147

capital, risk governance, and transparency and disclosure are in place to ensure stability and

sustainability of the financial institutions including TOs. In addition, there are also prudential

standards and requirements which specifically cater to distinct features of Islamic finance.

These standards strengthen the governance of TOs, provide greater clarity on the use of multiple

Shari'ah

contracts in the models and structures of

Takaful

, and safeguard the interests of

Takaful

participants.

In general, the

Takaful

industry lacks a comprehensive legal and regulatory framework. The

major challenges include lack of

Takaful

Act, specific laws and standardization of financial

accounting and reporting, and tax laws related to

Takaful

. For example, in Turkey there is no

specific

Takaful

act. The banking sector in the country is mainly regulated by BRSA and CMB. In

contrast, Malaysia has

Takaful

regulatory framework in place pending specific laws.

8.2.

Shari'ah

Framework

All the activities of

Takaful

must be guided by the

Shari'ah

. Apparently, there is a variation to the

degree of

Shari'ah

framework for

Takaful

in the four countries selected for this study: Saudi

Arabia, Malaysia, Turkey and UK. Among all the four countries, Malaysia has made tremendous

progress in terms of

Shari'ah

framework for

Takaful

. Its Islamic Financial Service Act (IFSA,

2013) provides a comprehensive

Shari'ah

framework that recognizes the specificities of

Takaful

.

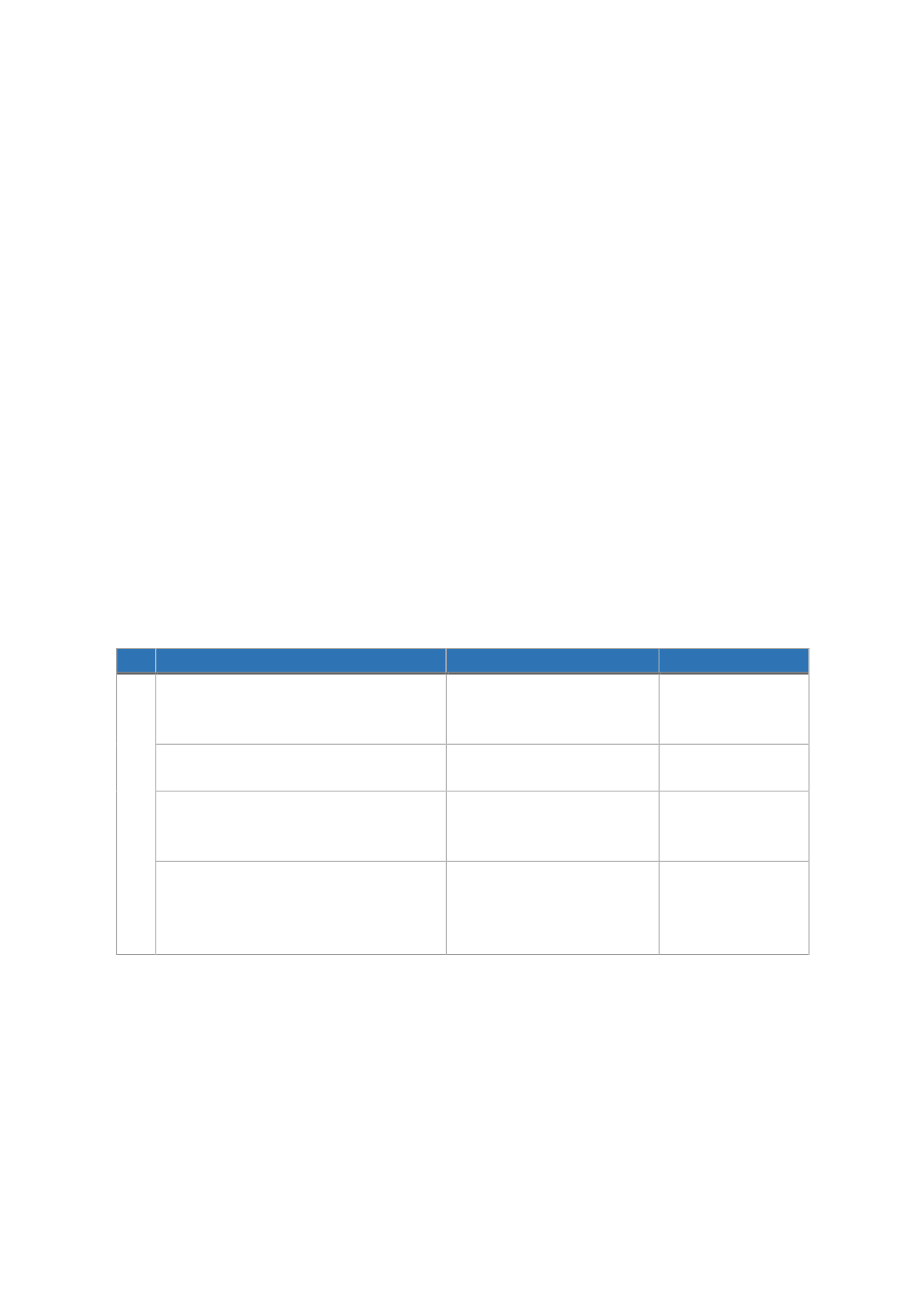

T

ABLE

23:

S

HARI

'

AH

I

SSUES AND

P

OLICY

R

ECOMMENDATIONS

No

Issues

Policy Recommendation

Country Affected

2

2.1. Absence of a comprehensive

Shari'ah

governance framework

for

Takaful

Developing a

Shari'ah

governance framework

for

Takaful

UK, Turkey and

Saudi Arabia

2.2. Lack of

Takaful Shari'ah

standards

Developing

Takaful

Shari'ah

standards

UK, Turkey and

Saudi Arabia

2.3. Conflict between the existing

legal framework and

Shari'ah

requirements

Harmonizing the existing

legal framework with

Shari'ah

requirements

Applies to all the

four countries

2.4. Absence of

Shari'ah

conflict

resolutions

Establishing

Shari'ah

units

for conflict resolutions

and empowering

Shari'ah

committees

UK, Turkey and

Saudi Arabia

Source: Authors

The

Shari'ah

Advisory Council (SAC) as part of the

Shari'ah

governance framework is the apex

authority that guides the

Takaful

industry on

Shari'ah

related issues. IFSA has also paved the

way for the development of various

Shari'ah

standards to guide TOs. These standards

strengthen the governance of TOs, provide greater clarity on the use of multiple

Shari'ah

contracts in the models and structures of

Takaful

, and safeguard the interests of

Takaful

participants. In the other three jurisdictions, Turkey, Saudi Arabia and the UK, there is the

absence of Islamic finance and

Takaful

act and lack of central

Shari'ah

board.

The insurance