Retail Payment Systems

In the OIC Member Countries

23

3.2 Actors and Industry Characteristics

Driven by globalisation, deregulation, as well as technological change and other forces, the

retail payment industry has experienced dramatic changes in structure and competition. The

banking sector in the OIC member states has also shown a strong growth potential in

comparison with developed economies (COMCEC, 2015). However, on average the financial

sector in OIC member countries remains operationally inefficient (SESRIC, 2013).

The provision of retail payment services is a highly intricate matter. Many participants are

involved in a series of interrelated bilateral transactions and subject to large economies of

scale and scope along with strong adoption, usage and network externalities (Bolt &

Chakravorti, 2012). This not only makes optimal payment pricing difficult, it also makes sound

public policy challenging.

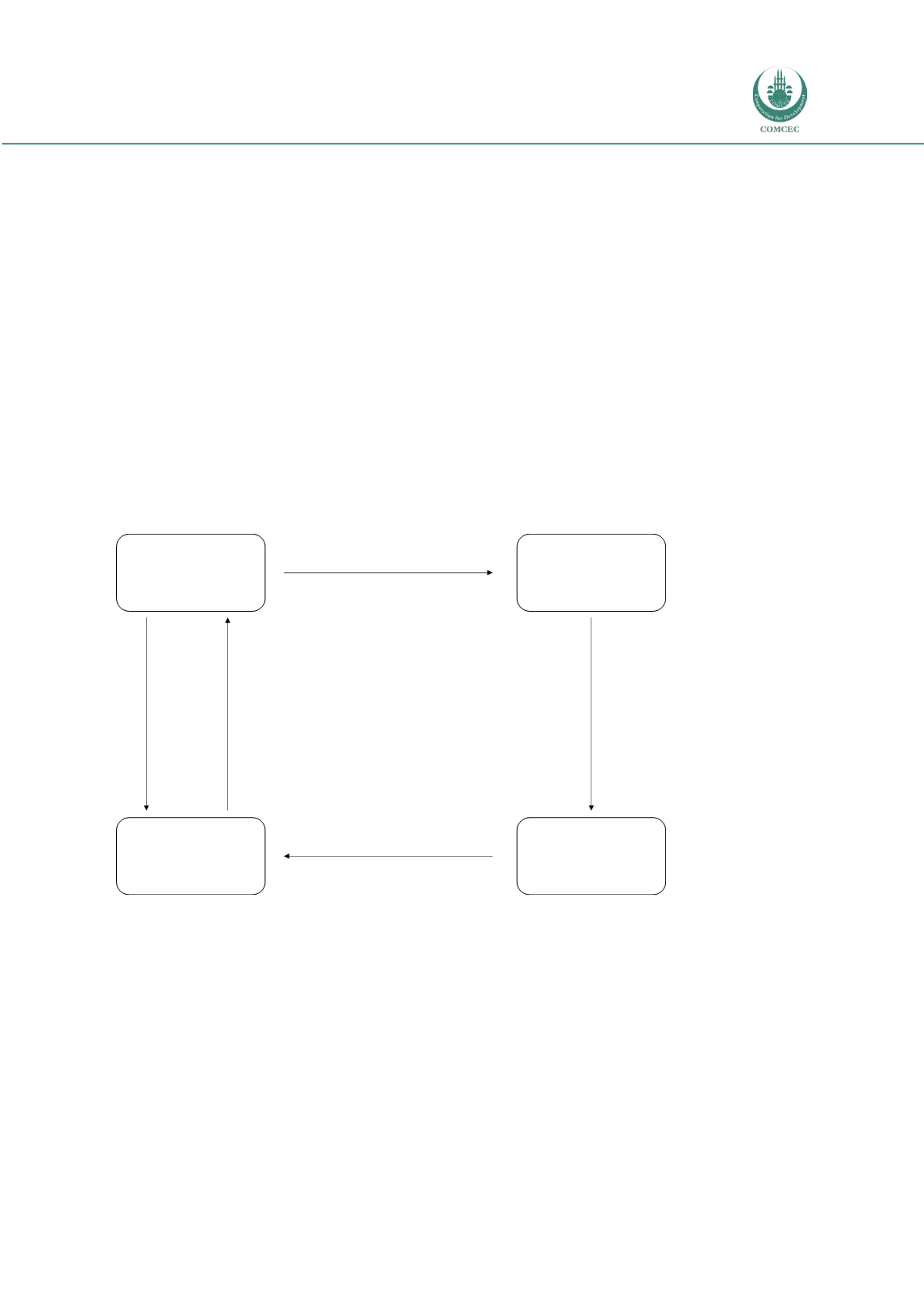

Figure 2. Payment flows and fees

Source: Adopted from Bolt and Chakravorti (2012)

In principle, retail payment systems follow similar market structure (see Figure 2). Most

transactions happen in three- or four-party networks: consumers and their banks (issuers) as

well as merchants and their banks (acquirers). Both issuers and acquirers are a part of a

payment network that sets the rules and procedures for clearing and settlement among its

members. By setting rules, they also create constraints that foster allegiances, provide comfort

for participants and exclude players that do not have access. This effectively creates lock-in

that stabilises the systems but also restricts some forms of later innovation.

CONSUMER

MERCHANT

MERCHANT’S BANK

CONSUMER’S BANK

Fixed goods price or instrument-

contingent pricing

Interchange fee

Potential rewards

Merchant fees (fixed,

proportional, or both)

Consumer fees (annual,

finance, other)