146

CHAPTER 7: POLICY RECOMMENDATIONS

This chapter provides policy recommendations on

Takaful

industries in the four countries,

namely the UK, Turkey, Malaysia and Saudi Arabia, selected for this study. Twenty policy

recommendations are proposed based on the data obtained from the review of extant literature,

country case studies, content analysis of published documents and questionnaire survey

administered to

Takaful

industry players, regulators,

Shari'ah

scholars and academicians; and

the data were also sourced from interviews conductedwith 12 experts. These recommendations

are presented for the following five areas: 1) legal and regulatory framework, 2)

Shari'ah

, 3)

product and services, 4) talent development, and 5)

Takaful

business sustainability.

8.1. Legal and Regulatory Framework

The enactment of new regulations in many countries provides clear recognition to the Islamic

financial system and greater clarity on the regulatory and legislative framework for Islamic

finance, which includes recognizing the specificities of

Takaful

in last few years. However,

regulations for the

Takaful

industry are at the very beginning of a long way to go. It can be said

that regulatory framework for the

Takaful

industry is quite limited compared to the other

finance and Islamic finance fields. Comprehensive regulations and government support are

highly demanded by the

Takaful

industry mostly for operating, transparency, and governance

issues which can increase viability and the competitiveness of the sector. Regulatory and

governance are almost always on the agenda and the need is increasing (COMCEC, 2016).

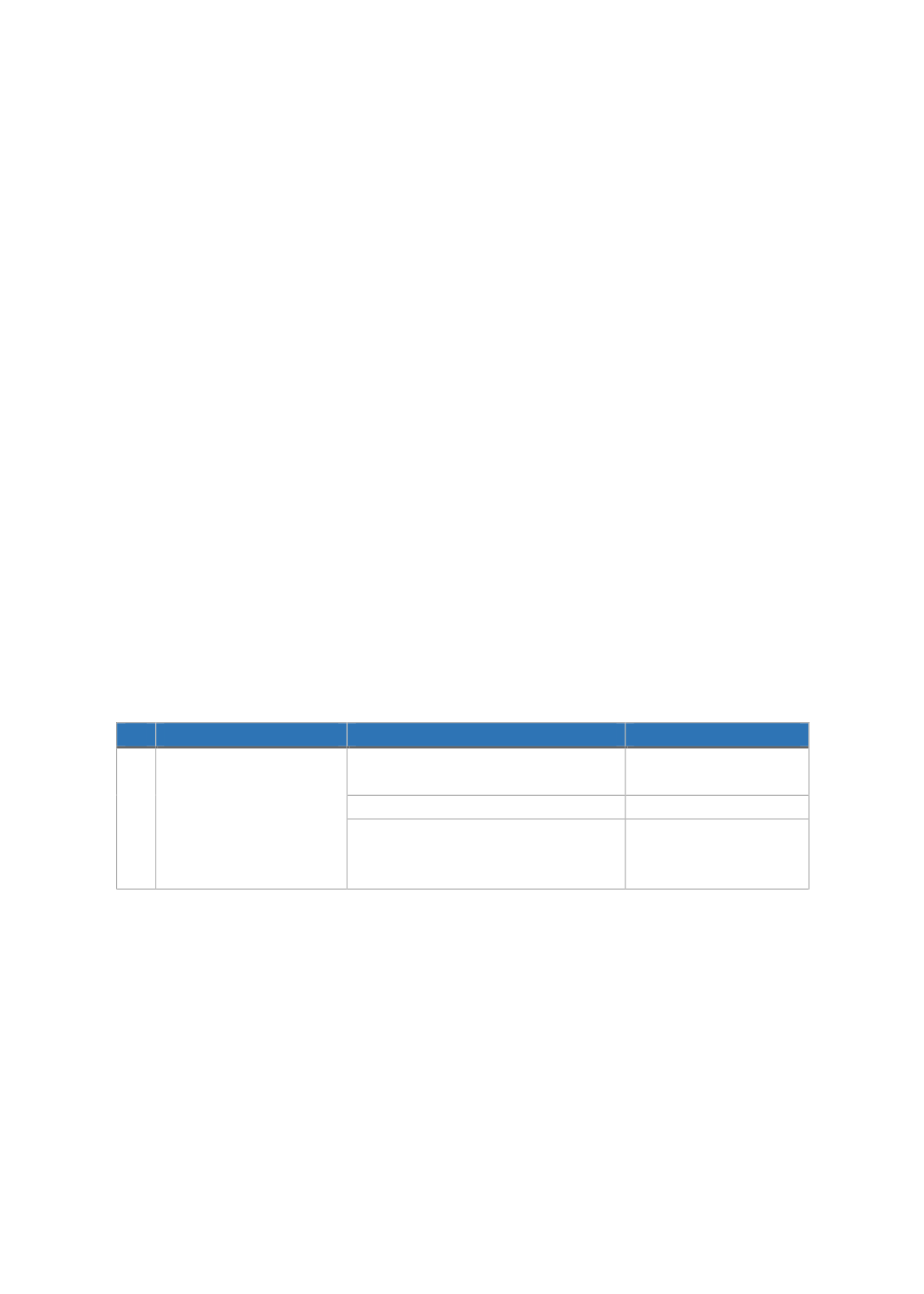

T

ABLE

22: L

EGAL AND

R

EGULATORY

F

RAMEWORK

I

SSUES AND

P

OLICY

R

ECOMMENDATIONS

No

Issues

Policy Recommendation

Country Affected

1

1.1. Absence of a

comprehensive

Takaful

legal and

regulatory

framework

Developing the

Takaful

Act

UK, Turkey and Saudi

Arabia

Developing specific

Takaful

laws

Malaysia

Standardization of financial

accounting and reporting, and tax

laws related to

Takaful

Applies to all the four

countries

Source: Authors

Through regulations, the institutionalization of the

Shari'ah

committees both in country level

and TO level as the apex authority or main management function serves to provide legal and

contractual certainty for Islamic finance transactions. Some of the

Takaful

operating countries

have

Shari'ah

governance framework even needs further regulatory actions and improvements.

However, there is a need in many untapped economies for it. Furthermore, there is a need for

enhancing the proficiency of committee members through training programs.

Through international standards, TOs are guided in their application of the

Shari'ah

concepts in

product development and innovation. Furthermore, the regulatory requirements such as