Improving Public Debt Management

In the OIC Member Countries

96

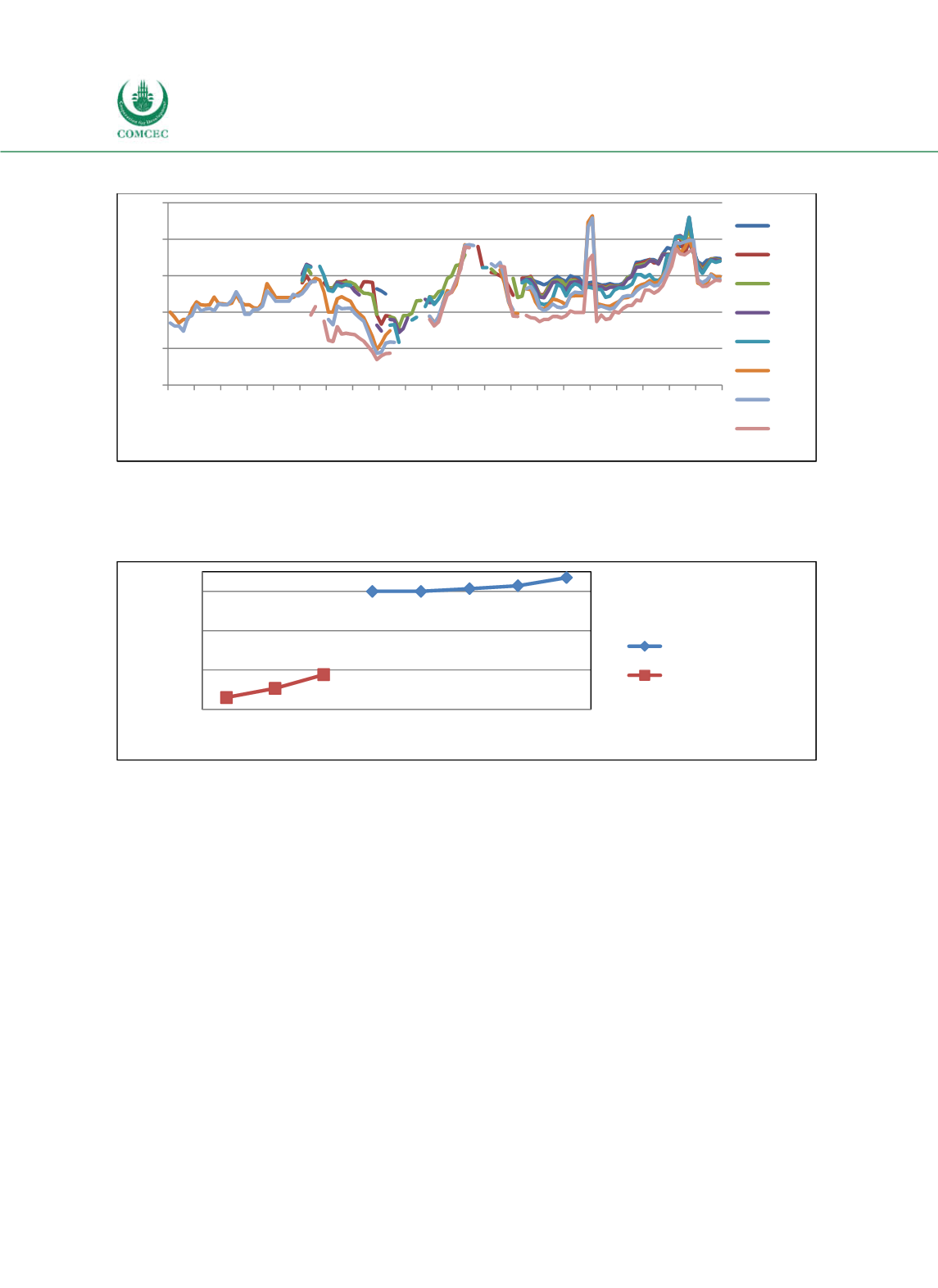

Figure 4-11: Uganda - Yields on T-Bonds and T-Bills

Source: Investing (2016), calculations by the Ifo Institute.

Note: Due to missing data some graphs might not be continuous.

Figure 4-12: Uganda - Yield Curves of T-Bonds and T-Bills (2016)

Source: Investing (2016), calculations by the Ifo Institute.

Although the history of largerscale Islamic banking in Uganda can be traced back to 2008,

when the BoU first received an application from an institution that wanted to operate as an

Islamic bank, the BoU legalized the roll out of Islamic banking products only recently (The

EastAfrican 2016). With the Financial Institutions (Amendment) Bill, Uganda set the rules for

Islamic banking in Uganda, for instance the creation of key governance structures such as a

sharia

advisory board (The EastAfrican 2016). The Bill also allows the government to issue

sh riah

compliant bonds and the creation of a special Islamic index on the Uganda Stock

Exchange (Mugerwa 2016). As part of the Rural Income and Employment Enhancement

Project, the staterun Microfinance Support Centre (MSC) plans to start Islamic MicroFinance

Loans by 2017 (Ojambo 2016).

Domestic debt market

Between 2006 and 2015, domestic debt represented less than 50% of total general

government debt (see Figure 410). Due to the HIPC and MDRI debt relief, which cancelled a

large amount of external debt, the share of domestic debt increased from 16.9% in 2006 to

48.4% in 2007. Between 2007 and 2011, however, the share of domestic debt decreased

steadily to 24.2% which can be attributed to new external borrowing used to finance several

infrastructure projects (IMF 2015a). The share of domestic debt has increased once again to

0 5 10 15 20 25

Mar06 Sep06 Mar07 Sep07 Mar08 Sep08 Mar09 Sep09 Mar10 Sep10 Mar11 Sep11 Mar12 Sep12 Mar13 Sep13 Mar14 Sep14 Mar15 Sep15 Mar16

Yield (in %)

10Y 5Y 4Y 3Y 2Y 1Y 6M 3M

14 15 16 17

3M 6M 1Y 2Y 3Y 4Y 5Y 10Y

Yield (in %)

Maturity (in years)

Government Bonds

Treasury Bills