92

b)

The

Takaful

model that was represented in the first insurance experience in the

Saudi Arabia was implemented by the National Cooperative Insurance Company; a

government insurance company established by a Royal Decree in 1985. This

Company was later renamed the Company for Cooperative Insurance). The

Takaful

model adopted by the Company was based on Mudarabah. It was managing the

insurance and investment funds of 25% of the proceeds from policyholders’

premiums. The

Takaful

was charging the actual administrative and management

expenses of the

Takaful

fund. The Takaful Company, however, was not able to meet

the profitability benchmark of feasibility study unlike the insurance companies

operating in the market in the kingdom.

c)

The cooperative model proposed by the Council of Senior Scholars in the Kingdom

in resolution No. 51 for the year 1395 AH was not practical because it required the

contribution by the insured (policyholder) to be a mere donation. This means that

the beneficiaries of the

Takaful

fund could include policyholders and others who do

not hold insurance policy or do not contribute to the fund. Furthermore, the surplus

from the insurance must be channelled to charity and the policyholders are not

entitled to benefit from such surplus because their donation is separate from their

liability.

d)

The cooperative model has been criticized by scholars from Saudi Arabia due to its

inherent

Shari’ah

issues. Fatwas critical of the cooperative model include those

issued by the S

hari’ah

advisory board of Al-Ahli Bank no. 89.

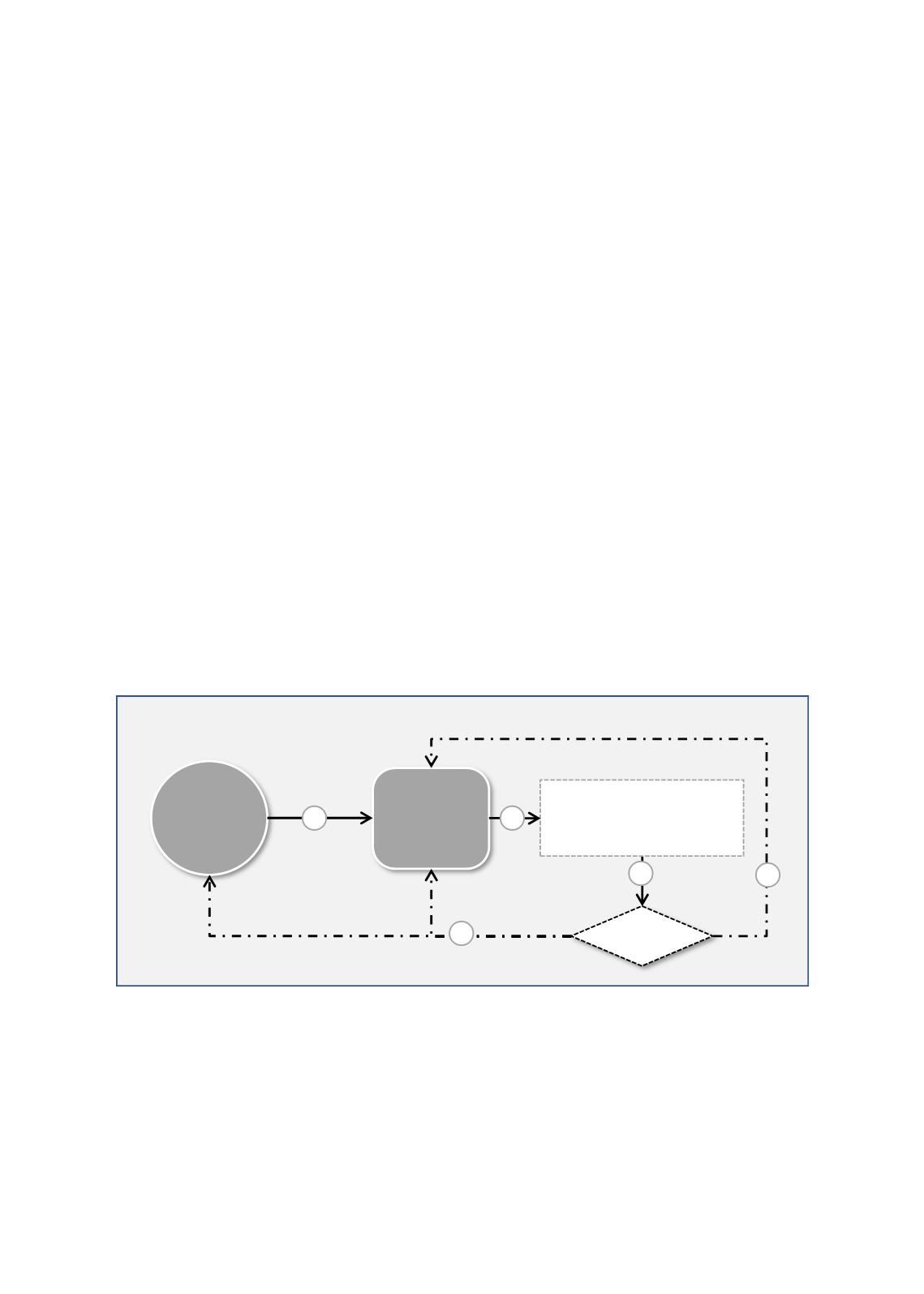

F

IGURE

18: T

HE

F

LOW CHART OF THE

1

ST

C

OOPERATIVE

I

NSURANCE

M

ODEL IN

S

AUDI

A

RABIA

Source: Cooperative Insurance Companies Control Law 2004, Interview with Sulaiman Mohammed Aljewisser

Description/ illustration of the Model:

Figure 18presents the standard model implemented by the insurance companies in Saudi

Arabia, where:

TPs

TO

Surplus

?

Contribution

Yes

No

10%

90%

•

Operating Expenses

•

Investment Outcome

•

Claims

1

2

3

4

5