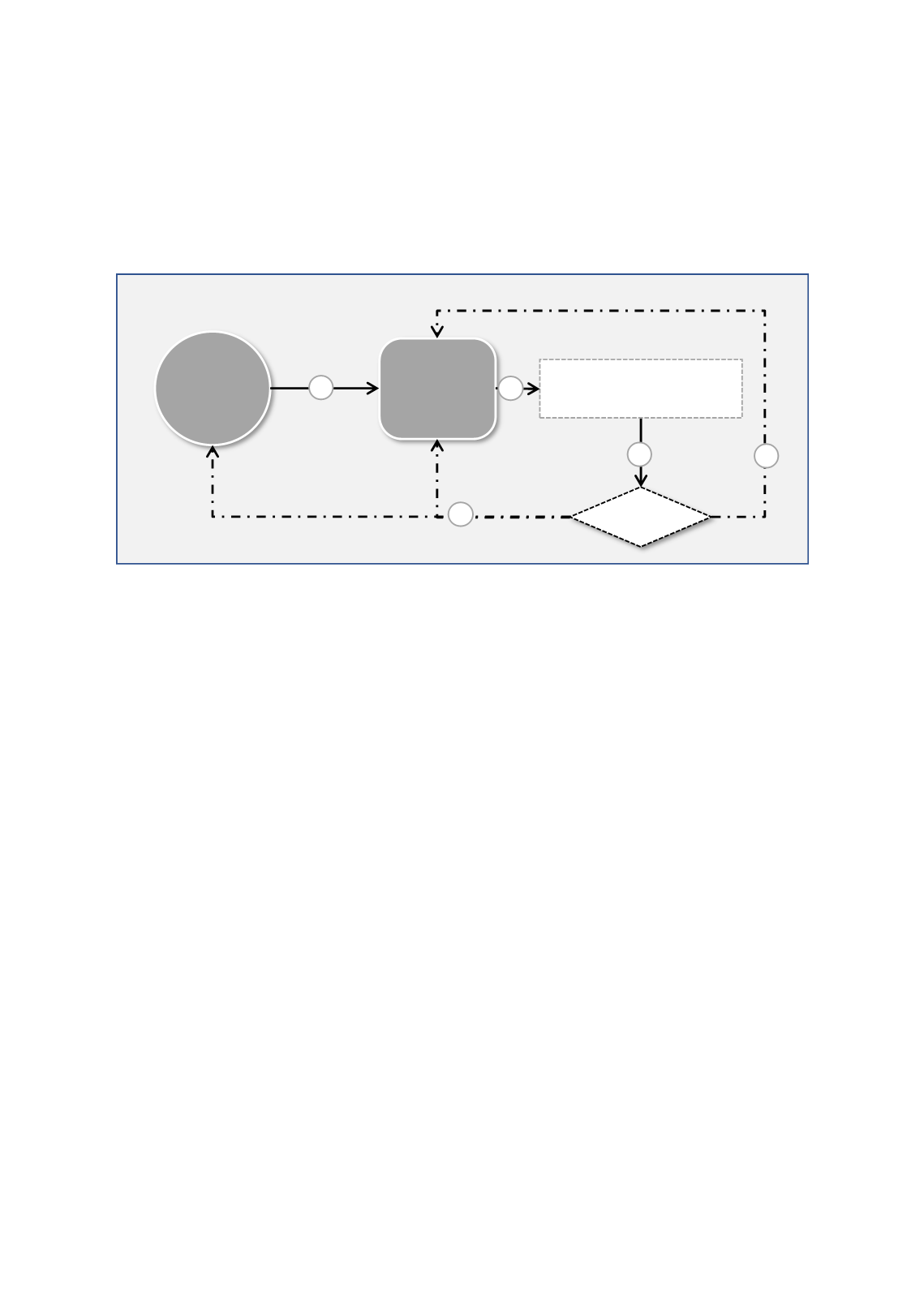

F

IGURE

20: T

HE

F

LOW CHART OF THE

3

RD

C

OOPERATIVE

I

NSURANCE

M

ODEL IN

S

AUDI

A

RABIA

Source: Letter of Approval from SAMA to Al Rajhi Takaful, and Interview with Sulaiman Mohammed Aljewisser

Description/ illustration of the Model:

Figure 20presents the third model of the cooperative insurance implemented by

Takaful

Al

Rajhi company where:

1.

Policyholders make contributions to the

Takaful

fund operated by the TO.

2.

The collected funds will be used by the TO to pay the claims and for investment

purposes. The percentages of the operating expenses, the claims and investment are at

the discretion of the insurance company.

3.

At the end of the financial year surplus or deficit is computed.

4.

If there is any surplus, 10% of it will be distributed to the policyholders, and remaining

90% will be used to cover the

wakalah

fee, which is 40% for medical

Takaful

and 30%

for Motor and General

Takaful

(from the net premiums). If there is any remaining

amount, it will go back to the

Takaful

fund.

5.

In the case of deficit, it will be borne by the shareholders of the insurance company

based on

qard hassan

(which cannot be claimed according to the regulations).

TPs

TO

Surplus

?

Contribution

Yes

No

10%

90% *

•

Investment Outcome

•

Claims

1

2

3

4

5