Risk Management in

Islamic Financial Instruments

15

instruments that avoid interest, but are not profit sharing, i.e.

mudaraba

, which is the Islamic

contract that is most frequently engaged in (Greuning and Iqbal, 2008).

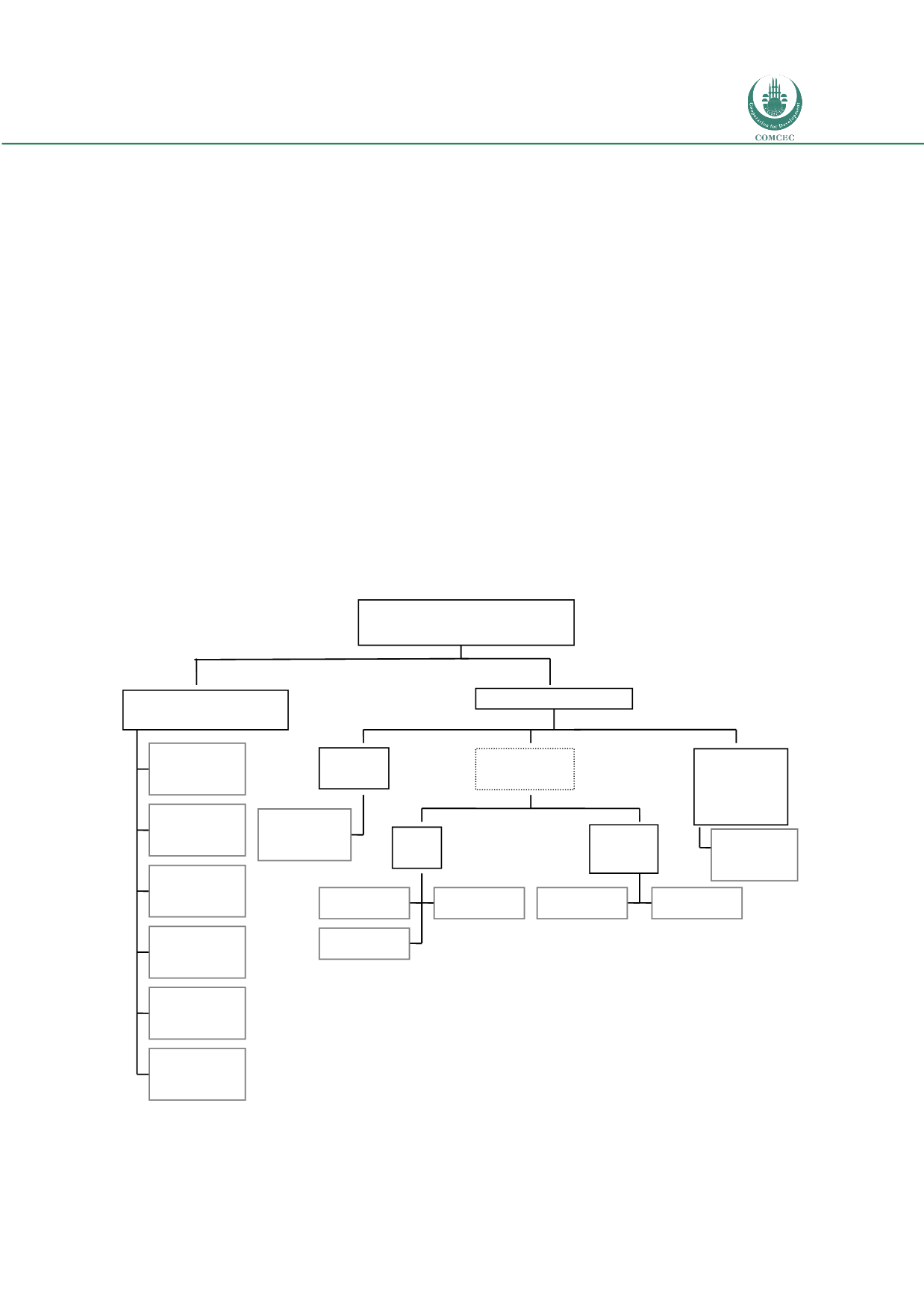

Islamic financial contracts vary in function, scope, and complexity. Thus, it is important that

the reader understands the profile of contracts within the Islamic financial system. Please find

an outline of the various Islamic financial contracts relevant to our discussion, largely derived

from Hawary, Grais and Iqbal (2003).

2.2 ISLAMIC FINANCIAL CONTRACTS

For the purposes of efficacious comprehensibility, it is useful to divide the contacts into three

categories: (1) Intermediation contracts:

Mudaraba, Amana, Takaful, Kifala, Joala, Wakala

; (2)

Transaction Contracts:

Qard Hasana

; and (3) Asset-Based contracts: a. Trade Financing

(

Murabaha, Baimuajjal, bai salaam

) b. Collateral-based (

Ijara, Istisna

) c. Equity Based:

Musaharaka.

Please see Figure 2.1, which was adapted from World Bank presentation

materials from the International Conference on Islamic Banking: Risk Management,

Regulation, and Supervision (2003).

Figure 2.1 Islamic Financial System (IFS)

Mudarabah

Kifala /Aqd-Daman

Ammanah

Takaful

Wikalah

Joala

Intermediation Contracts

Qard

Hassanah

Miscelleneous

Murabaha

Bay Mua'ajal

Bay salam

Trade

Financing

Ijarah

Istisna

Collateralised

Securities

Asset

Based

Securities

Musharaka

Equity

Participation

Transactional

Contracts

Profile of Contracts