Improving Public Debt Management

In the OIC Member Countries

94

primary issuance of securities for monetary policy are deposited in a separate, blocked

account to which the government does not have access (MoFPED 2013).

Debt reporting

Each year, the Minister for Finance, Planning and Economic Development presents to

parliament a report on the state of Ugandan public debt, grants and guarantees that includes a

detailed description of the structure of the debt portfolio (see, for example, MoFPED 2014,

Republic of Uganda 2015, 2016). The debt strategy document also includes statistics and cost

and risk analysis of the existing debt portfolio (MoFPED 2016). Both documents are published

online.

Debt management strategy (incl. risk management)

The objective of the government concerning public debt management is to “meet the

Government’s financing requirements at the minimum cost, subject to a prudent degree of risk,

(…) ensure that the level of public debt remains sustainable, over the medium and longterm

horizon while being mindful of the future generations and (…) promote the development of the

domestic financial markets” (MoFPED 2016, p. 89).

The Public Debt Management Strategy (PDMS) is prepared by the MoFPED in collaboration

with the Bank of Uganda. The government considers prudent public debt management to be an

important policy field as the government’s debt portfolio can have a huge impact on the overall

economy (MoFPED 2016). The PDMS 20162021 includes an assessment of the cost and risk

characteristics of the current debt portfolio and compares the respective indicators with the

benchmark objective values (see Table 44). Finally, it presents the mediumterm guidelines

for public debt management.

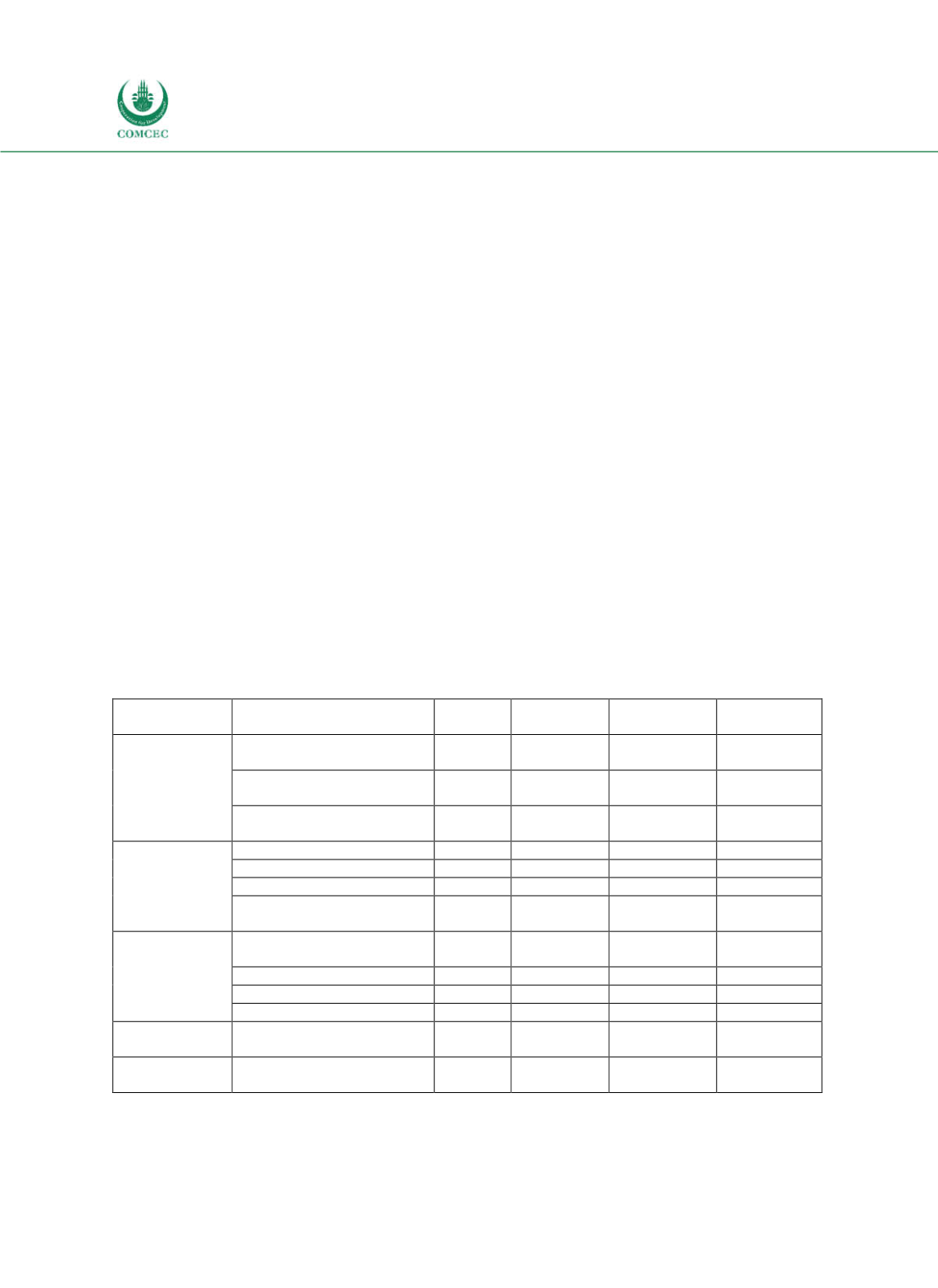

Table 4-4: Uganda - Cost and Risk Indicators of the Government’s Debt Portfolio

Type of risk

Risk indicator

June

2015

June 2016

(estimated)

2020

(projections)

Indicative

Constraint

Solvency

PV of debt (% of GDP)

23.6% 27.2% 34.5% Less than

50%

PV of external debt (% of

GDP)

10.3% 16.3%

Less than

30%

PV of domestic debt (% of

GDP)

13.4% 10.9%

Less than

20%

Cost of debt

WAIR (%)

4% 4%

Max. 6%

External debt WAIR (%)

1% 1%

Max. 2%

Domestic debt WAIR (%)

8.3% 8.3%

Max. 16%

Interest payments (% of

GDP)

1.3% 1.2%

2% Less than 2%

Refinancing

risk

Debt maturing in 1 year

(% of total)

22.4% 14.1% 9.3% Max. 15%

ATM external debt (years)

18.7

16.8

13.2

Min. 15years

ATM domestic debt (years)

2.8

3.9

3

Min. 3years

ATM total debt (years)

12.2

11.9

11.3

Min. 3years

Interest rate

risk

ATR (years)

12.2

11.6

11.1

Min. 10years

Exchange rate

risk

FX debt (% of total)

59.2% 62.1% 80.8% Less than

80%

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; PV = Present value; FX = Foreign

exchange; ST = Short-term; WAIR = Weighted average interest rate.

Source: MoFPED (2016, p. 24).