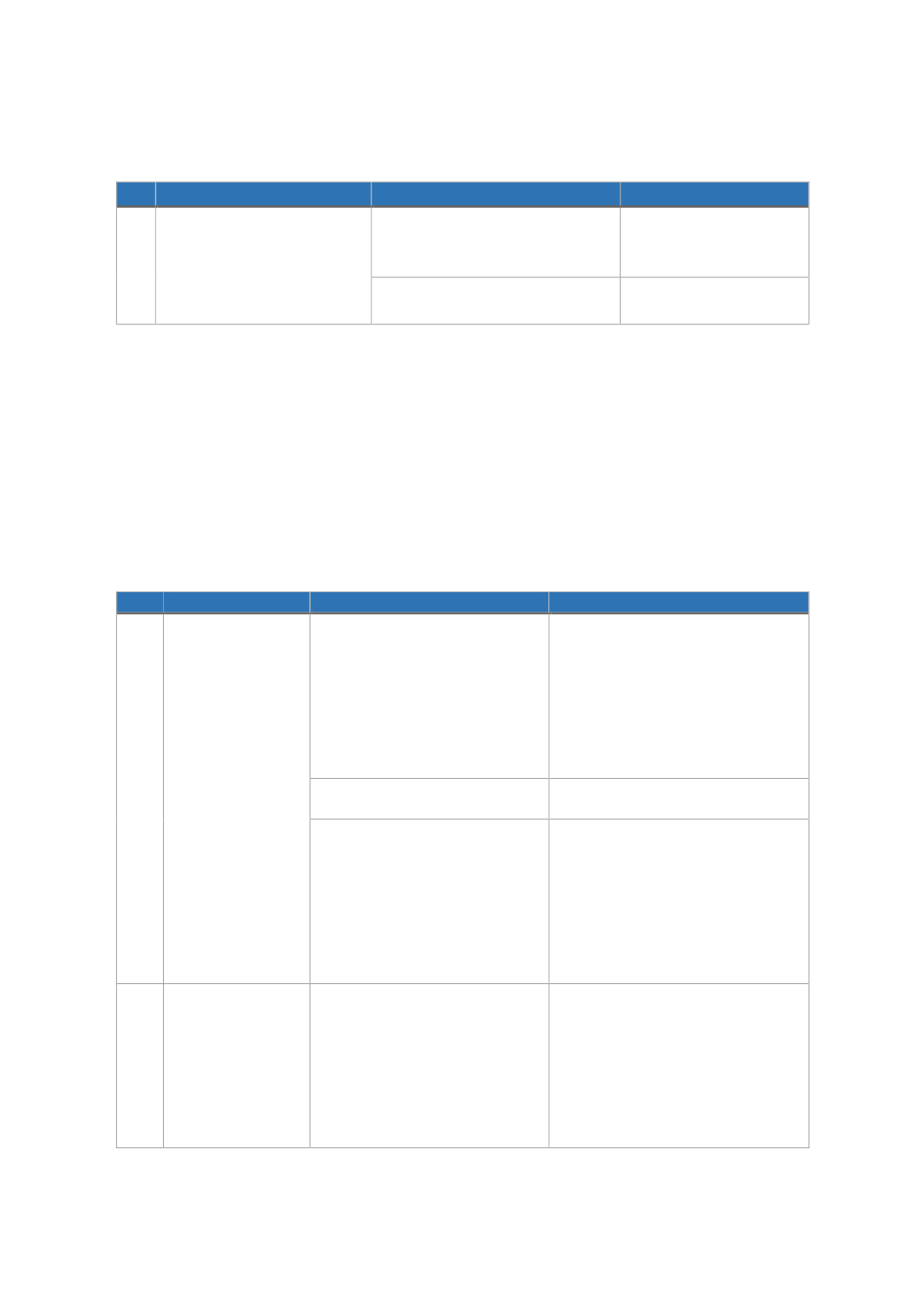

151

T

ABLE

26: T

AKAFUL

B

USINESS

S

USTAINABILITY

I

SSUES AND

P

OLICY

R

ECOMMENDATIONS

No

Issues

Policy Recommendation

Country Affected

5

5.1. Low growth and lack

of competitiveness

Create mega

Takaful

business

through merger and

acquisition

Applies to all the four

countries

Create favourable tax

incentives

Applies to all the four

countries

Source: Authors

It is imperative for the industry to continue designing and delivering solutions that meet the real

needs of the economy and offer positive experience to participants to stay relevant. To achieve

this, TOs must strive to address protection gaps in OIC countries, rather than merely replicating

available insurance offerings. Unique features of

Takaful

would strengthen the value proposition

and business sustainability of the industry.

The following table summarises the policy recommendations and identifies the list of agencies

responsible for the implementation:

T

ABLE

27: P

OLICY RECOMMENDATIONS AND THE

I

MPLEMENTING

A

GENCIES

No

Item

Policy recommendations

Implementing agencies

1

Legal and

Regulatory

Framework

Developing the

Takaful

Act

Saudi Arabia: SAMA

UK: Financial Conduct

Authority (FCA),

complemented by the

Islamic Insurance

Association of London (IIAL)

Turkey: Ministry of Treasury

and Finance

Developing specific

Takaful

laws

Malaysia: BNM

Developing

Takaful

standards

Saudi Arabia: SAMA

UK: Financial Conduct

Authority (FCA),

complemented by the

Islamic Insurance

Association of London (IIAL)

Turkey: Ministry of Treasury

and Finance

2

Shari'ah

Framework

Developing the

Shari'ah

governance framework for

Takaful

Saudi Arabia: SAMA

UK: Financial Conduct

Authority (FCA),

complemented by the

Islamic Insurance

Association of London (IIAL)

Turkey: Ministry of Treasury

and Finance