Risk Management in

Islamic Financial Instruments

187

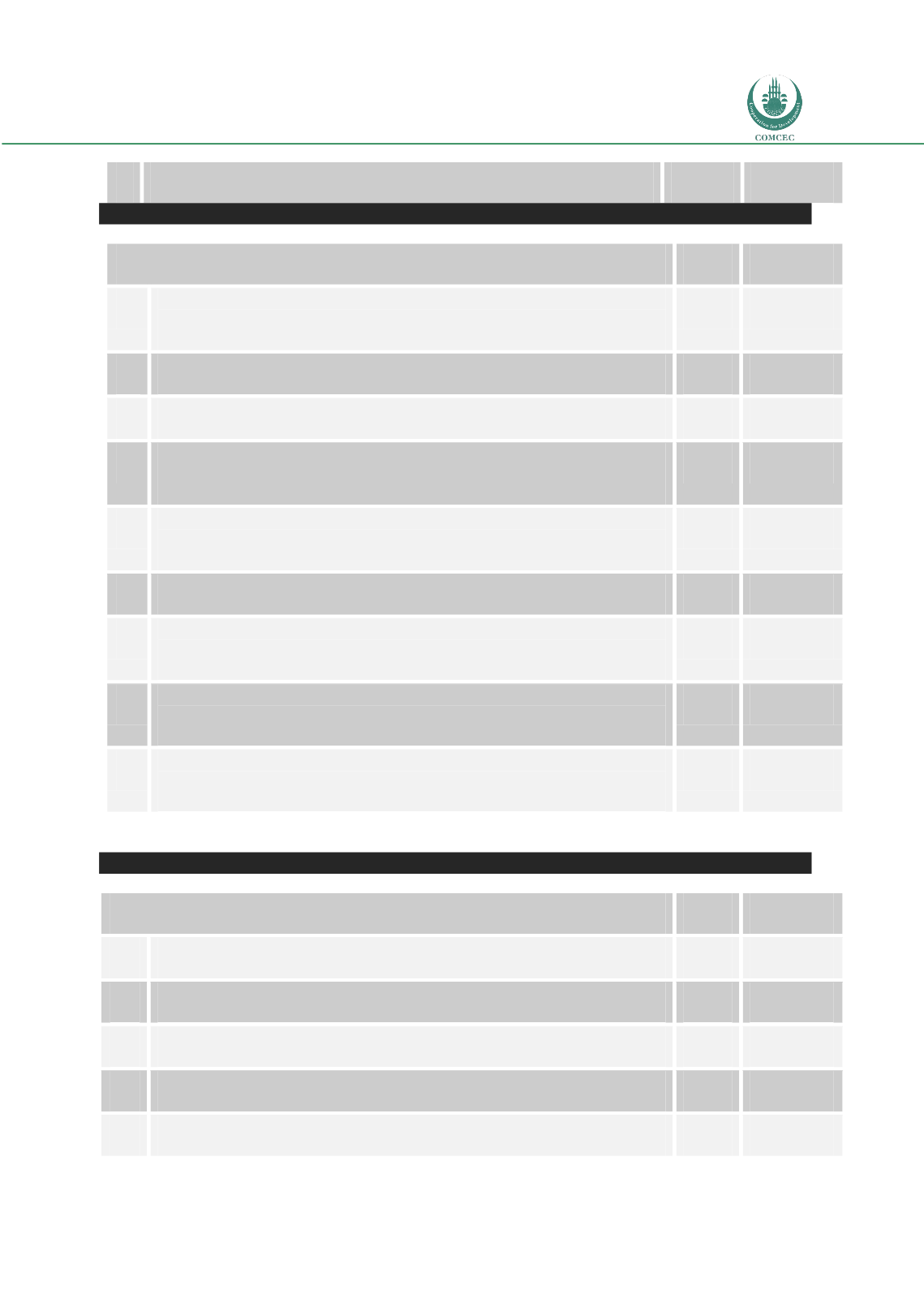

6

Are mark-up rates on loans set taking account of the loan grading?

Maintaining an Appropriate Risk Measuring, Mitigating, and Monitoring Process

yes

No

1

Is there a computerized support system for estimating the variability of earnings and risk

management?

2

Are credit limits for individual counterparty set and are these strictly monitored?

3

Does the bank have a policy of diversifying investments across different countries

4

Does the bank have a policy of diversifying investments across different sectors (like

manufacturing, trading etc.)?

5

Does the bank have a policy of diversifying investments across different Industries (like

airlines, retail, etc.)?

6

Does the bank have in place a system for managing problem loans?

7

Does the bank regularly (e.g. weekly) compile a maturity ladder chart according to

settlement date and monitor cash position gaps?

8

Does the bank regularly conduct simulation analysis and measure benchmark (interest)

rate risk sensitivity?

9

Does the bank have in place a regular reporting system regarding risk management for

senior officers and management?

Part II: Risk Reporting

Maintaining an Appropriate Risk Measuring, Mitigating, and Monitoring Process-Risk Reports

yes

No

1

Capital at Risk Report

2

Credit Risk Report

3

Aggregate Market Risk Report

4

Interest Rate Risk Report

5

Liquidity Risk Report