Retail Payment Systems

In the OIC Member Countries

22

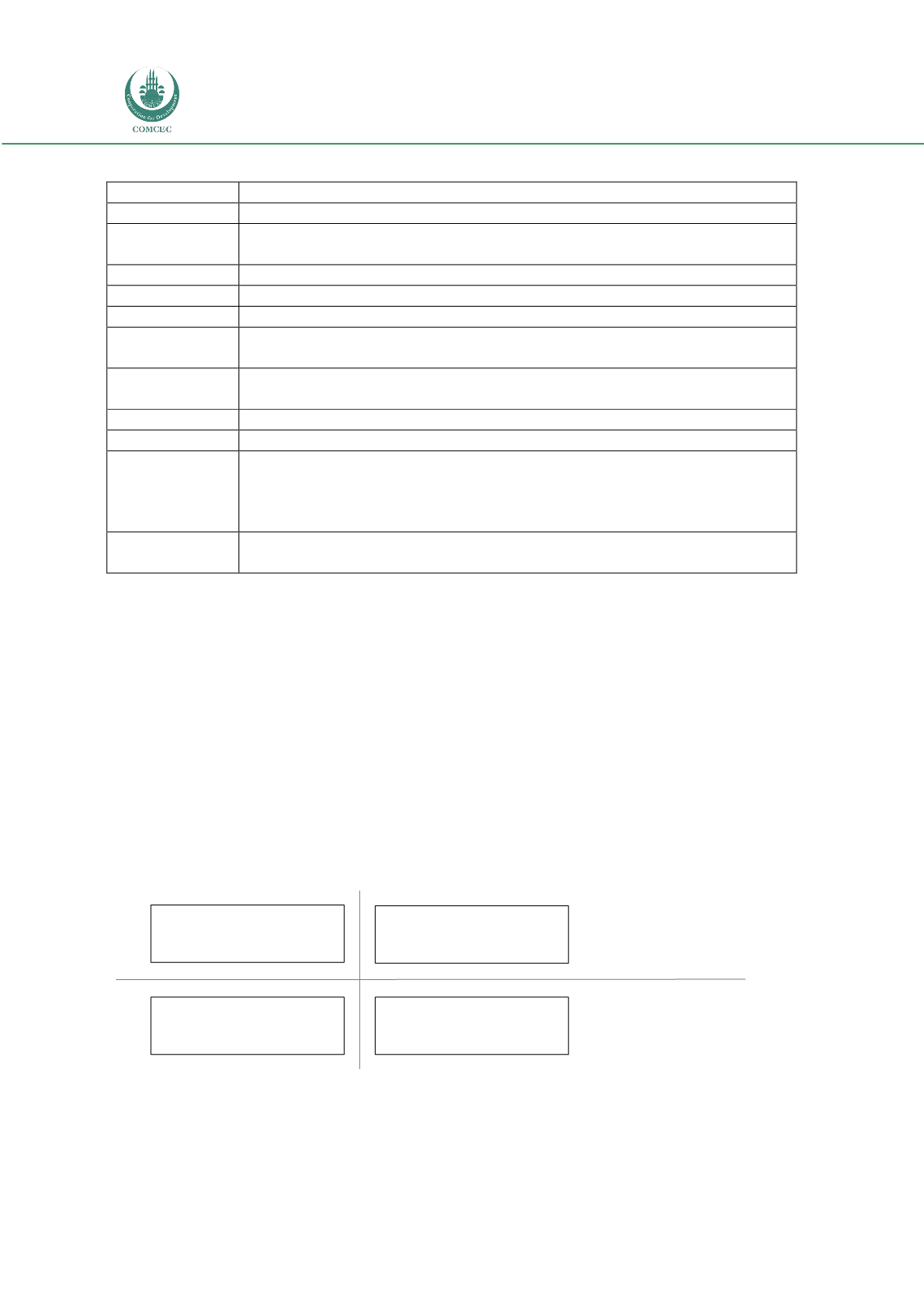

Table 4. Features and characteristics of retail payment innovations

Features

Characteristics

Funding type

prepaid, debit, credit

Access channel

POS, internet, other telecommunication networks, branch/automated

teller machine (ATM), other

Access device

computer, mobile phone, telephone, card, other

Main usage

P2P, P2B, B2B, government payments

Market impact

high, medium, low, pilot phase

Product group

internet payment, mobile payment, innovations in the use of card

payments, EBPP, improvements in infrastructure and security

Access

technique

remote, proximity (contact, contactless)

Scheme owner

bank(s), non-bank(s), both bank(s) and non-bank(s), central bank(s)

Cooperation

banks only, bank(s) and non-bank(s), non-banks only, no cooperation

Purpose

improved security, improved efficiency (reduced use of cash or cheques,

lower processing costs, speeding-up of processing, overcoming

infrastructural lags, inclusion of unbanked or under-banked, government

payments, fostering competition, improved convenience, other)

Focus

payment initiation, overall payment process and clearing and settlement,

payment receipt, new scheme

Ondrus and Pigneur (2005) propose the use of a matrix to segment the retail payment market

according to type of technology and service providers involved. These two axes of

decomposition provide a better overview of the market with its different initiatives (see Figure

1). The cells on the top correspond to the product launched by financial institutions and MNOs

together or separately. On the bottom, the cells represent the retail payment systems

introduced by newcomers and intermediaries. On the left, retail payment schemes are based

on card technology while on the right, the cells symbolise payment solutions using mobile

technology.

Figure 1. Classification Matrix

Source: Adopted from Ondrus and Pigneur (2005)

II

I

III

IV

OPERATOR-DRIVEN

(FINANCIAL INSTITUTIONS, MNOS)

SELF-ORGANISED

(NEWCOMERS, INTERMEDIARIES)

CARD-BASED

PHONE-BASED