Risk Management in

Islamic Financial Instruments

17

securities in the conventional space are a claim against a pool of assets, whereas in Islamic

finance, they are claims to individual assets. This promotes equity participation. In addition,

these Islamic assets are of relatively low risk, because they are collateralized against one, real

asset (Hawary, Grais, and Iqbal, 2003).

Ijara

(Islamic leasing) and

istisna*

7

are the underlying

contracts (respectively) that generate many collateralized Islamic securities. Usually, they have

longer maturities than asset-backed securities. Another sub-class of transactional contracts in

Islamic finance is

musharaka,

a form of Islamic contract that is, for all intents and purposes,

similar to mudaraba, except participation is more equitable with regards to labor, which is

provided jointly by the involved parties.

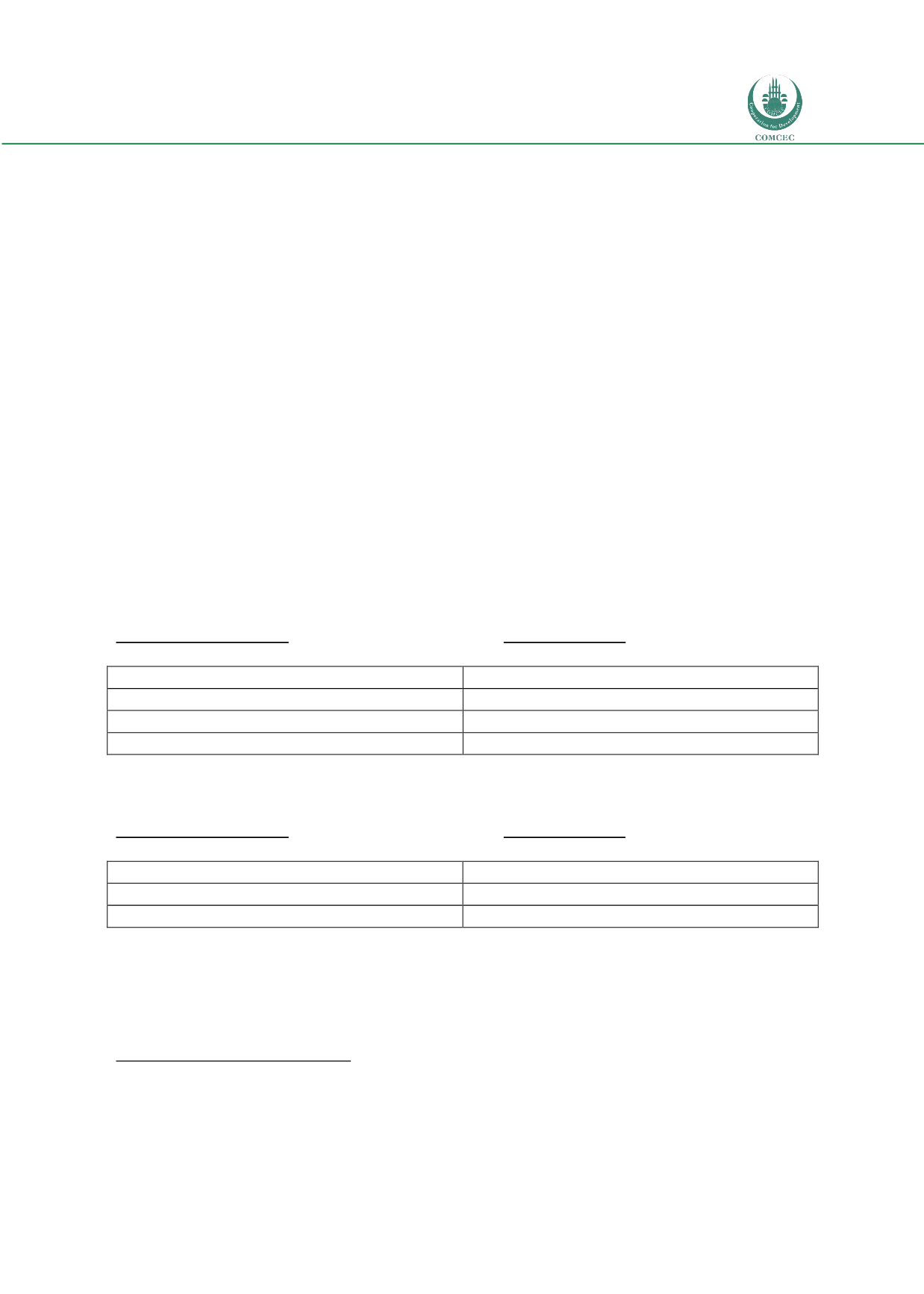

2.3 STRUCTURE AND FINANCIAL INTERMEDIATION PRACTICES OF IFIS

Now that we have defined the principal Islamic contracts underlying the types of financial

activities outlined by a theoretical, two-tiered Islamic balance sheet (based on the “

two

windows

” model discussed below), it is important to cover how those contracts are applied

within the scope of the theoretical balance sheet of an Islamic bank found outlined next

(Greuning and Iqbal, 2008). Note that the liabilities side is divided into two deposit windows:

demand deposits and investment/special investment accounts.

On the

asset side

, there is:

Conventional practice

Islamic method

Short-term trade finance

Murabaha; Salaam

Medium-term investments

Ijarah; Istisn’a

Long-term partnerships

Musharakah

Fee-based services

Joala; Kifala; etc.

On the

liabilities side

:

Conventional practice

Islamic method

Demand Deposits

Amanah

Medium-term investments

Mudarabah

Long-term partnerships

Mudarabah; Musharakah

*The liabilities side also includes reserves and equity capital

See below

Figure 2.2

, another, more visual description of Islamic contracts and their linkages

to Islamic finance.

8

7

*Differs

from

ijara;

pre-ordered production of an entity, with the raw materials provided by the buying agent.

8

Exhibit 2.3, “Islamic banking: Risk and contractual role” from Hawary, Dahlia El, Wafik Grais, and Zamir Iqbal. "Regulating Islamic Financial

Institutions: The Nature of the Regulated." International Conference on Islamic Banking: Risk Management, Regulation and Supervision, Aug.

2003.