Risk Management in

Islamic Financial Instruments

18

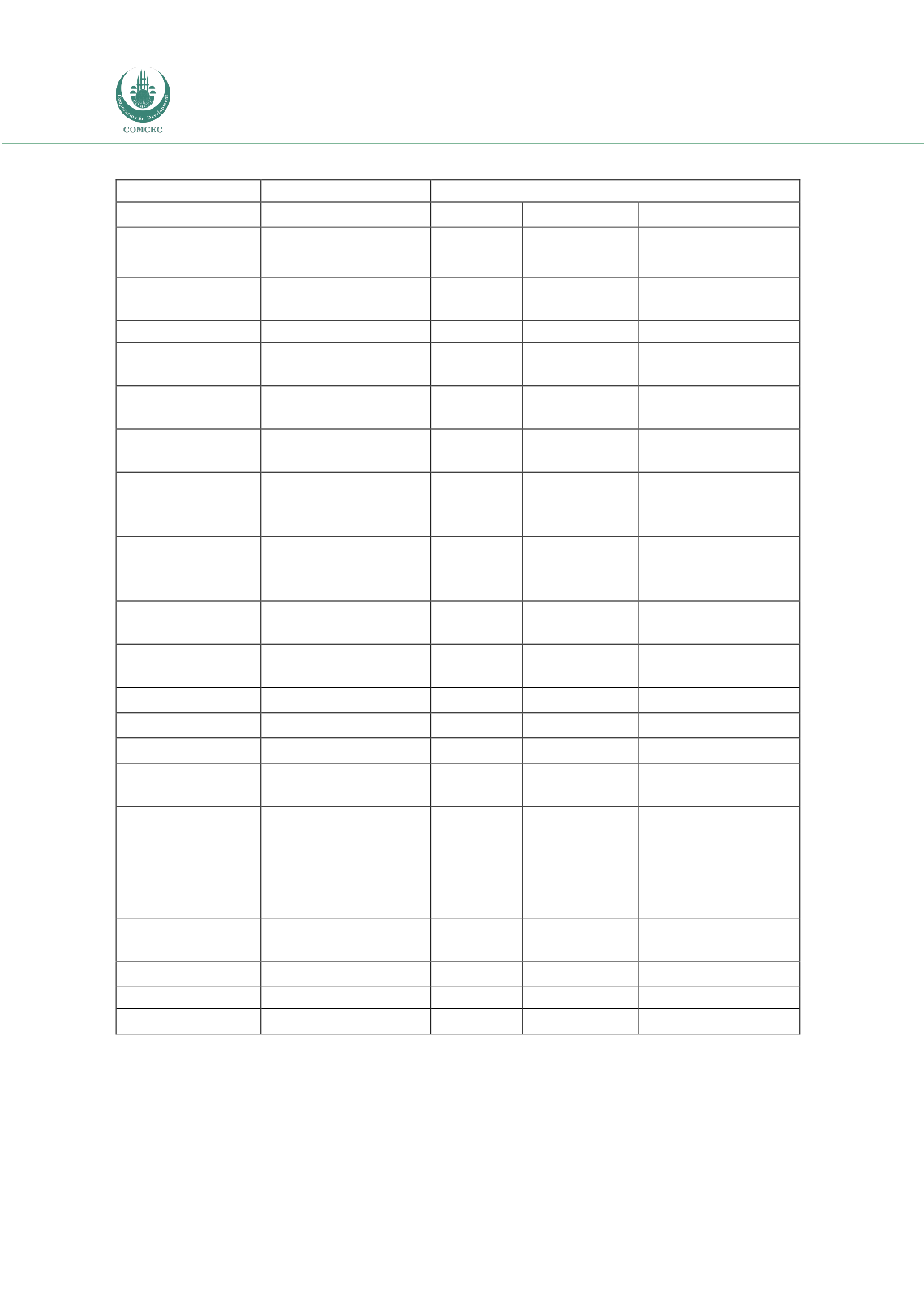

Figure 2.2: Islamic contracts and their linkages

Risk/contractual role of IFIs

Contract

Trustee

Partnership

Principal/agent

Link to conventional

finance

Agency /

brokerage

Investment

banking

Conventional/

commercial banking

Liabilities —

funding sources

Demand deposits

Amana

(Trust)

✓

Investment

accounts

Mudarabah

✓

Special investment

accounts

Mudarabah

✓

Musharakah

(Partnership)

✓

Equity -

shareholders'

funds

Musharakah

(Partnership)

✓

Assets —

application of

funds

Transaction

contracts

Short-term trade

financing

Murabahah

✓

Bay salaam

✓

Bay mua'ajal

✓

Medium-term

investments

Ijarah, Istisna

✓

✓

Mudarabah,

Musharakah

✓

✓

Long-term

partnerships

Mudarabah,

Musharakah

✓

✓

Fee-based services

Joa'la, Kifala, etc.

✓

✓

✓

Of the two theoretical models discussed, the

two-tier, mudaraba

model amalgamates the

liability and asset sides of the balance sheet (

mudaraba

funds the mobilization and utilization

on the basis of profit sharing). The first tier contact is between the investor and the bank,

where the bank, acting as a

mudarib,

invests on behalf of the investor. If profits are generated