93

1.

Policyholders (TPs) pay the insurance premiums to the insurance operator (TO).

2.

A share of the premiums is used to cover the operating expenses, and the other part goes

to the investment fund and the risk fund (for claims). The distribution is left to the

discretion of the insurance company.

3.

At the end of the year, the underwriting surplus/deficit is calculated.

4.

If there is any surplus, 90% will go to the shareholders (insurance operator), and 10%

is returned to the policyholders based on

Musharakah

in the profit of the insurance

company.

5.

In the case of deficit, it will be borne by the shareholders of the insurance company

based on it is a liability of the insurance company.

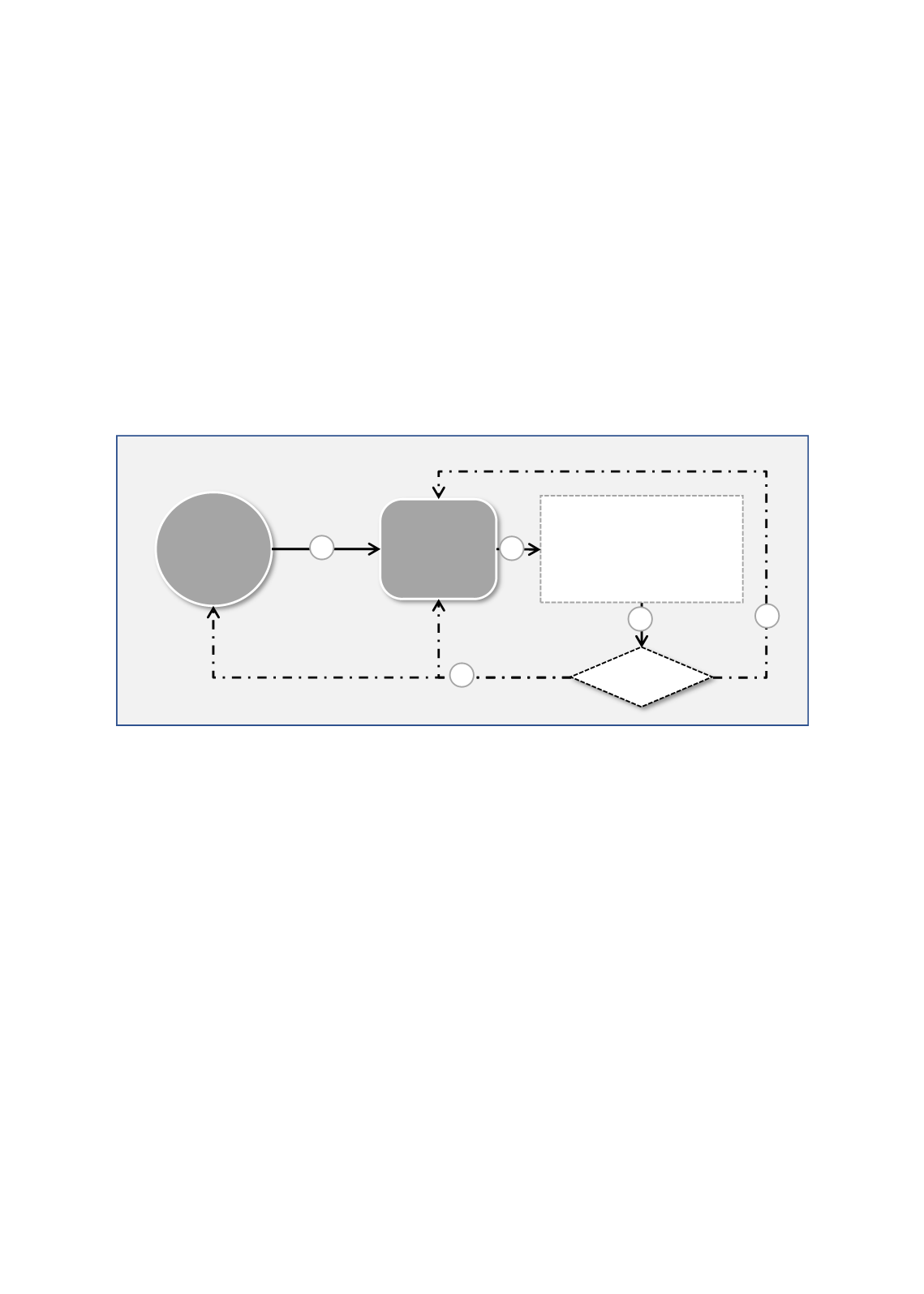

F

IGURE

19: T

HE

F

LOW CHART OF THE

2

ND

C

OOPERATIVE

I

NSURANCE

M

ODEL IN

S

AUDI

A

RABIA

Source: Letter of Approval from SAMA to Solidarity Saudi Takaful Co., and Interview with Sulaiman Mohammed

Aljewisser

Description/ illustration of the Model:

Figure 19presents the second model of the cooperative insurance adopted by Solidarity Saudi

Takaful

Co. and Alinma Tokio Marine Company.

1.

Policyholders (TPs) make contributions to the TO.

2.

A share of the contributions will cover operating expenses, and the other one is allocated

to the risk and the investment funds. A

wakalah

(agency) fee of 5% of the gross

premiums is put aside for the insurance operator. The fee should not exceed 90% of the

underwriting surplus at the end of the financial year. The percentages of the operating

expenses, the claims and investment are up to the decision of the insurance company.

3.

At the end of the period, the underwriting outcome – either surplus or deficit - is

estimated.

4.

If there is any surplus, 10% of it will be distributed among the policyholders as it is

permitted by the regulator.

TPs

TO

Surplus

?

Contribution

Yes

No

10%

90%

•

Wakalah Fee (5%) *

•

Operating Expenses

•

Investment Outcome

•

Claims

1

2

3

4

5